I believe that investing in high-yield dividend stocks can provide me greater returns than a standard savings account. To maximise returns, I’d open a Stocks and Shares ISA, allowing me to invest up to £20,000 a year tax-free.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

I formulated the following strategy to get the most out of my initial £5,000 and build towards a goal of £4,752 of passive income by 2034.

Should you invest £1,000 in United Utilities Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if United Utilities Group Plc made the list?

Curating a high-yield dividend portfolio

The first step in my plan is to do the research. I need to find several reliable FTSE 100 companies with a proven track record of paying dividends. Dividend yields change constantly and companies can choose not to pay them at any time, so I must find companies with a history of reliable payments to improve my chances.

Three FTSE 100 companies that I would consider for reliable dividends include Unilever, Phoenix Group, and National Grid. Although results over the past 12 months aren’t great, I believe they have a decent record of dividend payments.

Harnessing the power of compound returns

While good dividend stocks alone could bring in more profit than my standard savings account, the real magic is in compounding gains. By reinvesting my dividends back into the stock via a dividend reinvestment plan (DRIP), I can maximise my profits.

By compounding both my returns and dividends, I can create a snowball effect that balloons my investment. If I can build a portfolio of shares that outperform the FTSE 100, then I can maximise my profits even further.

New to investing?

If I were new to investing, I would consider an index like the iShares Core FTSE 100 ETF (LSE:ISF). This index exposes me to well-performing FTSE 100 stocks without needing to pick them myself. It has delivered a three-year daily total return of 7.83%, which is relatively good and would be difficult to beat if I wasn’t an experienced investor. With a total expense ratio of only 0.07%, it’s also one of the cheapest FTSE 100 indexes to invest in.

If the iShares Core FTSE 100 ETF continues to deliver an average annual return of around 7.83%, investing in it would accrue me a meagre £405 of returns after a year. However, by compounding my gains over 10 years, my savings would grow to £10,912 and I’d be earning over £800 a year in passive income.

Continuously building my investment

While my initial £5,000 savings can bring me some profit, I’ll need to continue adding to it if I want to see real gains. I would plan to continue investing a further £300 a month into my portfolio.

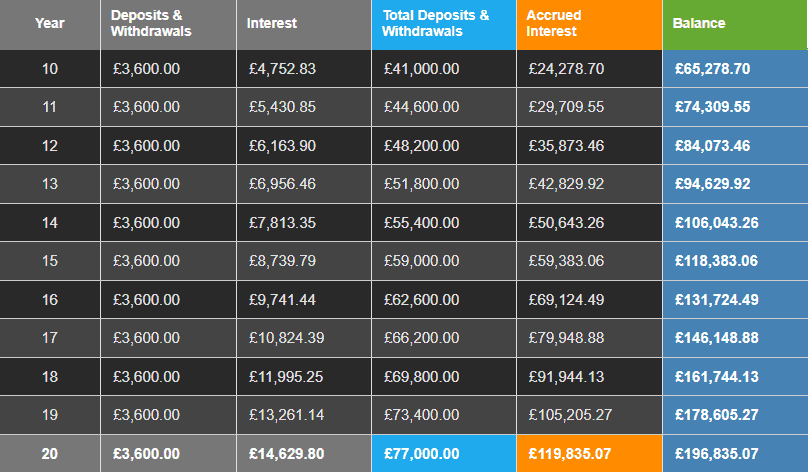

Using the iShares Core FTSE 100 ETF as an example, adding £300 per month could build up to £65,278 after 10 years. This would earn me £4,752 of passive income in 2034. After 20 years, my investment would be worth almost £200,000 and bring in over £15,000 of passive income in the following years. With a portfolio of well-selected FTSE 100 dividend stocks, I may even be able to improve on this.