There’s no better time for me to start investing than right now. The earlier I start, the higher returns I’m likely to get. That’s simply due to the power of compound interest and passive income.

With the right mindset and a long-term Foolish perspective, I think my investment dreams are achievable.

I’d start now

Here are the ingredients I reckon I need to pull this one off:

Should you invest £1,000 in Hargreaves Lansdown right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Hargreaves Lansdown made the list?

- £10K in savings to start with

- £100 per month to add to my investments

- 29 years of patience to let my investments grow

- A 10% average annual return (excluding dividends)

- An understanding that inflation will make my eventual £20K passive income worth less than it is today

Assuming I was able to invest with the above criteria in an index fund, like the S&P 500 or FTSE 100, for 29 years and achieve that 10% annual return, I’d have £383,055 by the end of it (not adjusted for inflation).

A 10% return is reasonable and is the annual average for the S&P 500 over the last 30 years.

However, I need to be aware there’s always a risk that an economic downturn could make those returns less during my investment period.

Shares to retire on

Assuming I built that foundation successfully, a new chapter could begin for me. Instead of focusing on shares with rising prices, I’d be looking for companies with strong dividends.

Here’s an example of one I think is great. It’s important to note I’d need around five-to-10 of these for a nicely diversified portfolio to protect me from industry and company-specific risks.

Hargreaves Lansdown

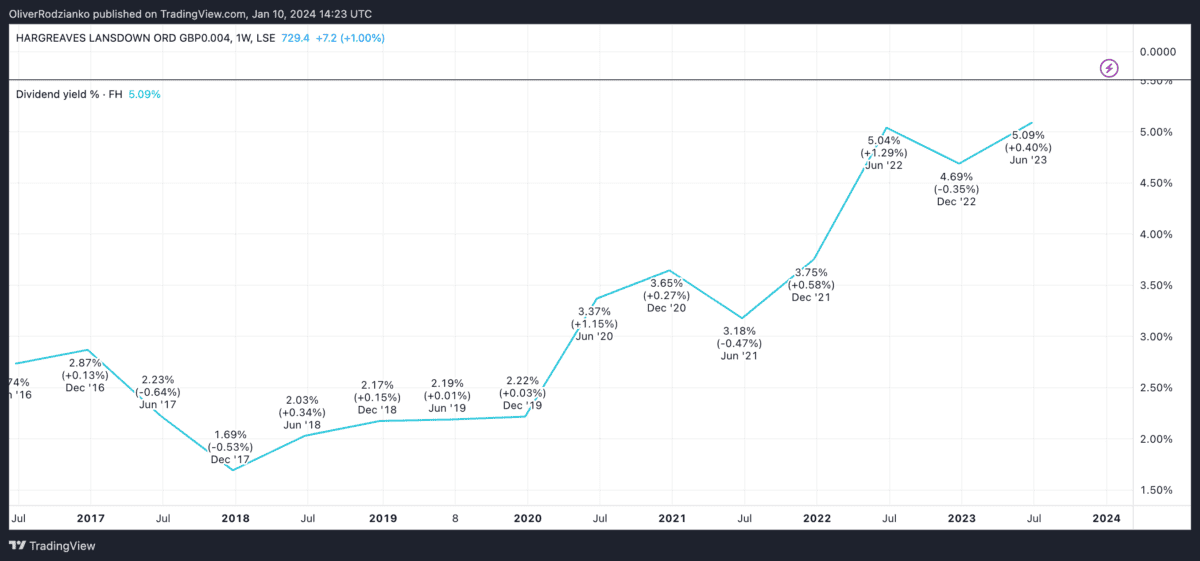

Hargreaves Lansdown (LSE: HL) is a British investment firm. It has a net margin of 44%, a three-year revenue growth rate of 10%, and a 5.7% dividend yield.

What’s more, that dividend has been growing at a rate of 6% per year on average over the last five years.

It’s worth noting that Hargreaves Lansdown stock is down over 20% in the last year, so it might not be called ‘stable’ in the short term. There’s a significant risk that I could lose some of the value of my savings in owning the company initially.

However, as it’s 70% below its high with strong financials, I think it could be considered undervalued and safe as such over the long term. I’d need to keep an eye on it, though. Its gross and operating margins have been in long-term decline, which could prevent the price from rebounding.

The £383,055 I’d hypothetically save over 29 years invested in it would yield £21,831 in dividends per year.

A look at the risks

Tax implications will reduce my investment returns and income, so I’d use a Stocks and Shares ISA to invest to ease my tax burden.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Additionally, the dividends could be cut or reduced at any time in case of an economic emergency.

This is often why people prefer reliable, government-backed bonds to dividend shares. They can be more stable for the above-mentioned reasons.

Yet I reckon £20K per year in share dividends is possible. I’d want really stable shares, though. That’s why I think companies that could be undervalued, like Hargreaves Lansdown, would be best to look for.