Here are two of my favourite FTSE 100 stocks to buy based on City analysts’ dividend forecasts through 2024.

In fact, I think they could deliver a market-beating passive income for years to come.

Power play

UK shares have (for the most part) suffered a poor start to 2024 as worries over the global economy have mounted. Continued pressure on consumer spending, combined with the fallout from conflict in the Middle East, could spell big trouble for corporate profitability.

This isn’t something that utilities like National Grid (LSE:NG) need to worry about, though. This explains expectations that dividends at this FTSE share will continue to grow over the short term.

City analysts think shareholder payouts will increase to 58.39p and 59.93p per share in the financial years to March 2024 and 2025, respectively. Consequently National Grid shares carry dividend yields of 5.5% for this year and 5.6% for next year.

I think the grid operator is one of the most secure income stocks out there. Its services remain in high demand at all points of the economic cycle. And it has a monopoly in its market. These qualities give the business the reliable and predictable cash flows that are essential for dividends.

Buying regulated businesses like this always carries risk. Should Ofgem decide to change pricing rules, introduce new operating procedures, or even cap dividends, investors could end up with disappointing returns.

Yet on balance, the dividend outlook here is encouraging. The steady growth of renewable energy should help National Grid grow payouts over the long term too.

Cash flows take flight

The earnings picture for financial services providers remains clouded by the tough economic climate. But thanks to its strong balance sheet, Phoenix Group (LSE:PHNX) is tipped to keep growing dividends in 2024.

This means the company — which provides savings and retirement services in the UK — carries a mighty 10.6% dividend yield for this year.

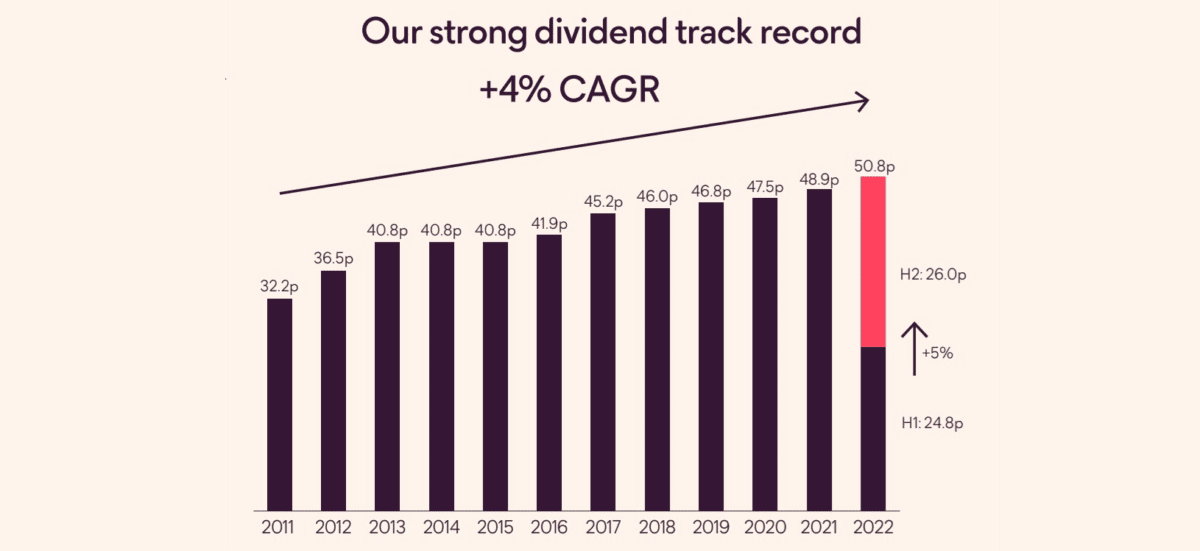

Phoenix’s robust financial health even allowed it to continue hiking dividends during the pandemic, as the graphic above shows. Put simply, it’s a cash machine. As of last June its Solvency II capital ratio stood right at the top end of its targeted 140% to 180% range.

Encouragingly for future dividends, Phoenix has recently upgraded its cash generation targets for the three years to 2025 too. Following the funds merger of the Standard Life and Phoenix Life businesses, cash generation is now tipped to be £4.5bn, up £400m from the previous target.

I think the business will meet current dividend forecasts. Though I am aware that this year’s predicted earnings of 54.31p per share are higher than predicted dividends of 47.21p.

Theoretically this leaves payout forecasts looking fragile. And if client demand suddenly falls of a cliff in 2024 questions over dividend estimates would inevitably rise.

This could in turn pull Phoenix’s share price much lower. However, as an income-hungry investor I think the potential benefits of owning the FTSE stock far outweigh this risk.