The Diageo (LSE: DGE) share price dropped by more than a fifth last year. This means the once-flying stock is up a meagre 2% over five years. For context, the plodding FTSE 100 has returned nearly 10% in that time (excluding dividends).

Here, I’ll look at what happened and share my thoughts as a frustrated Diageo shareholder.

The infamous profit warning

Regardless of business performance, last year was already destined to be remembered as a difficult one for Diageo. Sir Ivan Menezes, the company’s long-serving boss, sadly passed away in June. He’d spearheaded the firm’s push into the premium segment of the alcohol market.

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

Then on 10 November came a profit warning that sent the stock down 12% in a single day. The problem was the Latin America and Caribbean region, which makes up nearly 11% of the firm’s revenue.

Organic net sales there were set to fall more than 20% during the first half of FY24 (the six months to 31 December).

Management blamed a worsening macroeconomic environment in which consumers were drinking less and trading down to cheaper brands than its own.

Diageo’s top brands

The company hadn’t anticipated this slowdown and had essentially over-supplied the Latin American market. This has caused investors to worry that there may be hidden weakness lurking within other regions.

New CEO Debra Crew explained that unlike in developed markets like Europe and North America, there’s less point-of-sale data available at Latin American wholesalers and retailers. But the firm was confident this inventory issue is confined to this region.

The other 89%

What to make of all this?

Well, the first thing to note is that Diageo still has momentum in its other four regions, including slight sequential improvement in North America (NAM).

Therefore, the other 89% of the portfolio is progressing satisfactorily under the tough global trading conditions.

For additional perspective, it’s worth pointing out that the Latin American market was around 60% larger on a constant currency basis in 2022 than just four years previously. So it’s one worth pursuing.

Fair value

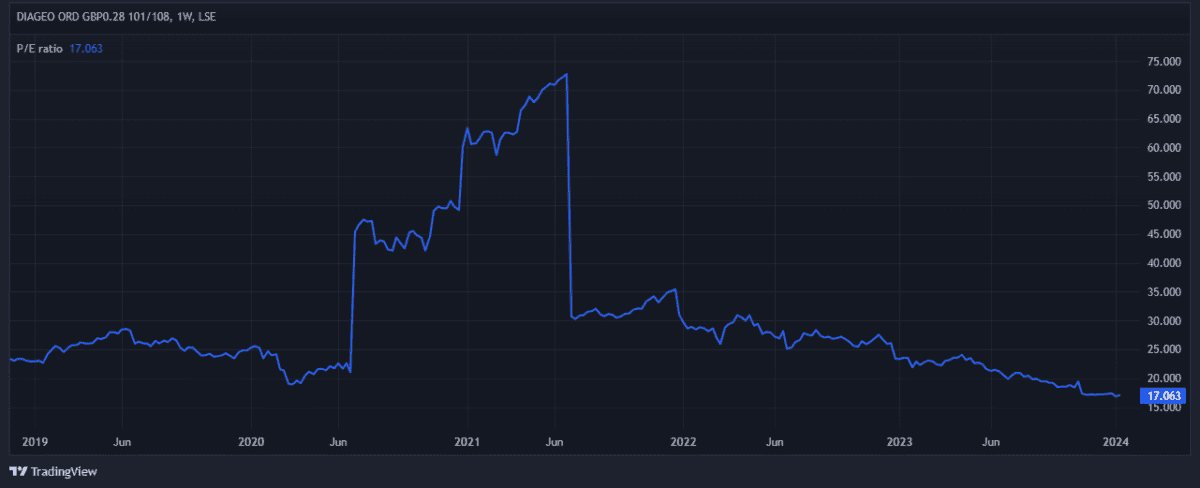

Turing to valuation, the shares are now trading on a price-to-earnings ratio of 17, or an earnings yield of nearly 6%.

That’s the cheapest the stock has been for many years, though this reflects the challenges the business is facing. On balance, I’d say it’s fairly valued.

That said, if weakness develops in its key North American market, which makes up 50% of profits, I’d expect the shares to drop further. This is a major risk.

Finally, the falling share price has pushed the forecast dividend yield for FY 2025 up to 3%. I find that attractive, given the company’s tremendous record as a Dividend Aristocrat.

Growth story intact

Despite this disappointing performance, I don’t think the investment case is broken here. The long-term growth opportunities for premium spirits in China and India look substantial.

India’s middle class and affluent population is expected to top 700m by 2030! It’s already the largest whisky market by volume in the world.

This bodes well for Diageo, which today sells a bottle of Johnnie Walker every seven seconds somewhere in the world.

If I wasn’t already a Diageo shareholder, I’d become one today.