We’d all love a passive income, regardless where that comes from. Some people in the UK invest in buy-to-let properties, other try their hand at trading.

However, for me, investing provides a pathway to financial growth and security. Stocks and shares offer the promise of substantial financial gains — much more so than buy-to-let — without the risks associated with trading.

How do we invest?

If I were new to investing, I’d start by opening an investment account with a reputable brokerage. This involves researching and selecting a platform that aligns with my needs, offering a user-friendly interface and access to a variety of investment options.

Personally, I use the Hargreaves Lansdown platform, but appreciate there are alternatives with lower trading fees.

After this, I would have to define my financial goals. I need to establish what and when I’m investing for. For example, when will I want to start taking a passive income?

Understanding my risk tolerance is crucial in determining the mix of assets in my portfolio. I’d have to educate myself on different investment vehicles, considering stocks, bonds, and even cash.

And finally, when I’m ready, I can start purchasing stocks, bonds, or other investment vehicles.

Compounding is key

If I’m investing £50 a week or £200 a month, I need to appreciate that I’m not going to build a huge portfolio over night.

In fact, the longer I leave my money invested, the faster it grows. And that’s all down to the magical power of compounding. While the initial growth may seem gradual, the power of compounding can significantly amplify returns over time.

As such, it’s essential to stay disciplined and resist the urge to react hastily to short-term market fluctuations.

As the portfolio grows, so does the potential for compounding to work its magic. That’s because I can start earning interest on my interest as well as my contributions.

Compounding takes place when I reinvest my returns year after year. This may involve me reinvesting the dividends I receive.

Or if I invest in a stock like Nvidia, which doesn’t offer a dividend, the company essentially reinvests on my behalf. That’s because it’s focused on growth.

Bringing it all together

A novice investor may look to achieve between 6-10% annually in the way of returns. While an experienced investor might aim for higher returns — perhaps around 10-15% annually.

Of course, it’s not guaranteed that my returns will be positive. If I invest poorly, I could, and probably will, lose money. And that’s important to recognise because if I lose 50% of my investments, I’ve got to gain 100% to get back to where I was.

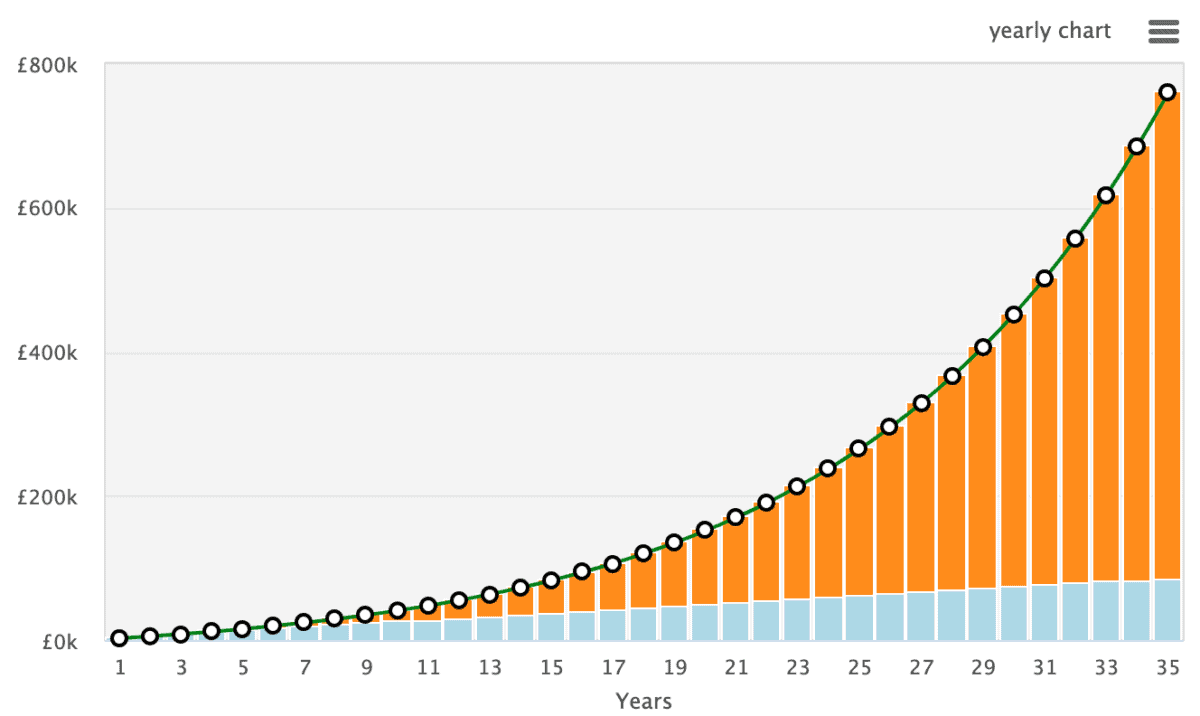

So if I were starting with nothing, and investing £50 a week, here’s how my investment could grow over 35 years, assuming a 10% annualised return. At the end of the period I’d have £759,327, and it would have generated £71,849 in the final year. Even in 35 years, that’s a strong figure.