After several disappointing years, investors might be asking themselves why should they put their money in the FTSE 100 again. After all, managers and investors alike have been pulling their money from the blue-chip index.

So, what wrong with the index, and could things change in 2024?

What’s wrong with the FTSE 100?

Investors have been pulling money out of the index due to several reasons, but it largely revolves around a lack of growth, momentum, and too much debt.

Not all of the index’s problems are systemic. The Brexit referendum created uncertainty, and this uncertainty was unfortunately sustained by the Covid-19 pandemic, and an imperfect split from the European Union.

In turn, we had poor levels of economic growth, and that’s reflected in fairly unexciting earnings growth. And amid this low growth, low interest (investor interest) environment, we’re seeing less stock listing activity.

It’s a vicious circle.

Could things be changing?

Despite all of these issues, the UK represents a fundamentally strong place to invest.

Just take this; there are plenty of elections scheduled across the world this year — 69 if my memory serves me correctly — and UK will likely be one of them. But how many on them will be fought by and won by centrist parties?

The UK is one of just a few states whereby the three frontrunners have moderate, on a relative scale, economic policies. And that’s great for investors and businesses. We don’t want volatility.

It’s also worth noting the FTSE 350 has posted a positive return in eight of the last nine election years. The average return has been 9.1%.

Moreover, in 2024, we’re expecting the start of an easing monetary policy. In fact, interest rates could fall as much as 300 basis points over the next three years.

So, why is that positive? Well, as interest rates fall, investors tend to move their attention away from cash and bonds towards stocks, in turn pushing share prices upwards.

It’s actually a bigger deal than many people recognise. With government bonds yielding 5%, investors likely avoid FTSE dividend stocks, which may also yield 5%, but carry greater risk. But as interest rates fall, the equation changes.

And finally, following years of economic underperformance, the UK is actually expected to be the strongest performing in Europe over the next 15 years, according to some forecasts.

FTSE forecasts

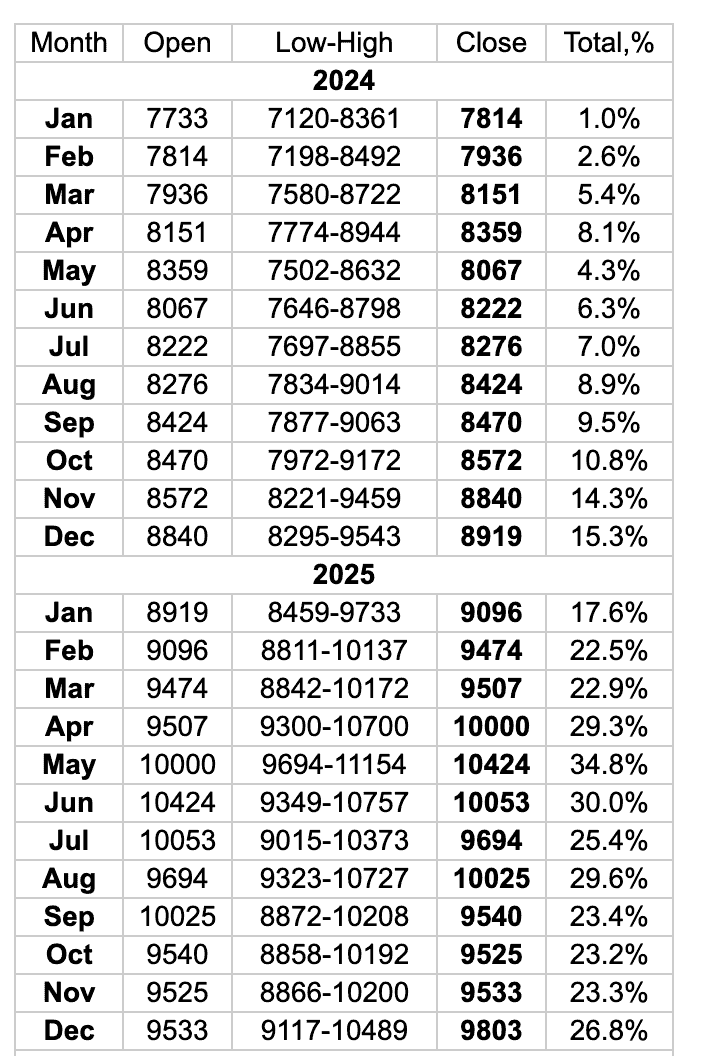

This optimism is reflected in the Economic Forecast Agency’s predictions for 2024 and 2025. As we can see below, the agency expects the FTSE 100 to gain throughout the year. Even the lower end of the forecast represents a considerable advance on the current position.

And according to the agency, the FTSE 100 could feasibly hit 9,000 towards the end of the year. But this represents one of the most optimistic outcomes for the year.

What would that look like in practical terms? It would likely only be achieved if the economy experiences a soft landing, inflation cools as expected, and interest rates fall earlier than the current consensus.