Investing in the stock market can be a wild ride at times. But make no mistake, owning UK shares can build significant wealth for investors who take a long-term view.

According to investment firm Vanguard, the average yearly return from British stocks sits at 9.18%, unadjusted for inflation. Even adjusted for inflation it sits at an impressive 5.35%.

Both figures beat the returns from savings accounts and bonds by a comfortable margin, as the table shows.

Total returns between 1901 and 2022

| Asset class | Nominal return | Real (inflation adjusted) return |

| Cash* | 4.55% | 0.87% |

| UK bonds | 5.14% | 1.44% |

| UK shares | 9.18% | 5.35% |

Past returns are no guarantee of the future, of course. But the performance of UK shares shows I could potentially unlock a substantial passive income stream without having to break the bank.

Let’s say I have £400 available to invest each month. That could be enough to help me establish a second income of £21,473 for the rest of my life. Here’s how.

A FTSE 100 strategy

Investing in FTSE 100 shares could be the strategy to help me achieve this goal. The UK’s leading index is packed with market-leading, multinational companies with great growth records. On top of this, Footsie stocks are known for providing consistent and generous dividends.

Between its inception in 1984 and 2022, the FTSE 100 delivered a staggering return of 1,514.92%. That combines both price gains and dividends, and works out at an annual average of 7.48%, according to IG Group.

Let’s assume the FTSE keeps on delivering this average return for the next 30 years. What would this transform a regular £400 monthly investment into?

| FTSE 100 | |

| 5 years | £28,995.78 |

| 10 years | £71,093.32 |

| 20 years | £220,948.85 |

| 30 years | £536,824.97 |

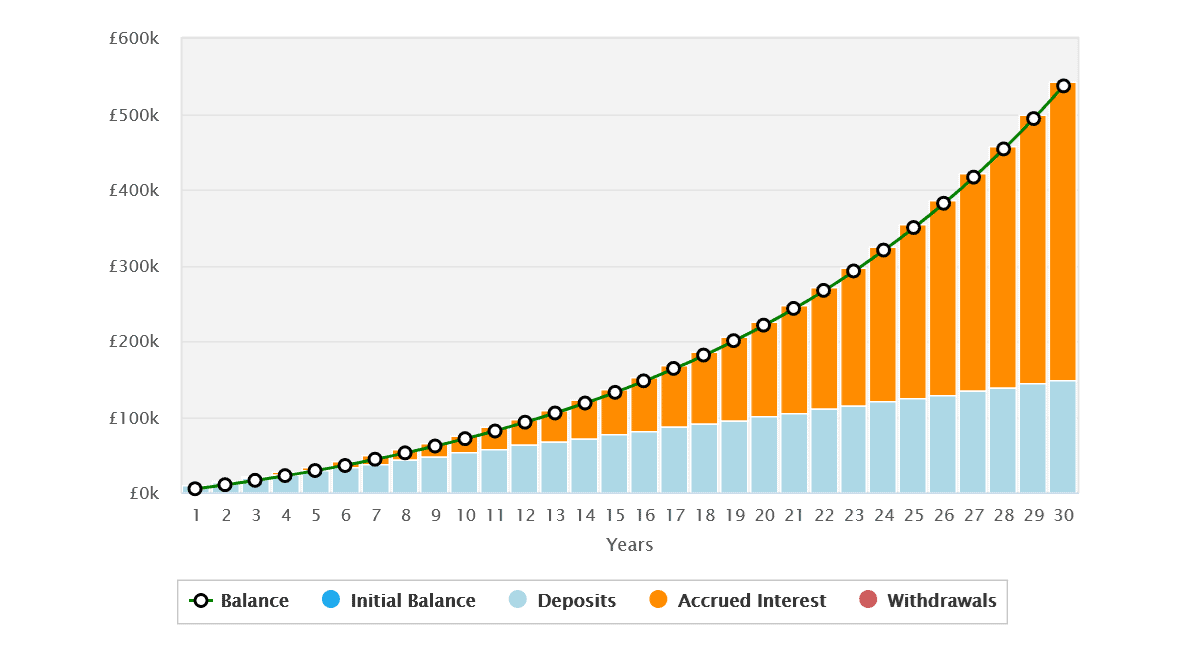

As the table shows, investing in blue-chip shares would build me a huge nest egg worth £536,824.97. That’s thanks to the miracle of compounding, in which I would reinvest dividends over those three decades to buy even more shares and receive even more dividends.

The graphic below shows the powerful impact of this mathematical miracle on building long-term wealth.

Now let’s transfer that into a passive income by using the 4% drawdown rule. This would allow me to draw a retirement income for 30 years before the well eventually runs dry.

Using this withdrawal strategy would provide me with a healthy annual passive income of £21,473.

Reward vs risk

Of course the prospect of making a five-figure income while doing nothing is very enticing. But it’s important to remember that share investing isn’t a risk-free endeavour and positive returns are never guaranteed.

A prolonged period of high inflation and elevated interest rates, for instance, could harm the profits I make. So could economic slowdowns in major economies like the US and China. Finally, rising geopolitical tensions may also hurt my returns if trade frictions flare up and conflicts emerge.

However, I think these risks are worth taking. As I’ve demonstrated, investing in UK shares can create life-changing wealth and hasten the path towards financial independence. It’s why I plan to continue building my own stocks portfolio in 2024.