Nvidia (NASDAQ:NVDA) stock is up 234% over the past 12 months, and I didn’t get a single percent of that.

However, I’m now a shareholder having finally found an entry point. The big question is: am I late to the party?

Strong metrics

Nvidia started to look hugely expensive last year. The firm’s share price surged as tech companies turned to its graphics processing units (GPUs) for their AI demands.

Should you invest £1,000 in Barratt Developments right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barratt Developments made the list?

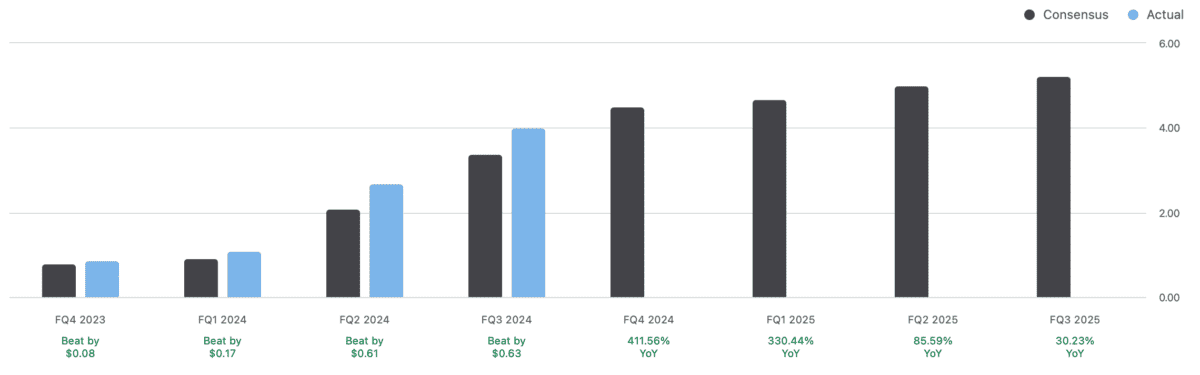

However, as the year went on, it delivered earnings beat after earnings beat. Analysts just haven’t been able to keep up with the relentless pace of growth the company is experiencing.

It’s still the case that Nvidia looks expensive according to some metrics. The company trades at 63.5 times TTM (trailing 12 Month) earnings and 43.1 times forward earnings.

However, as we can see from the above chart, analysts expect it to continue growing its earnings well into next year. In fact, they expect earnings to grow at 42.3% annually over the next three-to-five years.

In turn, this contributes to a forward price/earnings-to-growth (PEG) ratio of 0.92. The PEG ratio is calculated by dividing the forward price-to-earnings (P/E) ratio by the expected growth rate. A ratio under one suggests good value.

But clearly, it’s not just me that recognises this. Nvidia has an average price target of $653.89, 35% above the current share price.

This is normally a very good sign as these share price targets reflect the opinion of a pool of analysts. We can often expect some discount, but +35% is huge.

GPUs

So, why is Nvidia suddenly the most exciting stock on the market?

Well, its GPUs were originally created for high-performance graphics rendering (I used one of these for gaming) and have parallel processing capabilities that are ideally suited for AI workloads.

Nvidia’s H100 chipset, which directly connects a graphics processor with six high-bandwidth memory chips thanks to its advanced packaging, has experienced a surge in demand.

The chip is perfect for workloads like natural language processing, computer vision, and machine learning.

To complement this, Nvidia introduced its new top-of-the-line chip for AI work, the HGX H200, in November.

It’s seen as an upgrade to the H100, offering 1.4 times more memory bandwidth and 1.8 times more memory capacity.

Of course, the rapid pace of growth is contingent on the company staying ahead of the game.

In December, Intel redesigned the architecture of its flagship PC chipset for the first time in 40 years, using advanced packaging to stack four ’tiles’.

This is certainly a risk when investing in Nvidia — can it stay ahead of the competition — as is the company’s reliance on production partner TSMC given the geopolitical pressures facing Taiwan.

However, Nvidia remains top of the table for now, and it’s certainly got the cash flow to fund new R&D projects and stay ahead of the curve.