When I look for FTSE 100 shares, I’m always looking for great revenue growth and margins. If I can find a company trading at a cheap price, too, that’s even better.

Here’s one I’d never heard of before, and it looks like a winner in my books.

What is it?

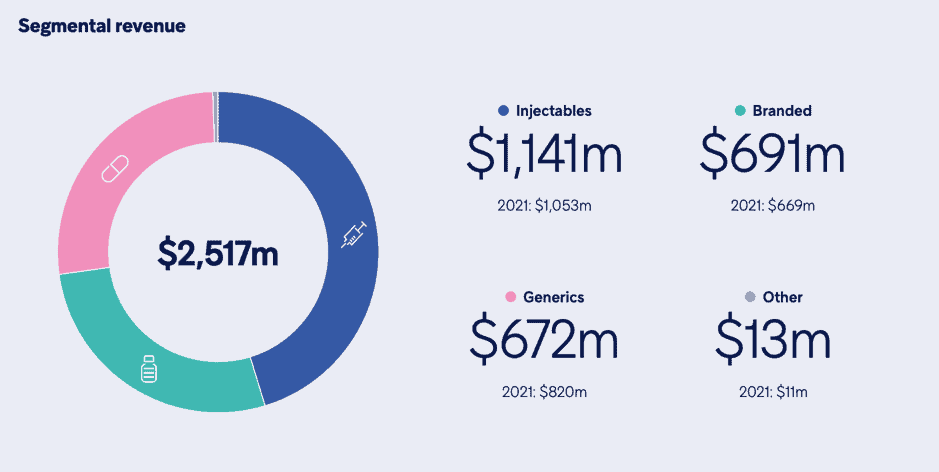

Hikma Pharmaceuticals (LSE:HIK) develops, manufactures, and produces a wide range of pharmaceutical products, primarily injectibles, generics, and branded products.

The company is notably established in generic medicines, which are copies of branded products that are allowed to be reproduced after the original patent has expired.

It has several manufacturing facilities across its core markets, providing reliable supply to demand.

Growing nicely, but profits falling

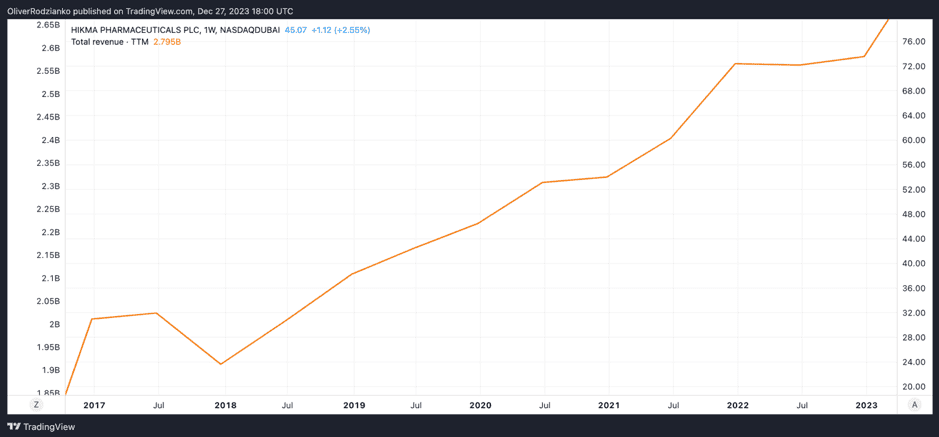

Hikma has reported great revenue growth rates over the long term, and the good news is they have been particularly high recently.

To illustrate this, the 10-year average annual revenue growth rate is 9.1%, the five-year rate is 8.3%, but the one-year rate is 15%!

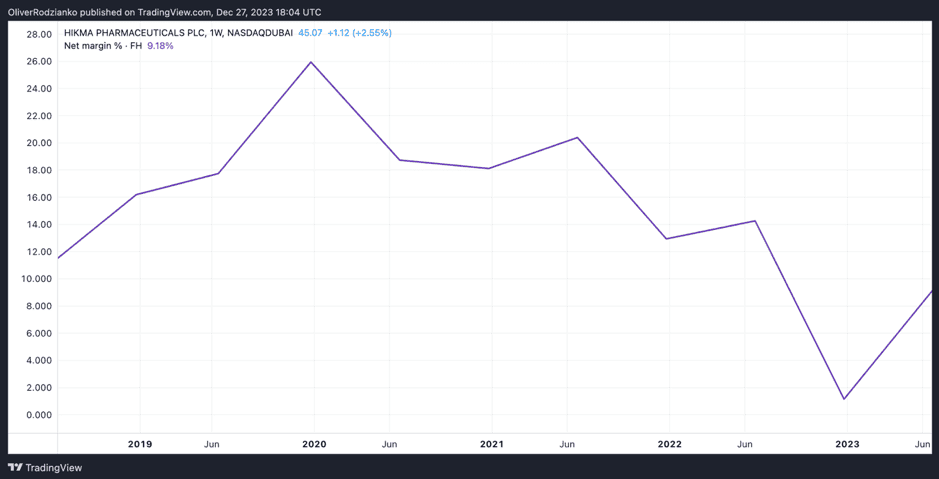

However, it’s worth noting that one of the risks with this company is the declining net margins, which is not ideal.

What this means to me is that although the company is growing in a revenue sense, it has specific expenses that are depleting its profitability. For a potential investor like myself, that’s a red flag because net income is equivalent to earnings. And earnings are one of the most potent drivers of share price increases over the short and long term.

A closer look at the price

With the price down around 35% from its all-time high, I reckon there could be a significant opportunity here.

When evaluating the company, using the normal price-to-earnings (P/E) ratio gives us a reading of around 33. However, I like to use forward earnings estimates, which is often considered a more accurate and advanced approach. That gives me a P/E ratio of around just 11.

That looks cheap to me. The industry median is 14.5!

The great thing about buying growing companies that are also selling at a cheap price is that my return on investment could be reasonably higher.

The reason is that, typically, great shares sell at above their fair value. Finding cheap, great stocks is quite similar to finding something like a genuine Rolex watch selling at 20% off by mistake.

Not the best in the world, though

That being said, I don’t think these shares are the best of the best. If they were, I’d certainly buy them, but I just think there are some better companies out there with more stable margins, for instance.

Yet, if I was looking to diversify my portfolio within the pharmaceutical sector, this could be a bargain buy. After all, as a Fool, I don’t want all my eggs in one basket.