The Barclays (LSE:BARC) share price has largely underperformed its peers in recent years. This can be traced to various issues. They include net interest margin (NIM) downgrades, and SEC fines related to securities sold in error.

However, downward pressure on the stock has arguably created some attractive buying conditions. Barclays trades at 6.96 times forward earnings, representing a 35.79% discount to the sector average.

Moreover, for a stock that pays a significant dividend, it possess an appealing price/earnings-to-growth (PEG) ratio of 1.39. Normally a PEG ratio above one suggests a stock is overvalued when adjusted for growth. But factoring in the 4.8% dividend yield, it looks good value.

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

So, is there better value in the banking sector than Barclays in 2024?

UK lender

Lloyds (LSE:LLOY) is the UK’s largest mortgage lender. And as it doesn’t have an investment arm, it’s more interest-rate-sensitive than its peers.

So, with interest rates rising over the last two years, and interest rates set to fall over the next three, Lloyds has likely been impacted more than its peers.

The impact of changing interest rates on banks is multi-faceted. Higher rates means higher net interest income. But they also lead to higher impairment charges as customers struggle with their repayments.

Lloyds has some deal of insulation from these impairment charges as its average mortgage customer boasts an income of £75,000 — far ahead of average.

However, it could certainly benefit from falling rates, especially if the bank’s hedging strategy is as effective as analysts expect it to be. And this is why the bank trades with a PEG ratio of 0.56. That’s a 60.59% discount versus the sector average.

Lloyds is also cheaper than Barclays on a forward earnings ratio at 6.8 — that’s a 37.01% discount to the sector.

Better value overseas?

One reason UK banks look so cheap versus the sector average is that the sector average is dragged upwards by US-based banking institutions. They trade at much higher multiples.

And this is because banks are cyclical stocks that tend to reflect the health and potential of the economy. The US is still seen as a much safe economy. And it’s one with much stronger growth potential versus the UK and Europe.

To that end, European banks certainly aren’t expensive either.

Intesa Sanpaolo is one of Europe’s top banking groups, with a significant presence in Italy and beyond. It’s Italy’s largest bank and has produced some its most successful quarters ever over the past 12 months.

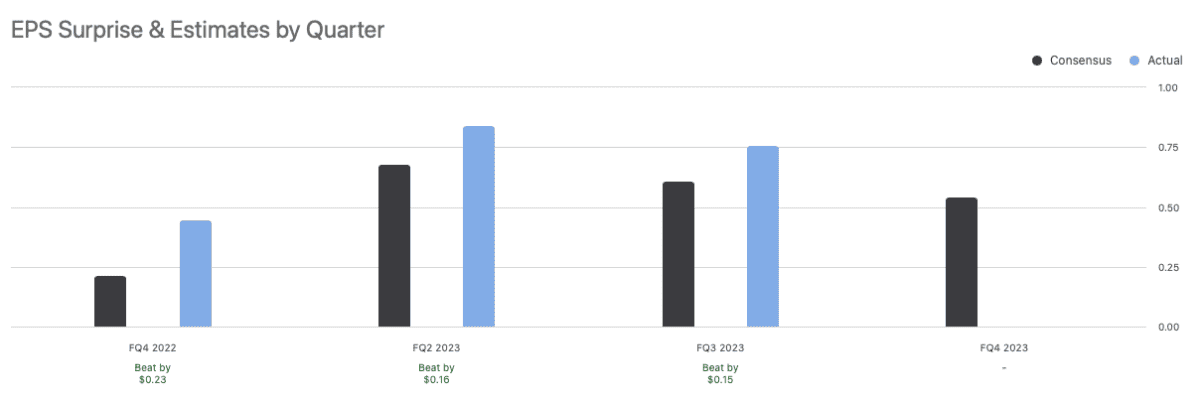

As the chart shows, Intesa has delivered three consecutive earnings beats, partially due to the impact of higher interest rates on income. Despite this, the stock has been volatile, rocked by a windfall tax in Italy.

However, this uncertainty has contributed to attractive buying conditions. Intesa Sanpaolo trades at 5.8 times forward earnings — a 46.26% discount to the sector, and has a forward PEG ratio of just 0.22.

So, personally, my top banking stocks for 2024 are Lloyds and Intesa Sanpaolo. But Barclays certainly looks good value too.