Despite rising interest rates, for most of us achieving a healthy passive income with savings accounts remains a challenging task. A better way to try and make a generous second income could be by regularly investing in FTSE 100 stocks.

It’s a strategy I’ve adopted. Although I realise it’s one that could take time to provide me with a life-enhancing second income.

Doing it like Buffett

With £1,000 in savings, I don’t stand a realistic change of earning annual interest (ie dividend income) of more than £70-£80. Those figures are based on purchasing UK shares with dividend yields of between 7% and 8%. And it’s assuming that broker forecasts prove correct, of course.

But I’m prepared to be patient. Over time, share investing has proved to be a great way to build wealth. Just ask billionaire investor Warren Buffett, who earned 99% of his wealth after the age of 50.

The ‘Sage of Omaha’ prioritises investing in US stocks. But British shares have also proven to deliver exceptional shareholder returns over the years.

Take the FTSE 100 for instance. The London Stock Exchange‘s leading index has delivered an average yearly return of 7.48% between its inception in 1984 and 2022.

This is the sort of return that could make me a significant second income. Allow me to quickly show you how.

Spectacular returns

Let’s imagine that I begin my investing journey with £1,000 in my pocket and spend £200 on FTSE 100 shares each month. We’ll also say I’m able to increase the size of my monthly contribution by 5% annually.

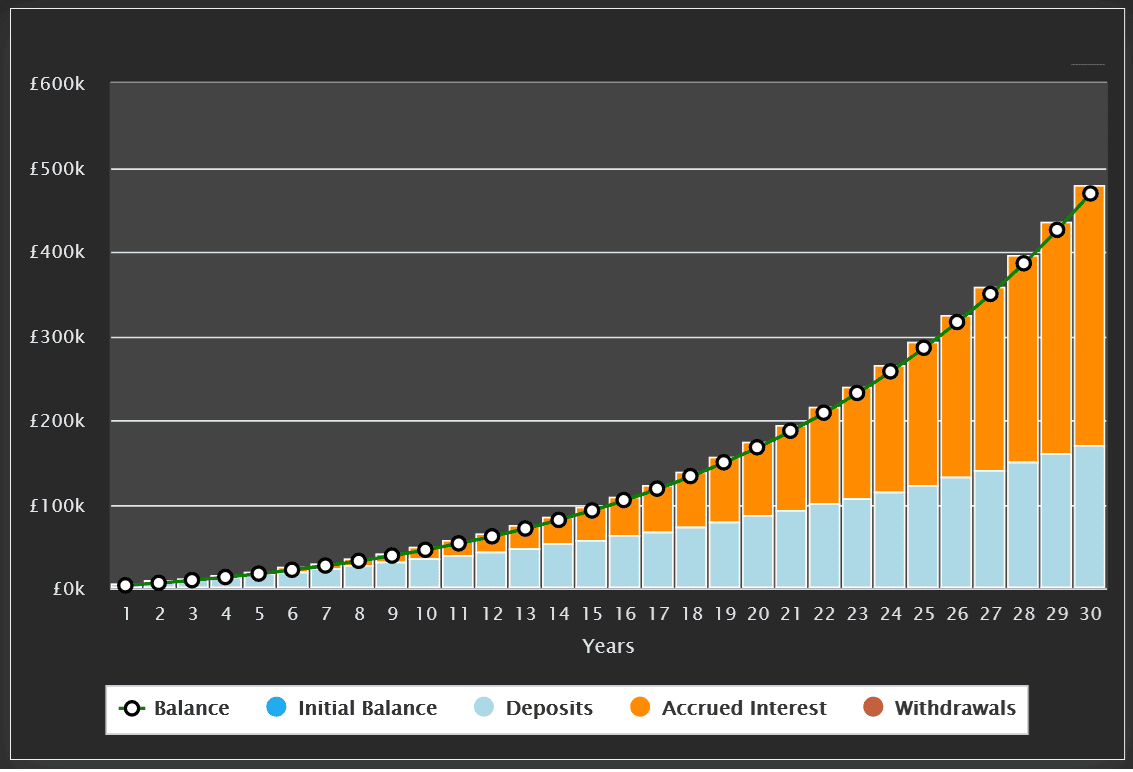

If the Footsie’s long-term annual return remains unchanged at 7.48%, my investment story could look like this:

Thanks to regular investing and the miracle of compound interest, I would, after 30 years, have created a lush nestegg worth a whopping £469,158.

To break this down, I would have made £300,700 interest on a total investment of £159,458. This would involve the reinvestment of any dividends I received, a process that would enable me to earn cash not just on my original investment, but also on any dividends I put back in the pot.

A £18,766 passive income

If I manage to hit this magic amount, I could eventually — using the much-trusted 4% drawdown rule — enjoy a healthy five-figure passive income.

By applying this 4% rate, I could ensure I have money for 30 years before the coffers are empty. It’s a popular formula used in retirement planning. And it’s one which, with that £469,158 sitting in my account, would give me a tasty second income of £18,766 a year.

I’m not saying reaching this target will be easy, of course. All long-term investors experience bumps along the road to building wealth.

But with a commitment to regular investing — not to mention the help of investment resources such as The Motley Fool — this target can be attainable.