Warren Buffett is among the most successful investors of all time. He’s amassed a fortune worth in excess of $120bn.

So how can one of the richest people in the world help me? Well, the great man’s advice can even help small savers aim for market-beating returns. And that’s perfect for those of us with less investing experience.

Starting with nothing

The first thing to address is how we can start investing without any existing capital. Well, the answer is simple. I need to put aside a chunk of my monthly salary, every month, and work from there.

Should you invest £1,000 in Rws right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rws made the list?

So I’ll need to set up an investment account, perhaps within an ISA if I’m a UK resident, and decide how much money I can put aside each month.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

It might not sound like a winning strategy, but these things take time.

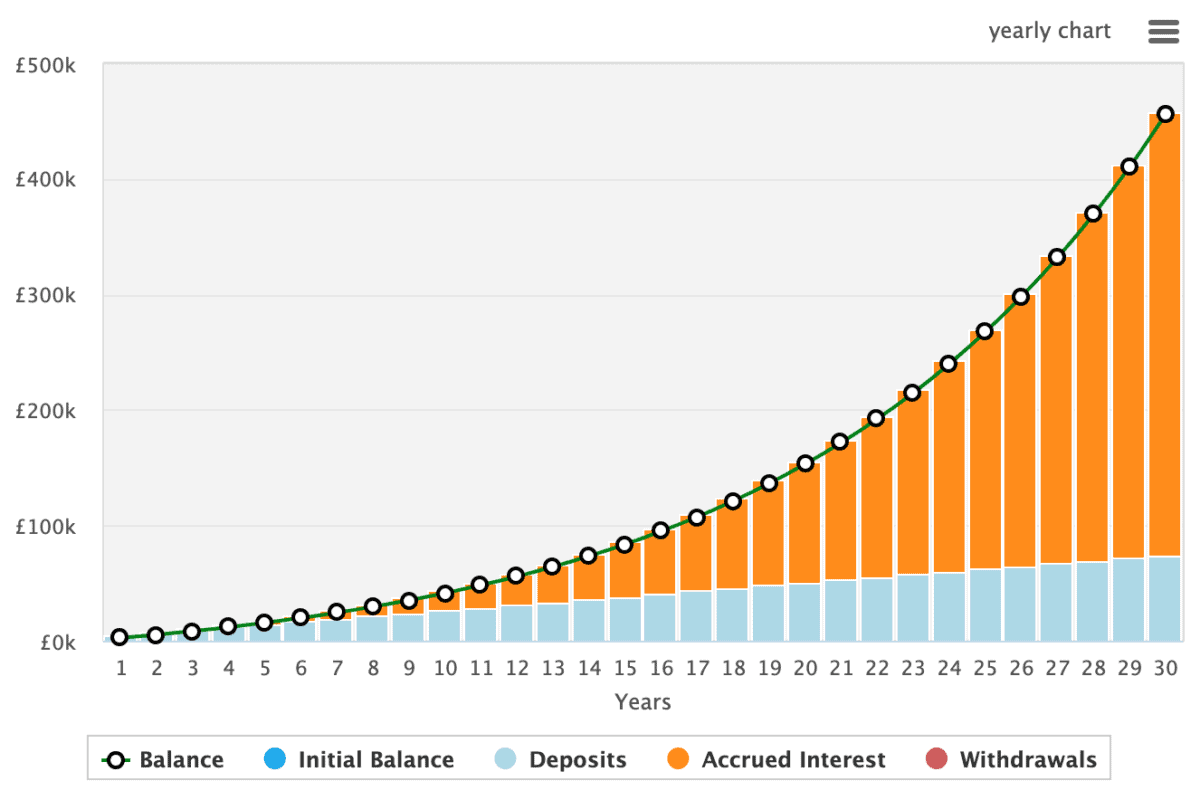

Moreover, with time I can benefit from compounding — this is a key ingredient when investing. Compounding happens when I reinvest my returns year after year. This then allows me to earn returns on my returns.

This leads to exponential growth. Just look at the example below.

Buffett’s teachings

Buffett has achieved annualised returns near 20% over the decades he’s been investing. That’s quite incredible and hard to replicate.

And his success is partially due to the copious research that he and his team undertake to make the right investment decisions.

However, that’s all secondary to his “rule number one” — often referred to as his “golden rule”.

So what is the rule? “Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.”

This might sound obvious, but it’s absolutely key. Protecting capital is paramount in investment strategy.

Avoiding losses not only preserves wealth but also prevents the compounding effect of setbacks. Of course, if I lose 50%, I’ve got to gain 100% to get back to where I was.

Embracing a cautious approach, thorough research, and risk management aligns with these rules, ensuring a disciplined investment mindset.

Remembering Buffett’s timeless advice underscores the fundamental importance of capital preservation in navigating the dynamic landscape of financial markets.

Following advice

It’s not easy to follow his advice. After all, novice investors may find the situation rather daunting.

Thankfully, there are a host of resource out there to help us make the right investment decisions. Platforms like The Motley Fool have done a huge amount for democratising investing.

If I want to follow Buffett’s investing strategy even more closely, there’s a world of literature to that end, including his own ‘Letters to Shareholders’.

Likewise, if I really want to copy Buffett, I could invest in Berkshire Hathaway — a company’s he’s led for decades.