BAE Systems (LSE: BA.) shares topped the FTSE 100 in 2022 following Russia’s tragic invasion of Ukraine on 24 February. They had another market-beating year in 2023 as geopolitical tensions and defence budgets remained high.

Here, I’ll look at how much I’d have today if I’d invested £5,000 in the defence stock as 2022 began.

More than double

At the start of 2022, the share price was 549p. As I write, it’s at 1,152p, which represents a gain of 109%.

That means my £5,000 investment would have increased to around £10,450. That beats any market average return I’d have got investing passively.

On top of this, I’d have received cash dividends as a shareholder. There have been four payouts over this period and those would have taken my total return to just under £11,000.

Market timing

Of course, there would have been a degree of the unexpected in the timing of this hypothetical investment.

In early 2014, Russia invaded and annexed the Crimean Peninsula (then part of Ukraine). But the full-scale invasion eight years later was unexpected by most observers.

We can see evidence of this in the BAE share price. At the start of 2022, it was only around 5% higher than it was in 1999. Following the invasion, it doubled inside two years.

Strong business performance

In a November trading update, the firm reiterated its 2023 guidance. Revenue is anticipated to be around £24.7bn, representing year-on-year growth of approximately 6%. Underlying earnings per share are expected to grow 10%-12%.

By November, BAE had taken in £30bn of orders, adding to the £37bn it received in 2022.

An attractive feature of defence spending from an investing standpoint is the long cycle involved. The contracts being secured now will be executed over many years, which provides the firm with great long-term visibility of its top-line growth.

Moreover, as the spending is motivated by national security concerns, it shouldn’t be affected by what happens in the wider global economy. The sales are essentially recession-resistant.

Meanwhile, there’s a £1.5bn share buyback programme ongoing and the well-funded dividend, currently yielding 2.6%, is expected to grow around 7% this year. So there’s a lot to like with this stock.

On the negative side, the valuation might be getting a little stretched at 18.3 times earnings. That’s nearly twice the FTSE 100 average at present. So there could be valuation risk.

Would I buy BAE stock today?

Defence stocks like this tend to trade in line with rising or falling defence budgets, which is understandable. Therefore, the shares will likely pull back sharply if a hoped-for ceasefire in Ukraine leads to military budgets being subsequently cut.

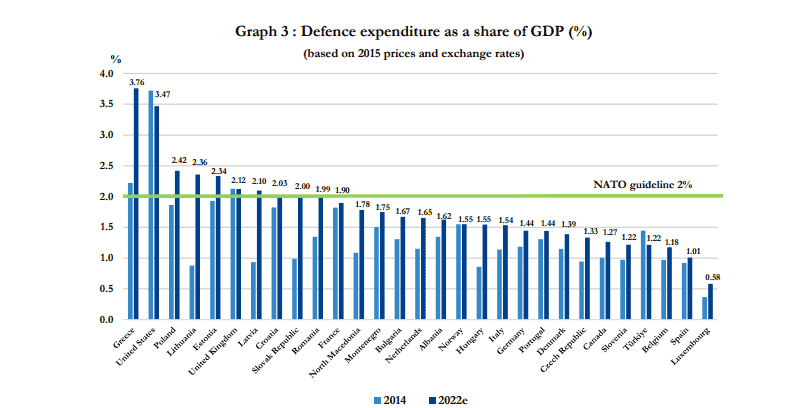

Yet even if a peace agreement happens in Ukraine, I expect global defence spending to remain high. Many NATO countries need to invest heavily in the years ahead just to meet their 2% GDP spend commitment as members.

BAE serves customers across all domains — air, land, sea, cyber and space — and is therefore perfectly placed to keep picking up contracts. This could underpin further earnings and share price growth.

If I didn’t already own the stock, I’d buy it today. But I wouldn’t go overboard as it’s trading at an all-time high.