Some think that interest rates dropping could help the BT (LSE:BT.A) share price recover from the doldrums. It’s certainly possible for a few reasons. Let’s take a closer look.

BT’s debt

BT’s debt has put a few investors off. The telecommunications giant has a significant debt burden, which can be more challenging to manage in a high-interest-rate environment.

Net debt currently stands at £19.7bn, up from £18.9bn in March. Incidentally, the company’s net debt positions surpasses the company’s market capitalisation of £12.4bn.

While leverage is a key tool for investment and growth, the weight of this debt may be overwhelming for certain investors. A substantial portion of this increasing debt is attributed to pension contributions, although the communications giant aims to achieve £3bn in savings by 2024.

Debt structuring

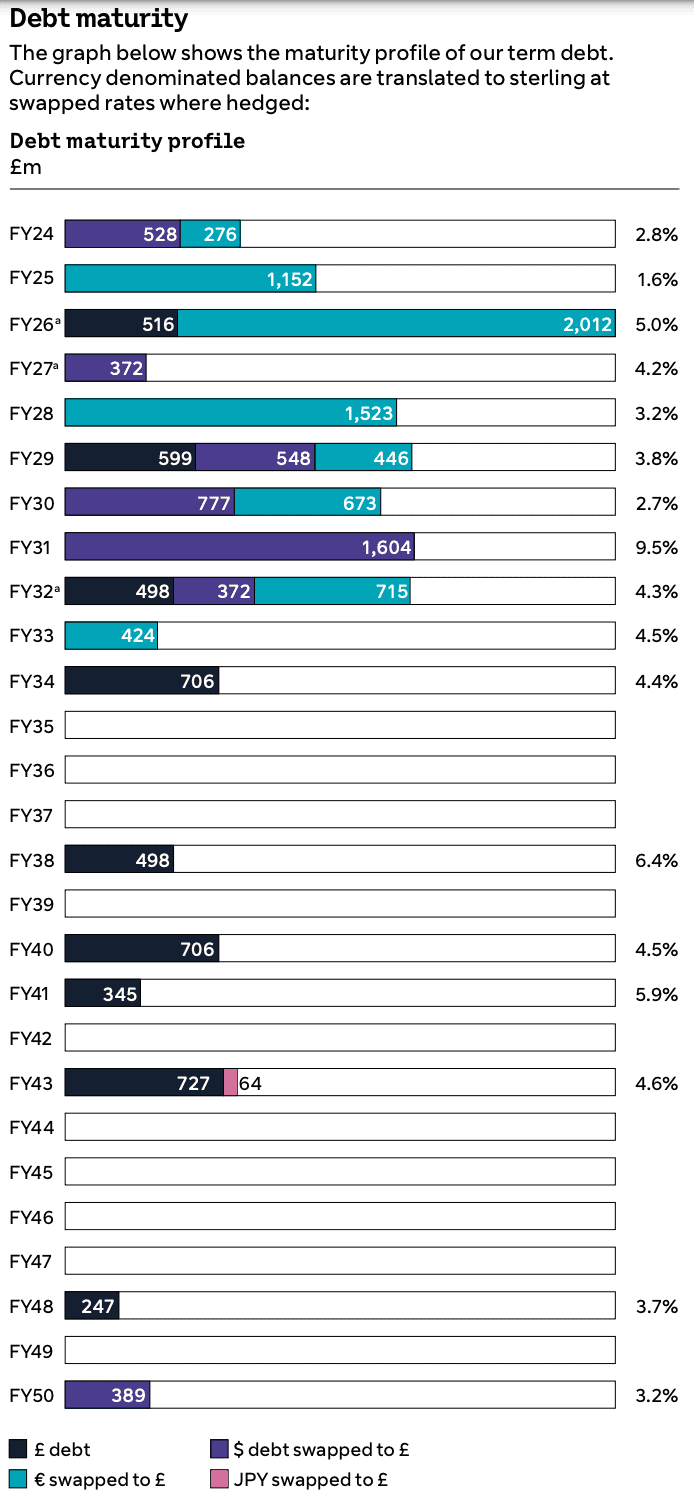

As we can see from the chart below, much of BT’s debt matures in the next five years, including a substantial figure in 2026.

This impending debt maturity raises the importance of the company’s financial strategies and management decisions in the coming years. The company is aiming to reduce debt, but it’s not certain how.

Successfully addressing and refinancing these obligations will be crucial for BT to alleviate concerns, maintain financial stability, and foster investor confidence in the face of the looming debt maturity challenges.

Fixed vs variable

Unlike most of us with a mortgage, BT doesn’t have all its debt on either a fixed or variable terms, but a mixture of both.

According to BT, at least 70% of ongoing net debt is at fixed rates, suggesting that somewhere between 20-30% is on variable rates. As such, we can expect falling interest rates to have a significant impact on the group’s debt position.

The majority of fixed-rate debt offers protection against rising rates, while any variable-rate debt could see reduced interest expenses, potentially easing the overall financial burden and enhancing BT’s financial flexibility.

Of course, there are further considerations too. For example, lower interest rates could allow BT to raise more money at lower rates of interest.

Will I be investing in BT?

BT shares trade at a 53% discount to the global communications sector on a forward basis. That’s not a bad sign.

The table below details BT’s earnings per share (EPS) forecasts for the next three years, coupled with the associated forward price-to-earnings (P/E) ratios.

| 2024 | 2025 | 2026 | |

| EPS | 15.6 | 15.3 | 15.9 |

| P/E | 8 | 8.2 | 7.9 |

However, while BT’s P/E is significantly below the industry and index average, the lower ratio also reflects the company’s high net debt levels. Likewise, I’m also not excited by the company’s EPS growth.

So while we may see some upward movement in the BT share price is rates fall in 2024, it’s not a company I’m looking to invest in. Looking at the bigger picture, I think it’s a company with a lot of problems and a lack of direction. It’s a pass from me.