Fundsmith Equity is one of the most popular investment funds in the UK – and for good reason. Over the long term, it’s delivered strong, market-beating investment returns.

I hold Fundsmith and it’s a relatively large holding for me. Is it still a good investment in 2024? Let’s discuss.

Investment strategy

Firstly, let’s look at the investment strategy here. Fundsmith is a high-conviction, concentrated global equity fund (it only holds 20-30 stocks) that invests in ‘high-quality’ businesses.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Its portfolio manager, Terry Smith, looks to invest in companies that are very profitable, are financially strong, and are resilient to change.

Once Smith makes an investment in a company, he typically stays invested for the long term.

Is this a good strategy? I think so. History shows that investing in high-quality businesses for the long term tends to produce strong returns.

That said, the strategy is not going to work all of the time. And with a concentrated fund like Fundsmith, there’s always the risk that returns could deviate from market returns significantly.

2023 performance

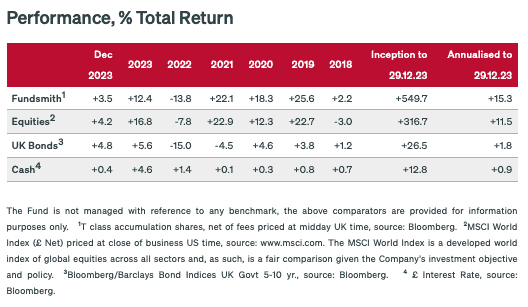

That leads me on to performance. In 2023, Fundsmith delivered a total return of 12.4%. That’s a solid gain.

But it’s quite a bit lower than the return from the MSCI World index, which delivered 16.8%. In other words, Fundsmith lagged the market.

Am I worried about the performance in 2023? Not particularly. That’s because 2023 was an odd year for the stock market in that a large proportion of the returns came from the mega-cap tech stocks (aka the ‘Magnificent 7’).

Fundsmith owns a few of these stocks, but not all of them. For example, it doesn’t own chip designer Nvidia, which rose 239% last year.

I am a little bit concerned about the performance trend however. For three years now, the fund has lagged the MSCI World index, as the table below shows.

Source: Fundsmith Equity

I’ll point out that long-term performance is still excellent. But I’m starting to wonder if Fundsmith needs more exposure to technology and, in particular, Big Tech. After all, we are in the midst of a global tech revolution.

2024 outlook

Looking at the fund’s top holdings as we start 2024, I think there’s a good mix of companies.

I’m happy that Microsoft is a large holding. It’s very well positioned in today’s digital world. I also like the fact that Novo Nordisk (weight-loss drugs) and Visa (electronic payments) are in the mix.

| Top 10 holdings |

| Microsoft |

| Novo Nordisk |

| L’Oreal |

| Meta Platforms |

| Stryker |

| IDEXX |

| LVMH |

| Visa |

| Philip Morris |

| Automatic Data Processing |

It’s worth touching on the sector split though.

At the start of 2024, Consumer Staples was 28.6% of the fund and Healthcare was 26.7%. Meanwhile, Information Technology and Communication Services were just 19.6% combined.

Given this breakdown, I’d expect the fund to do well if market conditions are a little challenging in 2024.

However, if tech stocks were to dominate again, Fundsmith may continue to underperform.

My view

Of course, we don’t know what 2024 will bring. All things considered however, I still see Fundsmith as a good choice for my portfolio.

Like any fund though, it’s not a silver bullet. Therefore, I’ll also be investing in other funds as well as individual stocks (like Nvidia) to give myself the best chance of success.