If we’re looking to invest, it’s hard to overlook the immensely powerful vehicle that is the Stocks and Shares ISA.

A Stocks and Shares ISA offers tax advantages, shielding capital gains and dividends from income tax. This tax-efficient investment vehicle allows individuals to build wealth over the long term.

With a diverse range of investment options, including stocks, bonds, and funds, it provides flexibility and potential for higher returns.

Additionally, the compound returns on investments within the ISA enhance wealth accumulation, making it a compelling choice for those seeking tax-efficient, long-term investment strategies.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Starting an investment journey

If I had £10,000 in excess savings and was looking to invest, I’d start by opening a Stocks and Shares ISA at a major UK investment platform. Personally, I use Hargreaves Lansdown.

In conjunction, I would conduct thorough research on potential stocks, establish clear financial goals, and consider diversifying my portfolio for risk management.

Staying informed about market trends, adjusting strategies, and maintaining a long-term perspective would be integral for a successful and informed investment journey.

Realism

Next, I’ve got to accept that I’m not going to achieve my goals overnight. Patience is key when it comes to investing through a Stocks and Shares ISA.

The beauty of this long-term strategy lies in the potential for gradual and sustainable growth. Markets can fluctuate, and short-term variations are inevitable.

Moreover, I need to recognise that the secret ingredient is compounding. This is the practice of investing my returns over and over again.

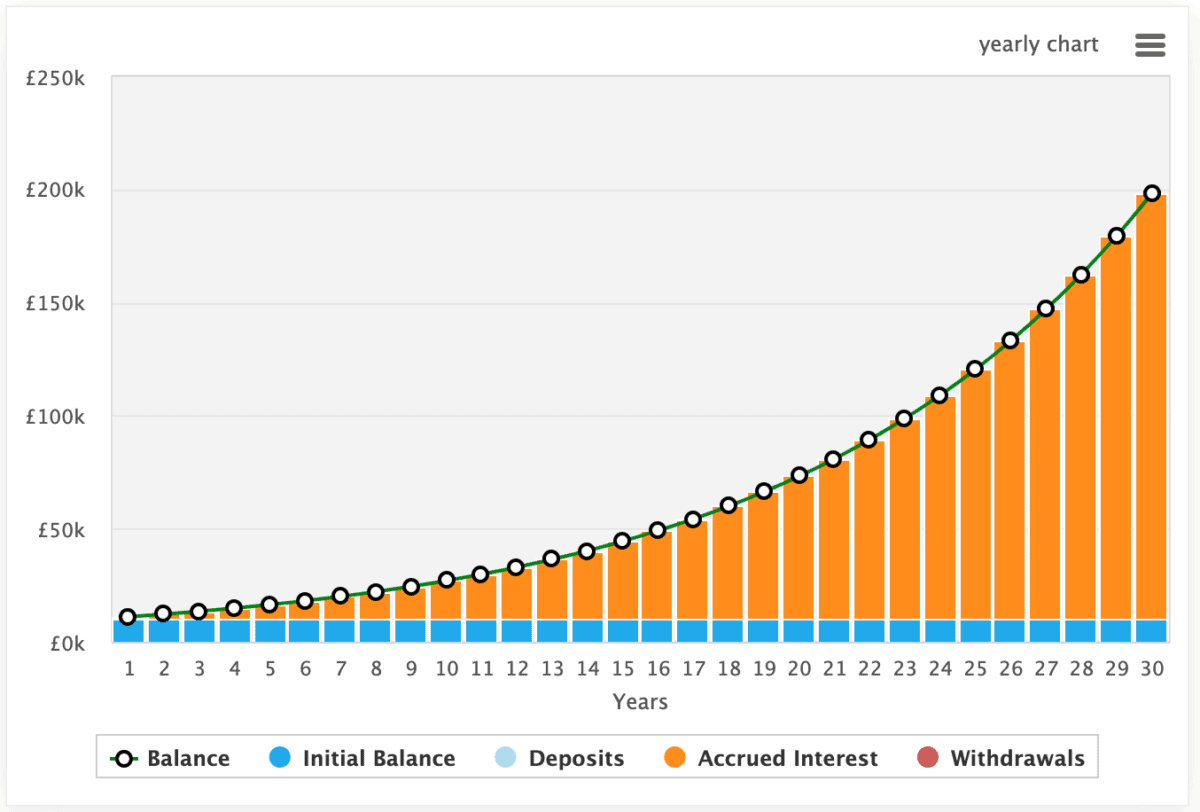

By consistently reinvesting returns, compounding can amplify wealth growth. In a Stocks and Shares ISA, reinvested dividends and capital gains generate additional earnings, which, in turn, contribute to a larger base for future returns.

Over time, compounding becomes a powerful force, exponentially increasing the overall value of investments and enhancing long-term financial goals.

Just look at how the pace of growth increases as time goes on. The below example assumes a 10% annualised return.

Of course, if I had the ability, I’d also be looking to add to my portfolio monthly, even if it were just £50 or so. Over a long period of time, it’d make a huge difference.

We all have a different idea of what being rich would look like. But transforming £10,000 into £200,000 would certainly satisfy me.

Investing for success

I need to recognise, however, that I’d be doing well to achieve a 10% annualised return. Of course, it’s by no means impossible. As more seasoned investor, I aim for low double-digit returns.

Central to a successful investing strategy is research. If I make poor investment choices and lose 50%, I’ve got to gain 100% to get back to where I was.

And this simple example underscores the need for sensible investment choices. Thankfully, these days it’s easier than ever. Platforms like The Motley Fool have democratised investing, and can help me make wiser choices.