Personally, I’d prefer to invest in stocks and shares for a second income rather than purchase a buy-to-let property or something similar.

Why’s that? Well, investing in the stock market is among the most passive ways to earn a second income.

I don’t need to worry about letting voids, or have to do any manual labour. It’s all about research and hitting the ‘buy’ and ‘sell’ buttons.

Moreover, there’s certainly capacity for much greater returns. In fact, I’ve been following a portfolio that’s up 75% over 18 months.

That’s clearly an extreme example of the success that investors can achieve. However, I stick by my original comment — it’s easier to make money from stocks, than houses.

Getting started

Embarking on an investment journey can feel daunting. However, I could start small and prioritise education.

After setting up an account with a major investment platform, the next step is setting clear financial goals and assessing my risk tolerance.

This involves defining what I aim to achieve through investments and understanding how much market volatility I am comfortable with.

Depending on my goals and risk exposure, I can explore various investment options, such as stocks, bonds, or funds, allowing me to diversify my portfolio and manage risk effectively.

As I gain experience and confidence, I can gradually adjust my strategy and increase my investment contributions, fostering a steady and informed approach to wealth-building.

Effective strategies

With £10,000-£15,000, I have a great starting point. It’s more than most Britons have in savings. So, how could I go about turning that into a second income?

Well, to start with, I’d need to build wealth. Unfortunately, the passive income I could generate from £10,000-£15,000 isn’t going to be life-changing, but with time, it could be.

Through the power of compounding, reinvesting even modest returns over time can significantly amplify wealth. In simple terms, to practice compounding I need to reinvest my returns year after year.

As the initial investment grows, so does its earning potential, fostering a gradual yet impactful financial transformation.

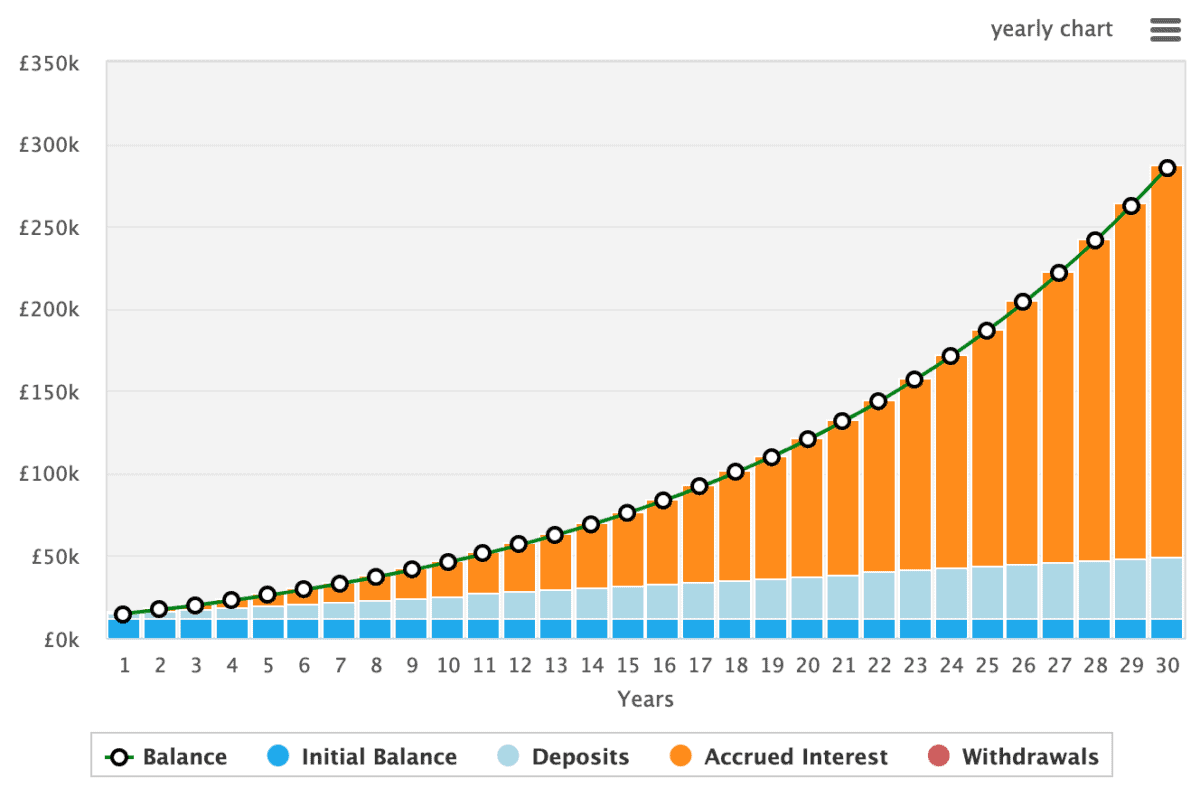

I may also be inclined to contribute monthly to help my portfolio grow. Take a look what happens if I could actualise 8% returns annually while contributing £100 a month — I’m using £12,500 as my starting figure.

After 30 years, I’d have almost £300,000. And with £300,000, I could generate around £21,800 a year in the 30th year.

Making wise choices

The only problem is, many novice investors lose money. And if I lose 50%, I’ve got to gain 100% to be back where I was.

The key is research. By thoroughly researching my investments and using platforms like The Motley Fool, I can make wiser investment decisions.

This may include practicing pound-cost-averaging or using a value investing approach. There’s certainly a lot to learn, but there are a host of resources to help me.