The runaway success of the Glencore (LSE: GLEN) share price in 2021 and 2022 wasn’t repeated in 2023. Despite this, I did double down on the stock back in March and it has since risen 15% from its year low. For me, the company has one of the most compelling growth stories in the FTSE 100.

Volatility is a given

When one invests in commodities, and particularly miners, one expects a bumpy ride. Not only are they cyclical businesses, but they’re very sensitive to the daily price movements in the underlying metals they produce.

At the beginning of 2023, the consensus opinion (for which I include myself) was that a recession was a dead cert. This fact alone weighed down on its share price all year, despite one never materialising.

Should you invest £1,000 in Relx right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Relx made the list?

Coupled with this, the reopening of China following Covid lockdowns, didn’t translate into a demand boom for commodities, even though one had been predicted at the beginning of the year.

Commodities supercycle

Despite its share price disappointing in 2023, if we remove 2022, the company actually had its best performance in the last 10 years. Nevertheless, analysts are starting to question whether 2022 was a one-off, when it made record revenues of $256bn.

I don’t sit in that camp. I believe the company is likely to see a number of major tailwinds in the years and decades ahead.

How so? First, there’s the expanding fiscal agenda in the US. The Inflation Reduction Act and the CHIPS & Science Act are estimated to unleash at least $2trn of government spending. The legislation is designed to increase US competitiveness, innovation and industrial capability.

To provide one example, only a few months ago, the US administration gave the green light to spending $16bn on railroads and building its first-ever high-speed line.

On top of all this, Western companies continue to onshore more and more of their manufacturing capability. This is not only in response to Covid supply issues but also increasing geopolitical tensions. When we put it all together, it’s incredible bullish for commodities.

But at the same time, stock levels within various commodities are at record low levels. Exacerbating this fact is that ore grades of a number of critical metals are in a long-term decline. This is because all the low-hanging fruit has long been mined.

Copper – the electrification metal

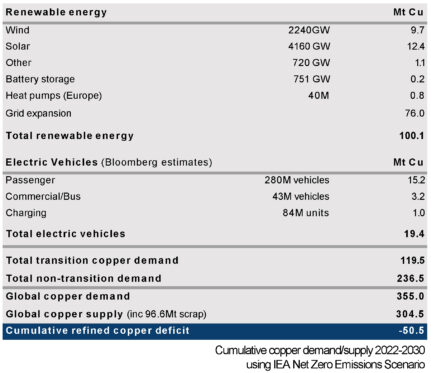

One metal that I view as the poster child of an impending deficit is copper. Modelling the International Energy Agency Net Zero Emissions Scenario, the following table highlights a deficit of 50m tonnes of copper, by 2030.

Source: Glencore company presentation

The problem is that I don’t think that most people understand the challenges inherent in bringing new supply on-line over short timeframes.

Major in-country risks include ESG mandates, land acquisition and protracted permitting applications. That is all before one considers normal disruptions such as strikes, skills shortages and infrastructure challenges.

The industry also remains very conservative toward capital expenditure. Capex sits well below its prior peaks of 2011. Glencore is unlikely to be in any rush to bring new supply of copper on-line until prices begin to reflect all these challenges.

It’s little wonder that I remain so bullish on its prospects in the years ahead.