There has been an avalanche of positivity surrounding Rolls-Royce (LSE: RR) shares over the last year. And rightly so, as the turnaround in business performance under chief executive Tufan Erginbilgiç has been quite dramatic.

This was reflected in the incredible 220% share price in 2023. Indeed, this made the FTSE 100 engine maker the best-performing blue-chip across the whole of Europe last year.

However, I want to focus on a couple of key risks as we enter the New Year.

Pandemics and pricing

As we know, the pandemic was utterly devastating to Rolls-Royce’s finances. This was due to its business model, where the company gets paid when aircraft powered by its engines are in the sky (measured as time on wing).

When there were no planes in the skies, with none needing regular servicing, the company went into survival mode. Jobs were shed, assets were disposed of, and huge debt was taken on.

While things are now much better, another global health emergency would be a huge setback. And it can’t be ruled out.

Right now in the US, China and elsewhere, a new variant of the coronavirus virus called JN.1 is spreading rapidly. It’s too early to tell how dangerous this is, but scientists say the trend could be exacerbated by mass travel in China around the Lunar New Year.

China is a key market for Rolls-Royce and a country where the authorities don’t mess about when it comes to enforcing lockdowns.

Also, the CEO has been renegotiating contracts with business partners. This should bear fruit long term, but in the meantime there could be pushback on pricing.

After all, the widebody airline market has quite a small number of important players. With Rolls playing hardball, customer relationships could be damaged.

It’s happened before

As strange as it sounds, investors who bought at the beginning of 2023 would still be doing fine even if Rolls shares did fall to £1.50 this year. They’d still be up around 60% or so, as the shares were 93p back then.

Of course, that’s not how most investors would see things. And I bought my shares at around £1.49 last year, so I would see my approximately 100% gain (as I write) almost completely wiped out.

Such things have happened to me before. Between early 2020 and late 2022, I watched in horror as my holding in Shopify went from a 300% gain to being down 25%.

Stocks often do take the stairs up and the elevator down, as the old investing saying goes.

Thankfully, I held on and things are back on track, but these huge dips can be painful as an investor. And they can never be discounted.

A wide range

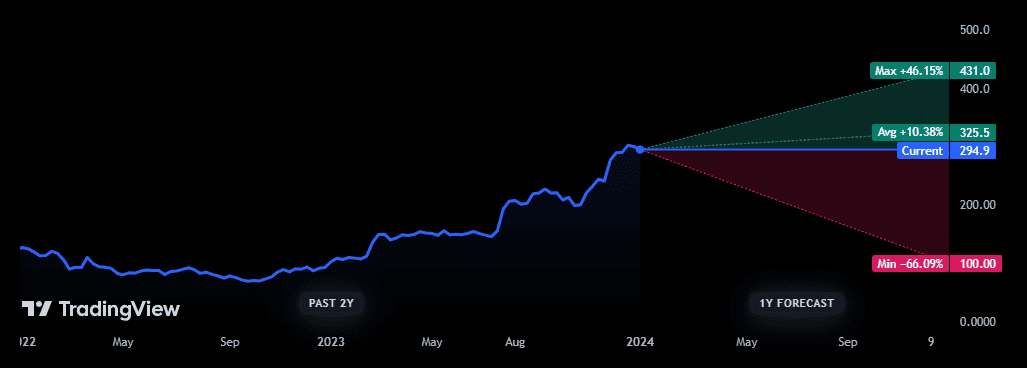

Ultimately, it’s uncertain where the shares will be by the end of this year. We can see this in the wide share price target range given by brokers for the next 12 months.

The consensus bull-case scenario sees the share price topping £4.31. However, the bear case from some analysts calls for a share price of just £1.

What should I do faced with this uncertainty?

Despite the risks, I’m going to keep holding my position in 2024. I’m bullish on the share price and remain hopeful for more gains.