The FTSE 100 and FTSE 250 may not always be as exciting as some tech-heavy US indexes. However, there are certainly companies in them that can help me grow my wealth over time. That’s even if I’m starting with nothing. Here’s how I’d do it.

Starting from scratch

The average UK citizen has around £17,365 in savings. But a striking 34% of adults have either no savings or less than £1,000 tucked away.

As such, many Britons start their investment journeys with little or no money.

Nevertheless, in the current landscape, we can embark on such a journey with as little as £100 (or less, depending on the brokerage).

And this means it’s essential to commit to regular contributions, providing our portfolios with the fuel to continue growing.

My first port of call in that situation would be to sort out a broker online and open an investing account. For that, I should certainly consider a Stock and Shares ISA for the tax benefits.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Realism

If I’m starting with nothing, I need to recognise that I’m not going to get rich overnight.

By setting achievable milestones, consistently saving or investing, and embracing a long-term perspective, even a modest beginning can lead to significant financial growth over time.

It’s not about rapid gains but rather the commitment to a sustainable and disciplined approach. This lays the foundation for future prosperity.

Moreover, by taking a long-term view I can look to benefit from the compounding of my returns.

This happens when I reinvest those returns year after year. It allows me to start earning interest on my interest as well as on my contributions.

It might not sound like an exciting strategy, but it really is a winning one. It leads to exponential growth.

And this is important when investing, versus saving where returns are often much lower.

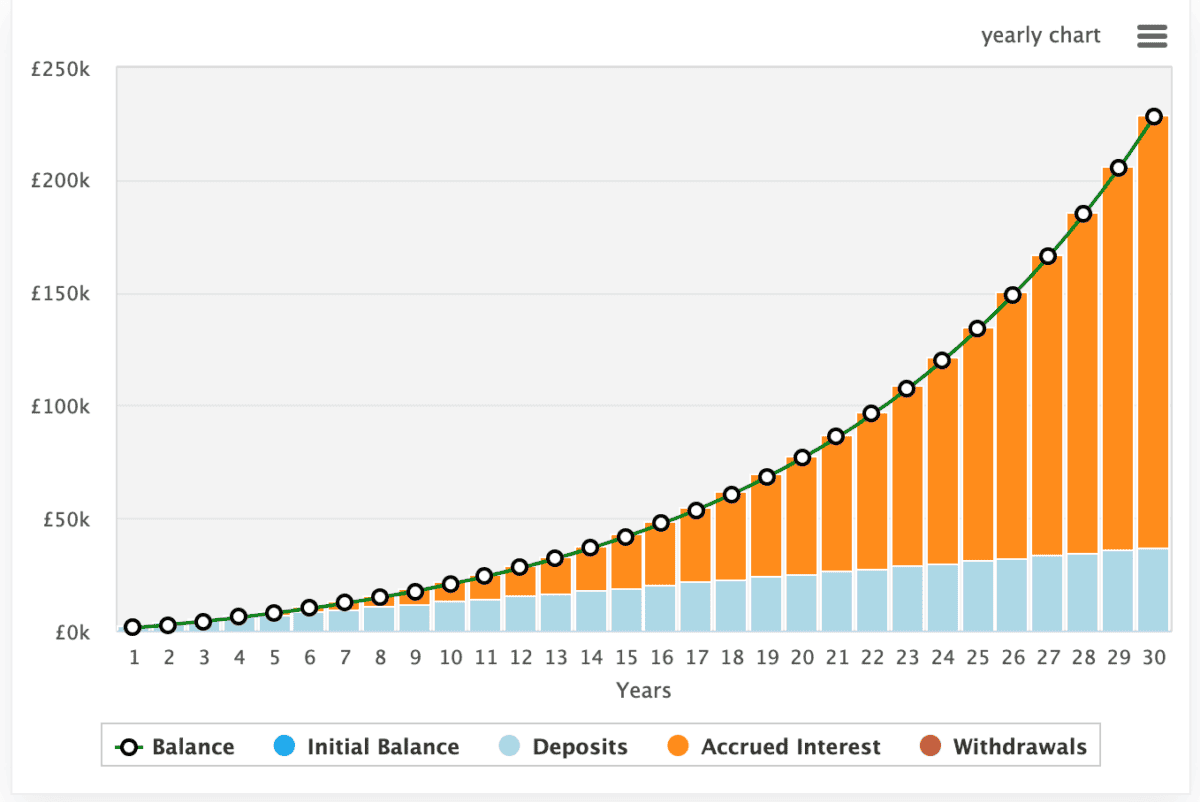

Novice investors, if making sensible decisions, can look to generate returns between 6% and 10%. The below chart shows how £100 a month can compound over 30 years with an annualised rate of return of 10%.

Investing wisely

Of course, investing isn’t risk-free and if I make poor decisions I’m going to lose money. That’s why it’s really important that I do my research and make the most of democratising resources like The Motley Fool.

For me, a good place to start is valuation metrics. And one of my favourite metrics is the price/earnings-to-growth (PEG) ratio. It’s an earnings measure that’s adjusted for growth, and a ratio under one suggests a company is undervalued.

| PEG | |

| Tesco | 0.47 |

| Rolls-Royce | 0.55 |

| Lloyds | 0.55 |

| Marks & Spencer | 0.82 |

| Intercontinental Hotels Group | 0.97 |

The above chart highlights the five stocks on the FTSE 100 deemed undervalued by the PEG ratio. And the top three, Tesco, Rolls-Royce, and Lloyds, could be good choice to help me build wealth over the long run given the ratios suggest they’re undervalued by around 50%.

There are companies on the FTSE 250 with PEG ratios below one too, including easyJet at 0.83. And if I choose to fill out a W-8BEN form, I can access US-listed companies too.