My top growth stock right now is PayPal (NASDAQ:PYPL). What’s more, I reckon it doubles up as a value investment. And I’m buying the shares this December near the end of the month.

The company was spun off from eBay in 2015. It’s a payment processor focusing on online transactions that most of us have used or heard of.

Like Peter Lynch, I love to have first-hand experience in the day-to-day life of companies I invest in. Thankfully, I know PayPal well, and I think it’s the best growth and value opportunity on the market right now.

Should you invest £1,000 in Paypal right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Paypal made the list?

Why I’m buying the shares

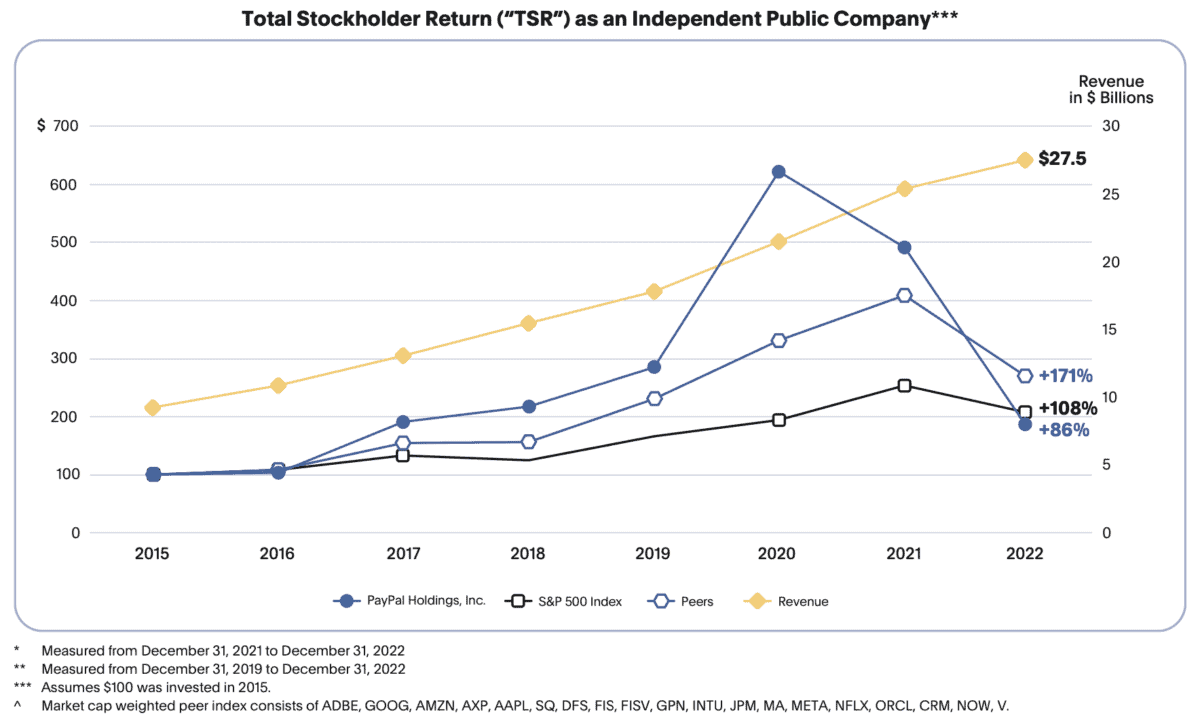

PayPal is a growth stock because of its 10-year average annual revenue growth rate of 18%. Also, in the last year, it managed to maintain a 12% revenue growth.

Indeed, careful observers will have noticed that the revenue growth rate is slowing. But I don’t think that’s a reason to back away from the shares.

The share price is currently down by around 80% since July 2021. However, looking at the following chart from the 2022 annual report, you’ll notice revenue has steadily risen…

This is incredibly attractive, especially considering a stable balance sheet with around an equal amount of cash to debt.

However, it may take some time for the organisation’s share price to accurately reflect some of the broader operational successes.

For that reason, I must maintain some patience here.

PayPal’s operations

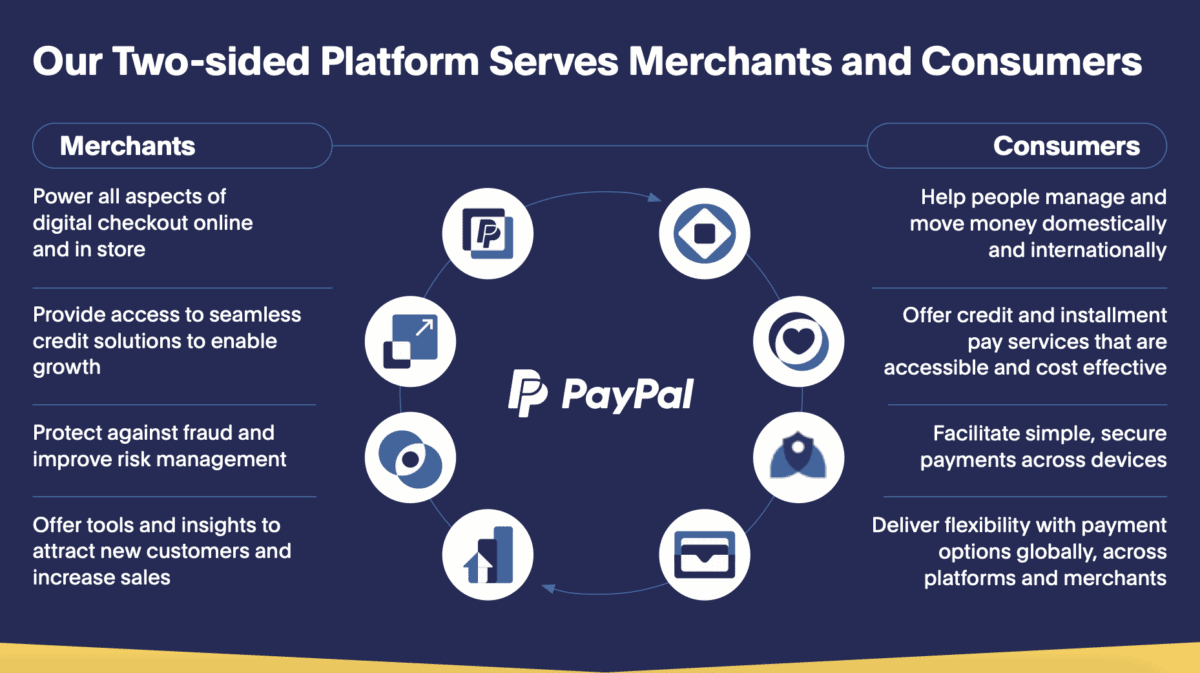

Here’s how PayPal works:

While the company has a compelling fintech product and service set, there are some fundamental difficulties the company must face moving forward.

Because of the continued success of Apple Pay, there is a significant risk to PayPal that it will lose market share.

To combat this, the company has tried to offer services like Pay in 4 and other ‘buy now, pay later’ schemes. This includes PayPal Credit, which is attractive to a range of consumers. But Apple Pay and other competitors have caught on, now introducing their own schemes along these lines.

One of the other areas I’m also watching is data security. In December 2022, a data breach affected the information of almost 35,000 users.

Forward strategies to strengthen cyber-security include data encryption, fraud monitoring and prevention, and using security keys. How PayPal effectively defends itself from cyber threats will be paramount to its future reputation and success. This is especially true in an increasingly technologically advanced era, on both the good and dark sides.

Major competitors

Here are PayPal’s three major competitors by my estimation:

- Square

- Stripe

- Apple Pay

Of these, only Stripe is a private company, so it is not available for the public to purchase shares.

Square offers significant competition for merchant payment processing, Stripe for e-commerce and online transactions, and Apple Pay for consumer spending. These are all elements that PayPal dominated before.

I’m sold

This article begins for me what is a deep dive into PayPal. It will culminate in a relatively significant investment by the end of the month.

As with every investment, I take time to do my research. Often, I’ll publish multiple articles on a company, both short and long form, before executing a trade.

However, I’m already sure I’ll be a shareholder of this one.