Lots of us invest so that one day we can take a second income to support our life plans. But for many of us, it seems a little farfetched, or unachievable.

So, here’s how I could get started with just £1,000.

The ISA

If I were starting from scratch today, I’d kick things off by opening a Stocks and Shares ISA. That’s because it offers enticing tax benefits for UK residents.

Gains made within the ISA, whether from capital appreciation or dividends, are shielded from capital gains tax and income tax.

This means that any profits generated from my investments remain entirely mine, enhancing the overall returns.

This means I can grow my wealth within a Stocks and Shares ISA and take a passive income without paying any tax. It’s a hugely efficient vehicle.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Contributing regularly

If I’m starting with £1,000, it would make sense to regularly contribute to my portfolio, thus fuelling my ambitions of growing my wealth. This approach accelerates the wealth-building process.

Contributing consistently, even if it’s a modest sum like £100 a month, enhances the compounding effect.

Over time, these contributions become powerful drivers of financial growth, transforming a humble beginning into a substantial investment portfolio.

It’s not just about the starting amount. It’s about the ongoing commitment to building a robust financial future.

Compounding for glory

The true alchemy in wealth-building lies in compounding.

When I consistently contribute to my portfolio, I’m not just adding money. I’m fostering a cycle of exponential growth.

Compounding turns my initial £1,000 and subsequent contributions into a snowball effect.

Each contribution earns returns, and as these returns accumulate, they also generate more returns.

Over time, the compounding effect transforms my humble contributions into something much larger.

It’s the snowball rolling down the hill, gaining momentum and size with every turn, transforming a modest start into a wealth-building juggernaut.

Consistency and compounding are the dynamic duo of financial success.

Bringing it all together

It’s important to note that if I invest poorly, I could lose money. If my investments lose 50% in value, I’d have to gain 100% to get back to where I was.

This is why it’s vital that I do my research and take advantage of democratising platforms, like The Motley Fool, to help me make wise investment decisions.

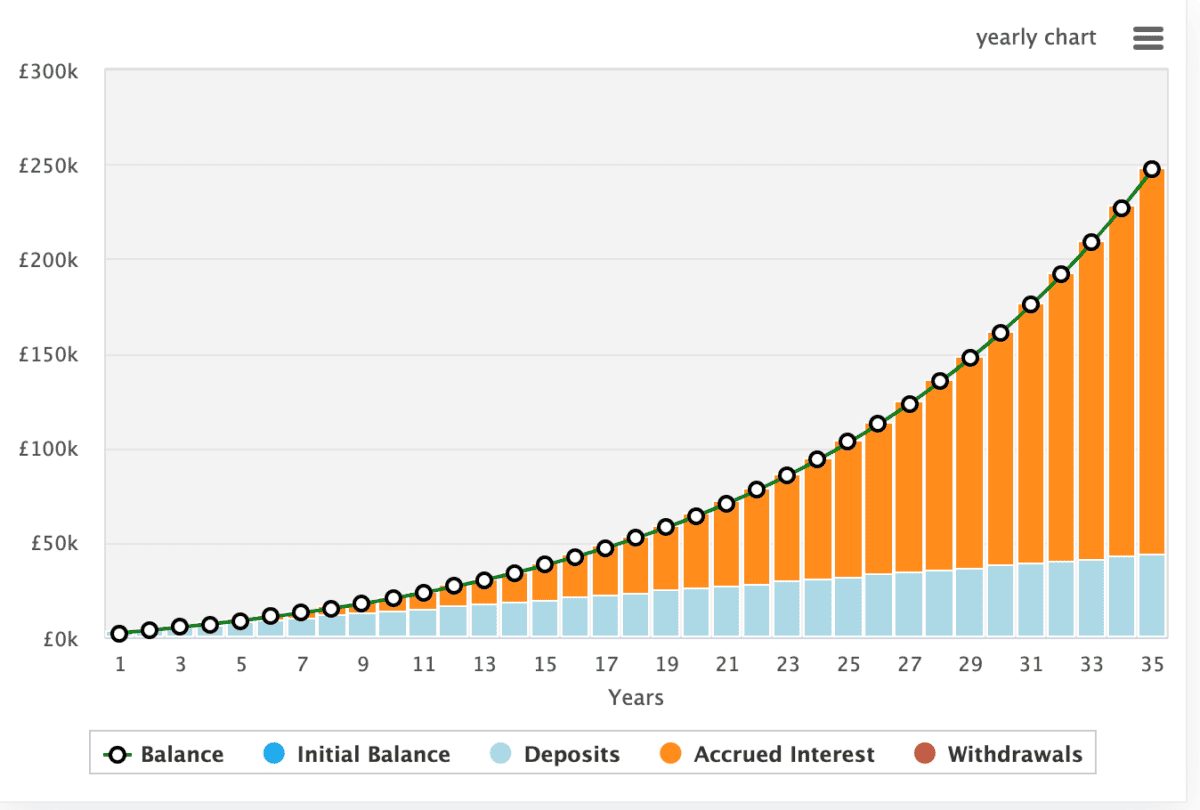

Many novice investors aim to earn between 6% and 10% annually. So, if we bring together the above, and assume 8%, here’s how my portfolio could grow over 35 years.

As we can see, the portfolio grows faster as time goes on. After 35 years, I’d have £247,210, and that’d be enough to generate £18,903 annually without having to touch the principal.

While it’s a long period of time, this is a substantial passive income having only put aside £100 a month. I could also consider increasingly my contributions in line with inflation to increase the pace of growth.