The Tesco (LSE:TSCO) share price has had a rough time over the past few years. It’s down over 50% from its all-time high.

However, recently, the shares have made somewhat of a comeback. Since October 2022, they’ve been up over 40%. But I think it’s been quite a bumpy ride since 2015.

The share price has often fallen over 20%, like from February to September 2022 or August 2018 to January 2019.

Should you invest £1,000 in Hollywood Bowl Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Hollywood Bowl Group Plc made the list?

But could this time be different? Or are the shares headed down again?

Well, I think they could be up over the long term, even if they go down in the short term. However, I reckon the price will climb slowly and steadily and could actually remain pretty flat.

What I can see

I think one of the core reasons for the fluctuations in share price since 2015 is the revenue changes the company has reported.

For example, in 2015, it reported £57bn in revenue, then went down to £54bn in 2016. The company’s revenue then increased to £64bn in 2019 and sunk as low as £58bn in 2021.

I’ve followed the price chart with the timings of these reports, and the share price seems to shift along with the revenue decreases and increases.

Since 2021, the revenue has increased from £58bn to £67bn today. So, I think this is a significant contributor to the recent share price rally.

This is no surprise to me, as I firmly believe that financial reports are the most significant influence on a company’s share price over time.

Also, as the organisation is already so prominent in its dominant market (the UK), I wouldn’t exactly call Tesco a growth company anymore.

In my opinion, this stunted revenue growth could lead to lacklustre share price increases.

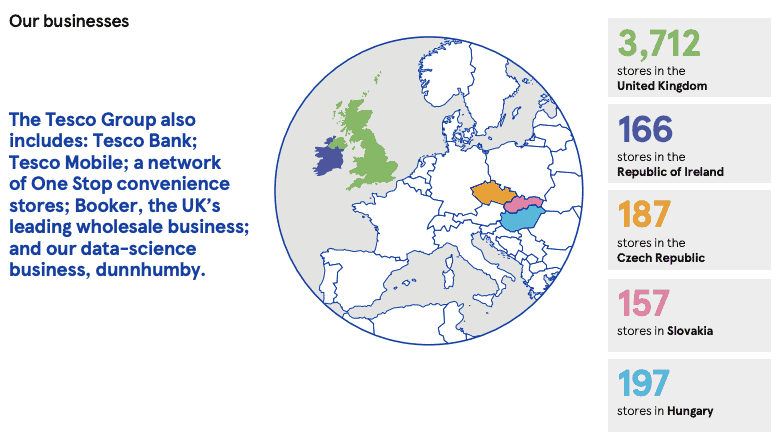

The picture below nicely outlines the scale of the Tesco business:

Where I think it could go from here

I think the company’s expansion will largely have to be driven by international markets from now on.

But Tesco has had multiple failed global launches, including a failed chain of stores in the US called Fresh & Easy. It eventually withdrew from the American market in 2013, resulting in around £1bn in losses.

There was also a similar story in Japan and Turkey, beginning in 2003. The company eventually exited from Japan in 2011 and Turkey in 2016.

However, it has had some success in China. Although there were initial challenges from 2004 onwards, it formed a joint venture with China Resources Enterprise in 2014. Yet, it sold out its entire stake in 2020.

Of course, the annual report image I provided above shows four countries other than the UK in which the company has been successful.

But my great takeaway from looking at Tesco’s international plans is that it has struggled.

So, I wonder whether it can effectively grow in the future like it did in the past if it cannot easily conquer overseas markets.

The bottom line

I don’t think the recent 40% rally will last because I don’t believe the company is prepared to keep up its revenue growth. I think history might repeat itself.

Therefore, the potentially stagnant nature of the share price with slower growth prospects means I’m not buying the shares.