Many people view Tesla stock (NASDAQ:TSLA) as a shaky investment right now.

A high valuation, a recent net income decrease, and founder and CEO Elon Musk’s PR difficulties are all risks I must consider.

Nonetheless, the company is my top stock this December, and I’m buying more. Here are the top three reasons why.

Should you invest £1,000 in Tesla right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Tesla made the list?

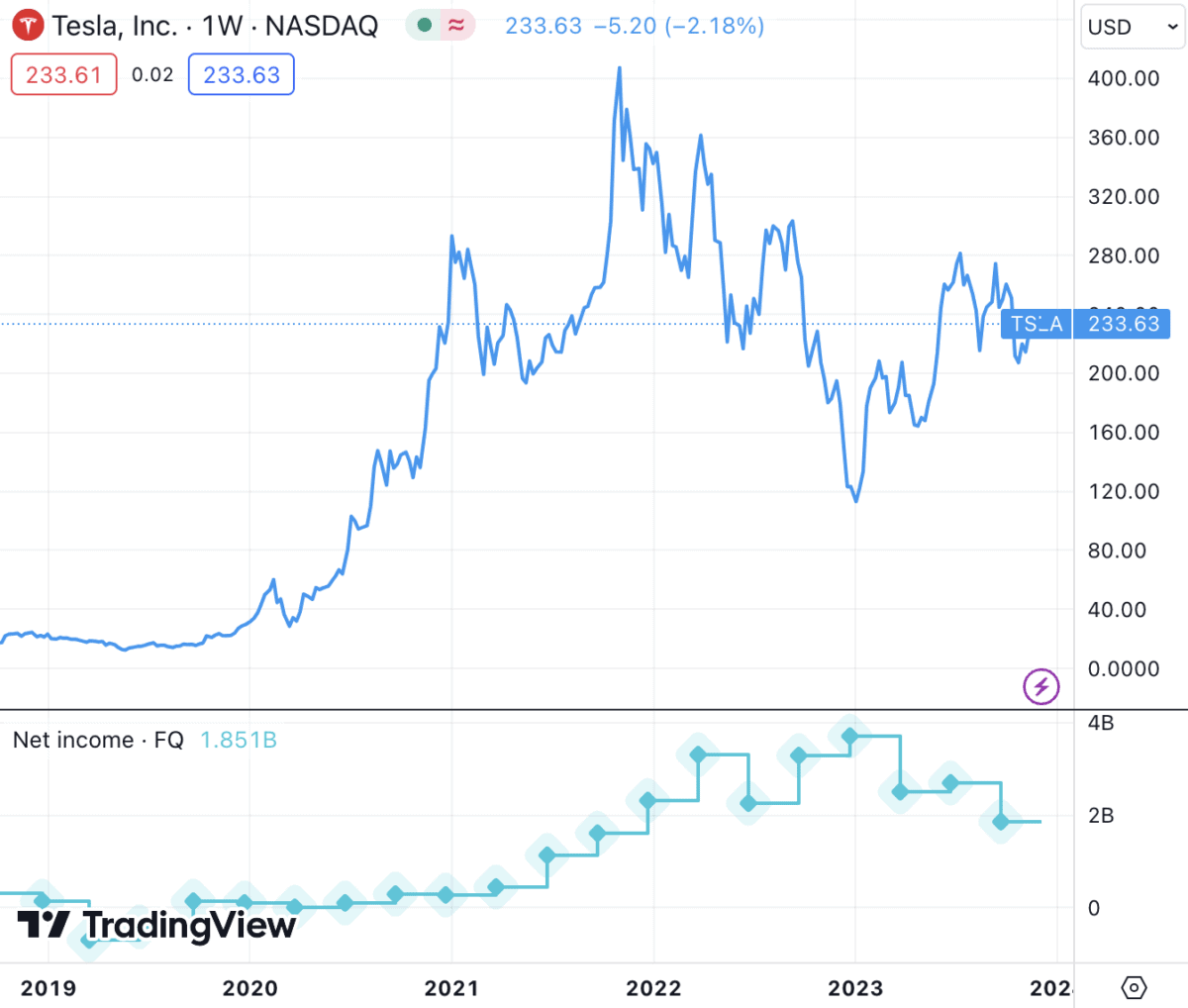

1. Down around 40%

The stock is currently down around 40% from its all-time high. It started falling in October 2021.

This presents a compelling opportunity for me. I’m always gutted when I miss an investment in a great company when the shares are on sale. This time, I’m not letting Tesla pass me by.

However, some immediate risks with the price include a price-to-earnings ratio of around 75, which is very high, even by technology sector standards.

And a low price doesn’t mean the price won’t fall further. That’s why, as a Fool, I’m well diversified in my portfolio. That keeps me protected from industry, geography, and company-specific risk.

2. AI initiatives

I’m most excited by Tesla’s autonomous driving initiatives driven by artificial intelligence (AI). I believe this is going to help Tesla’s margins significantly.

This development is important to me because the company saw a drop in net income recently, from $12.6bn in 2022 to $10.8bn for the last trailing 12-month period.

Source: TradingView

With margins being one of the company’s most critiqued financial points, I believe that if it successfully implements autonomous taxi initiatives, it will become strong on this front.

My strong sentiment for Tesla’s future related to this hinges on the fact that the company could technically still be successful if it sold its cars at no initial profit. If it revenue shares autonomous taxi services on a 50/50 revenue split with Tesla vehicle owners, it would be raking in cash daily for years after a car is sold to market.

3. Energy storage

Tesla’s energy storage business develops and distributes advanced battery storage systems. These include the Powerwall for residential use and the Megapack for larger utility projects. Both of these products store and manage renewable energy efficiently.

Amazingly, in the third quarter of 2023, energy storage revenues increased by 40% compared to the previous year. Gross profit for this area of Tesla’s business also increased by 266%.

Its energy storage systems are compatible with various technologies from other manufacturers. They can integrate with solar panels, grid systems, microgrids, and smart home systems.

It’s worth noting, however, that energy storage is only 6.7% of Tesla’s total revenues as of the third quarter of 2023. Therefore, I mustn’t overly weigh this segment of Tesla’s income in my analysis of its general company health.

Moving forward

Considering the above, I am a happy shareholder of Tesla shares. However, a closer look at one of the risks might be warranted.

Elon Musk has a very controversial public presence. There are both advantages and disadvantages to this. The share price may have risen to such a high valuation partly because of his celebrity presence and leadership. Alternatively, the stock can carry a lot of volatility due to his unpredictable comments.

Overall, I’m doubling down on Tesla shares. I love the company, and the rewards far outweigh the risks to me.