On 15 November, the UK medicines regulator approved a therapy that uses the CRISPR–Cas9 gene-editing tool, marking a world first. And it sent shares in this growth stock into hyperdrive.

And then on 8 December, the US Food and Drug Administration (FDA) also gave the treatment the green light. However, the stock slumped.

This might sound strange, but it probably reflects a fairly common phenomenon in investing. And that’s “buy the rumour, sell the news”.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

It suggests that traders may take positions in anticipation of a significant event or news (the “rumour”).

As the event unfolds and the news becomes public, there’s often a swift market reaction, and the prices may have already incorporated the anticipated information.

So what makes this company so exciting?

World’s first

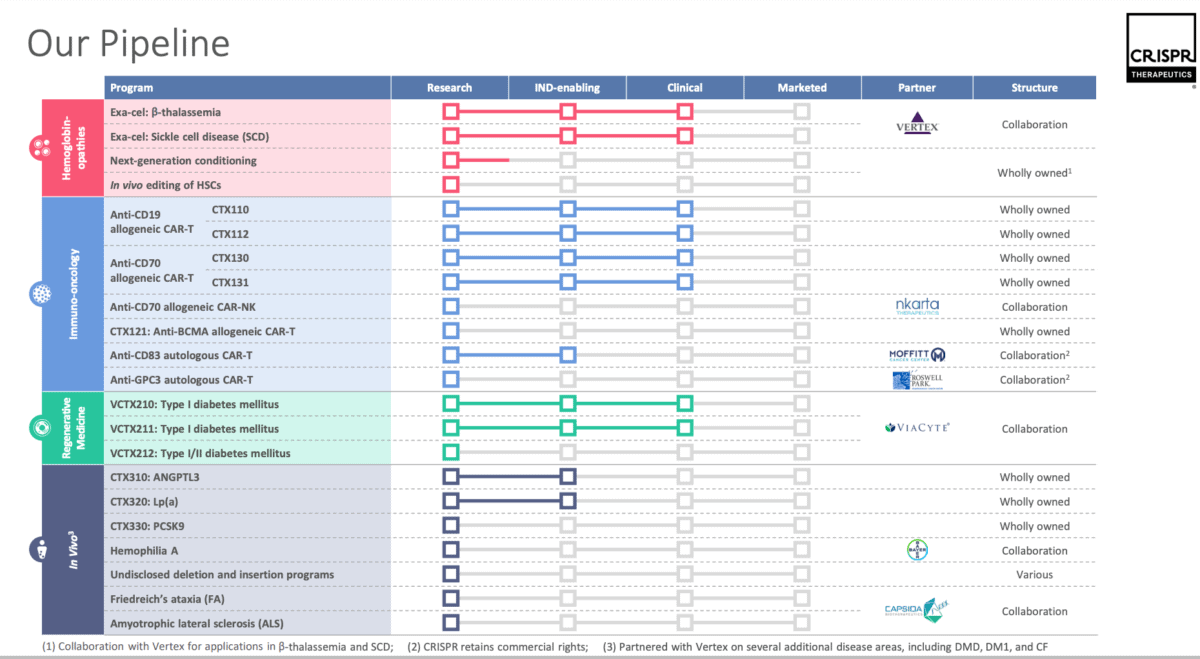

CRISPR Therapeutics (NASDAQ:CRSP) is a biotechnology company that made history by receiving the first-ever approval of a gene-editing therapy in the world.

At the core of CRISPR Therapeutics’ endeavours lies a revolutionary technology, enabling scientists to manipulate and modify genes.

This groundbreaking system holds significant transformative potential, especially for the treatment of genetic diseases. It does this by correcting or modifying specific genes responsible for a vast array of medical conditions.

Currently, the company’s operations have prioritised hereditary haematology disorders. This encompasses a range of genetic conditions affecting the blood and its components.

However, scientists believe there’s huge potential in other fields, including oncology.

The American and British approval of exa-cel (exagamglogene autotemcel) for Sickle Cell Disease (SCD), and transfusion dependent beta thalassemia (TDT) are hopefully just the start for CRISPR Therapeutics and other companies working in the space.

Big market

CRISPR Therapeutics and its partner Vertex anticipate that the initial patient pool will number around 20,000. Considering the reported list price of $2m per patient, this potential pool holds a market opportunity worth an estimated $40bn.

CRISPR Therapeutics is due 40% of sales under agreements with the much bigger Vertex. As such, the company’s revenue projection from this treatment alone could reach $16 billion.

It’s worth noting that the majority of SCD diagnoses are in the US (100,000 there and a further 20,000 globally), where it predominantly impacts people of African heritage.

SCD and TDT is likely most prevalent on the African continent, but many cases may be undiagnosed.

Unbounded potential

There are other players in the gene-editing game, and it’s worth noting that CRISPR SCD treatment isn’t known to provide a functional cure for life. As it stands, its treatment has been very successful, but only for the length of the trial. That’s a risk for the stock.

Nonetheless, I’m looking beyond that. This is an area of science and medicine with huge potential and, naturally, a lot of that potential is around illnesses which are more common, including cancer. This is definitely something I’m going to be watching closely.

Currently, the stock is trading at a 39.5% discount versus the average share price target. However, analyst think this stock could go as high at $111 in 2025.