The Scottish Mortgage Investment Trust (LSE:SMT) share price hasn’t traded above £10 since February 2022. But could it happen again soon? Let’s explore.

Scottish Mortgage and interest rates

Scottish Mortgage primarily invests in growth stocks, which typically have higher valuations and are more sensitive to interest rate fluctuations.

As interest rates have risen, the discount applied to future earnings expectations for these growth stocks has, in many cases, increased, putting downward pressure on the Scottish Mortgage share price.

Should you invest £1,000 in British Land Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if British Land Plc made the list?

Moreover, growth stocks typically require funding in order to support their growth objectives. However, the cost of borrowing has increased over the past two years, threatening the viability of many of these companies.

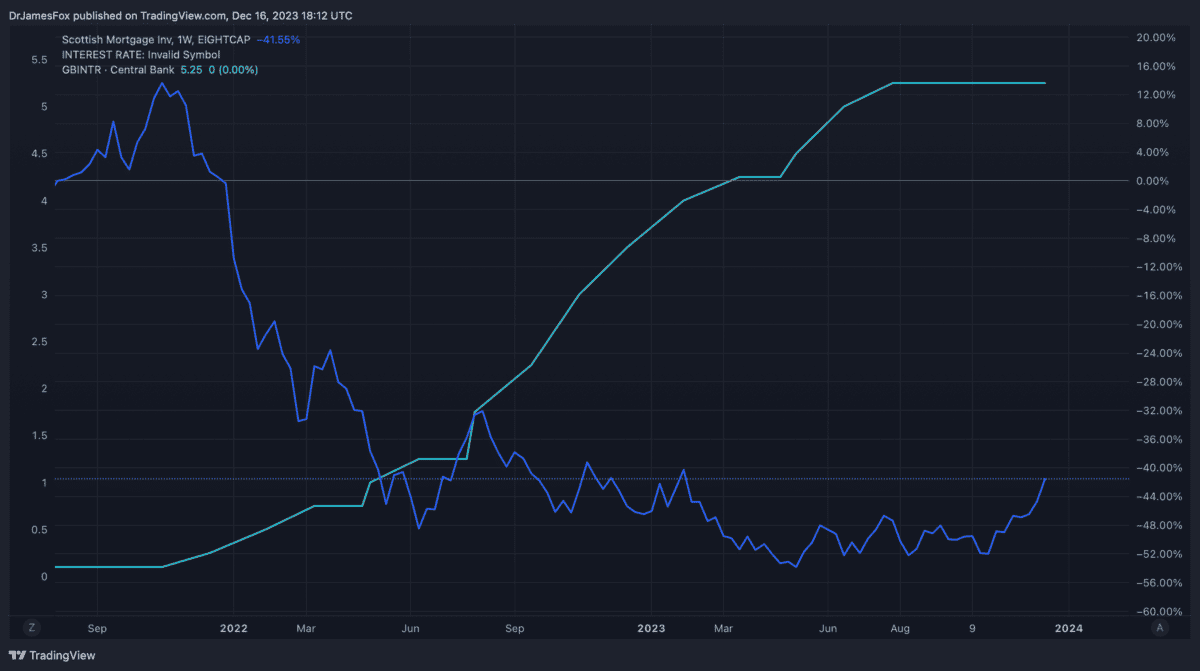

As we can see from the below chart, the Scottish Mortgage share price has fallen as interest rates have risen.

Now that we’re getting indications that the Bank of England, and its peers, will lower rates, the Scottish Mortgage share price has started moving upwards.

NAV discount

At its peak, the Scottish Mortgage share price indicated that each share was equal to its net asset value (NAV).

However, Scottish Mortgage currently trades at a discount of 13% to its NAV. The NAV represents the total value of the trust’s assets, minus its liabilities.

As such, a discount to the NAV suggests that the stock is undervalued by 13%. In other words, I can buy £1 of assets for 87p.

In theory, this could be a great time to buy the stock. But it’s not that straightforward.

That’s because a significant portion of Scottish Mortgage’s holdings, around a quarter, are in unlisted companies.

As they’re not publicly listed, they don’t have market values determined by investors. For example, SpaceX represents 3.7% of the portfolio, but the shares aren’t listed.

Some investors may feel that SpaceX’s own valuation, which is reported to be between $150bn and $175bn, is a little steep.

Of course, whether this is an overvaluation or not depends on the perspective of the investor in question. Personally, I’m not sure 10 times forward revenue is that expensive.

So, in short, the NAV discount could represent an opportunity, but there are some caveats.

Is £10 feasible?

At present, the net asset value (NAV) of Scottish Mortgage’s investments is approximately £8.66 per share.

As a result, reaching £10 per share in the near future appears unlikely. Having said that, I don’t think it’s impossible in 2024.

There are several considerations, including the fund’s exposure to China, which has been falling but remains significant.

Chinese markets have underperformed over the past 12 month, and could continue to do so in 2024 amid a failing domestic economy.

Nonetheless, falling interest rates could have a profound impact on stock valuations. Of course, some of this may already be priced in.

Personally, I’m increasing my position in Scottish Mortgage, as I anticipate momentum returning as interest rates fall.