I’m 30, and I invest for a second income. The thing is, I’m not investing for a second income today, I’m looking to build wealth investing and then take a second income when it’s really worth it.

For example, if I had £20,000 in savings, it would be hard for me to generate anything more than £1,600 a year as a second income over the next year. That’s fine, but £200 a month isn’t going to make a profound difference to my life.

Instead, I’m thinking longer term. Because, by investing wisely, saving regularly, and with compound returns, I can turn this £20,000 into something much larger.

Building wealth

If I want to turn my £20,000 into a substantial sum, I need to follow an age-old strategy for building wealth. And by diversifying my investments and taking advantage of compound returns, my money can work for me.

Regular contributions and smart investment choices are key. If I stay disciplined and patient, there’s potential for significant growth over time. It’s about understanding risks, staying informed, and adapting strategies as needed.

While there are no guarantees, the combination of strategic investing and the power of compounding offers a pathway to building substantial wealth over the long term.

Of course, I need to recognise that if I make poor investment decisions, I could lose money. That’s why it’s really important I use the all the resources available to me to help me make the right decisions.

Achievable aims

It’s amazing what can be achieved when we take a long-term investment horizon and we harness the power of compound returns.

Compound returns are the magic behind long-term wealth-building. As I consistently invest and let my returns generate additional earnings, the compounding effect kicks in.

Over time, I not only earn returns on my initial investment but also on the accumulated returns. It’s a snowball effect that accelerates growth.

However, I need to have achievable objectives and a realistic timeline that reflects my capacity to continually put money aside.

As I mentioned above, continually adding to my £20,000 will help fuel the growth of my portfolio. And that could be anything, perhaps just £100 a month.

I’ve also got to think about what’s achievable over the long run in terms of an annualised yield. Many novice investors will look to achieve 6-10%, while I’m aiming for low double-digits.

Some investors can do better. In fact, I know of a portfolio that has gained 33% a year since inception.

Bringing it all together

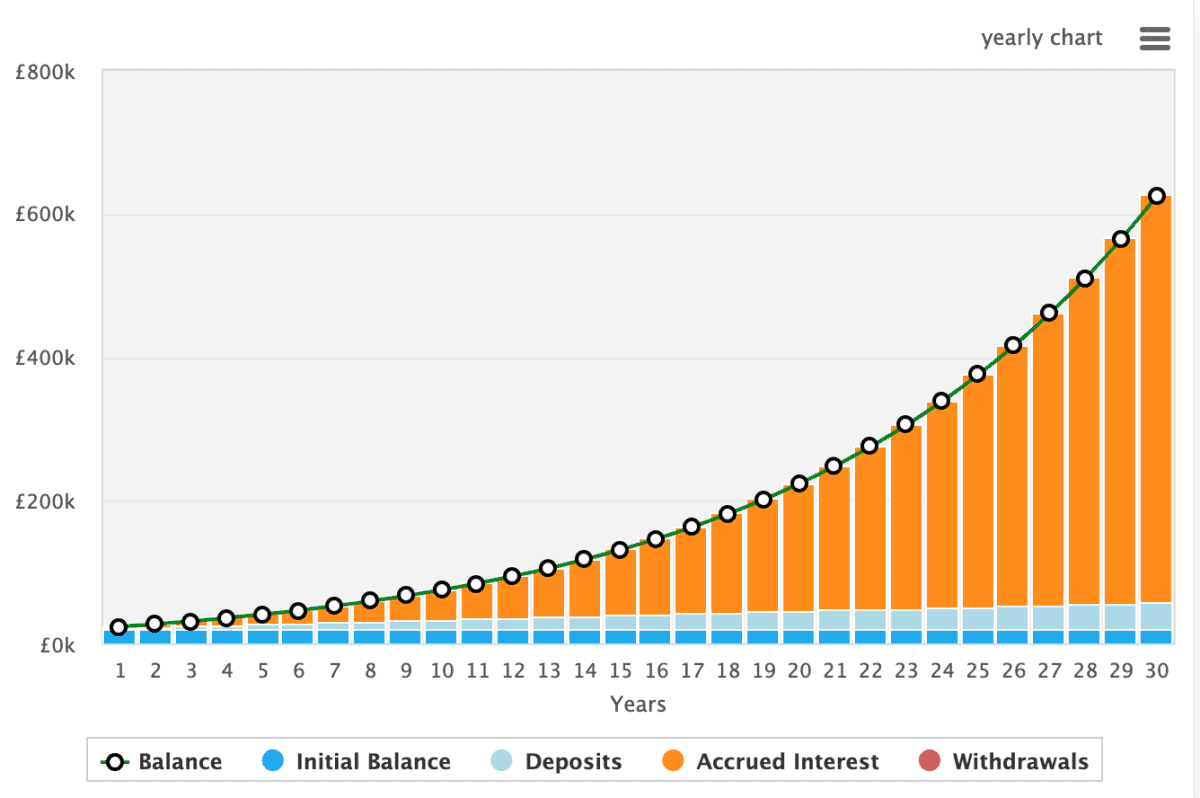

So if I had £20,000, and I added £100 a month, while achieving an annualised return of 10%, after 30 years, I’d have £624,680.

Of course, there are so many variables here, including the impact of investing at the beginning of the month versus the end, over a long period of time, it just means I’ve got more money in play for longer.

So here’s how it would look.

And with £624,680 invested in stocks, well, I could do a lot better than just £1,600 a year. If I had it all invested in dividend stocks, with an average yield of 8% (this is achievable today but may not be in 30 years) I’d receive £49,974 annually.