The Shell (LSE:SHEL) share price has had an exceptional 170% rally since 2020.

Can the company maintain this growth given the current transition away from fossil fuels?

It’s no secret that the organisation is committed to renewables. So, I took a closer look at what Shell has in store to keep its share price climbing.

The current state of affairs

I think Shell has a moderately strong financial picture, but there are specific weaknesses I’ve been addressing.

The company looks undervalued to me. With a present price-to-earnings (P/E) ratio of around seven, I think this is low. The prime reason is that over the past 10 years, its median P/E ratio has been 13.

Additionally, the industry median P/E ratio is nine.

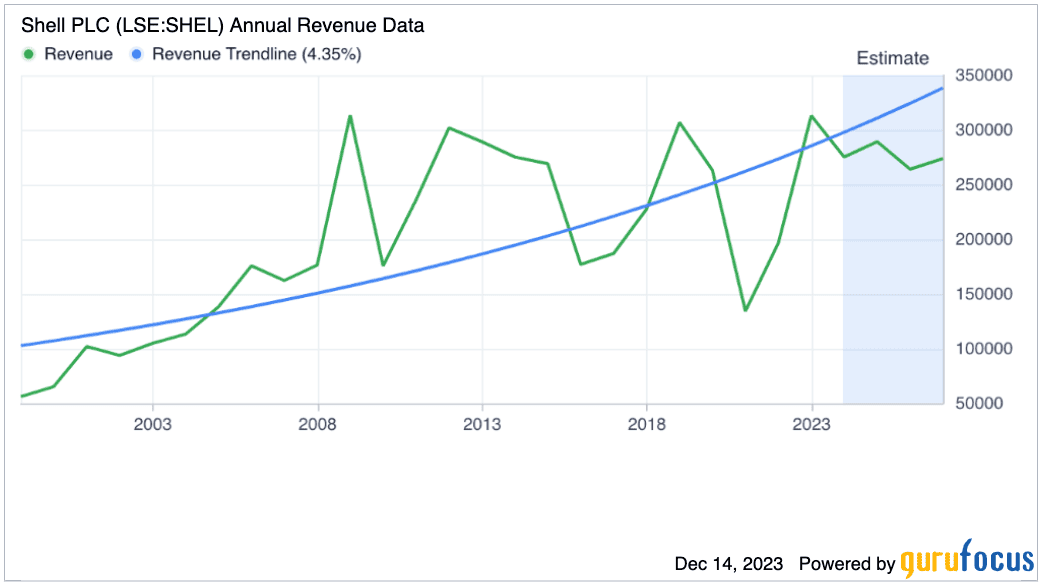

However, I can see the company is struggling with revenue growth rates. It’s had quite a roller-coaster ride to its current stronger position:

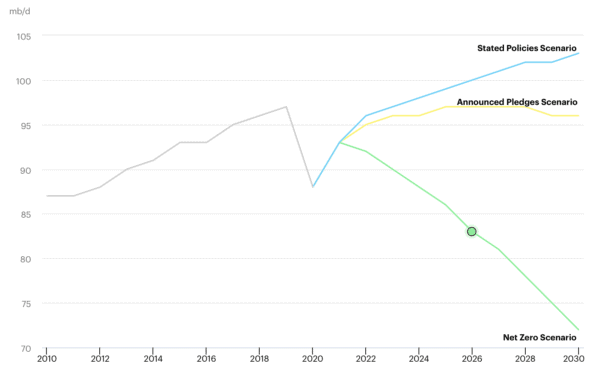

These revenue fluctuations are often caused by global supply and demand, and it is common consensus at the moment that demand growth for oil is slowing down:

So, the company has been trying to combat this with sustainability initiatives.

The renewable transition

In 2022, Shell’s Energy Transition Progress Report outlined its level of success in moving to renewables.

That year, the company invested $3.5bn in the green energy sector, which was 14% of capital spending.

But, CEO Wael Sawan is splitting this segment of the business in an effort to drive efficiency. He thinks he can boost returns by giving individual departments more focus on specific renewable initiatives.

Yes, the drive towards renewable energy is paramount, but global demand is slower than net-zero projections would like.

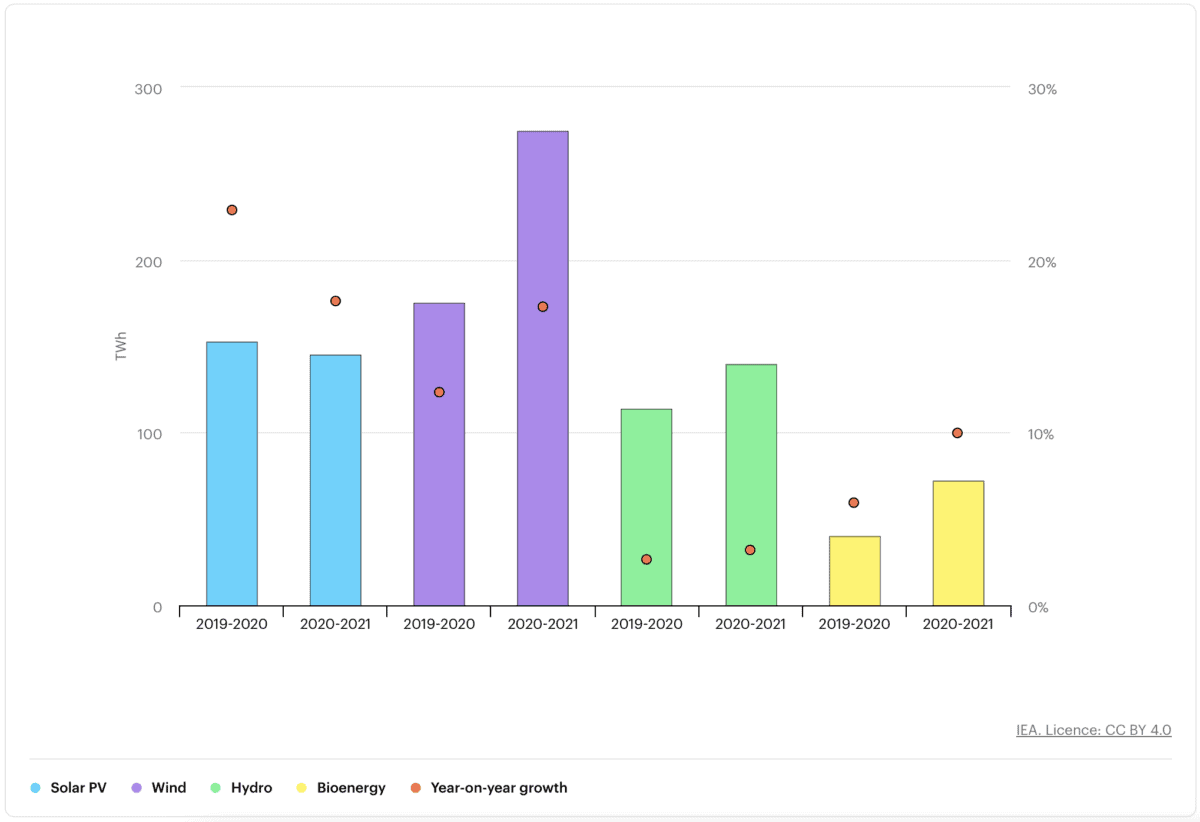

That’s not to say growth and demand for renewables aren’t on the up. This chart shows each department of renewable energy and their recent growth rates:

With Shell focusing on sustainable aviation fuel, solar and wind power, hydrogen, electric vehicle charging, and biofuels, the company is certainly positioning itself to capitalise on continued growth in renewables.

Currently, the organisation commits roughly $2bn-$3bn annually to these efforts, but it also balances this with oil and gas investments.

Can the climb continue?

My view on whether Shell can continue its recent share price results depends on its long-term sustainability efforts.

If the company can successfully harness renewables, it might be the beginning of a great new chapter for Shell.

As the company is a leader in oil and gas, it certainly has the infrastructure to make the significant investments necessary to adapt to the change.

Shell has recently decided to sell 50% of its stake in the Madison Fields Solar Project and 60% in Brazos Wind Farm. This reveals to me some of the difficulties the company is facing in delivering strong financial results in this sector.

And with a moderately high level of debt, the organisation could face some trouble ahead if it wants to beat its competitors in the race to renewables. Its cash-to-debt ratio is 0.5, which is also the industry median.

My verdict

I think the future earnings potential of the company is too unpredictable to make this a reliable investment worth owning right now.

So, personally, I’m not buying the shares nor adding Shell to my watchlist.