The buzz around artificial intelligence (AI) has sent the share prices of US technology stocks through the roof in 2023. Standing tallest among this bunch is Nvidia (NASDAQ:NVDA), its share price rising a whopping 226% between 1 January and 11 December.

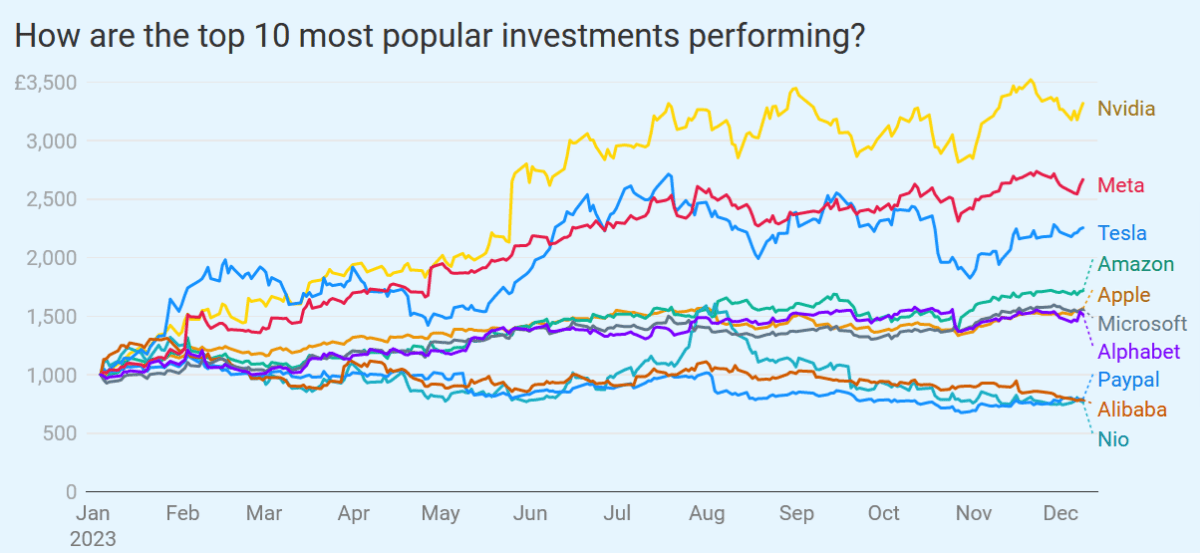

According to Finder.com, this performance would have turned an investment of £1,000 at the start of the year into £3,257.21 by the end of the period.

The chart below shows the theoretical return Nvidia shares would have provided compared with those of other US tech shares.

I missed the boat by not investing in the graphics processing unit (GPU) maker at the start of the year. But could I still make a big profit from Nvidia shares by buying them today?

Long-term riser

A look at the company’s share price performance over the past five years suggests the answer could be ‘yes.’ As you can see, the chipmaker was rising rapidly in value long before the AI craze exploded in 2023.

This is thanks to the importance of Nvidia’s GPUs across the entire tech sector. They give the business exposure to several fast-growing industries including gaming, cryptocurrency mining, data analytics, and video editing.

Yet today the company describes itself first and foremost as “[the] World Leader in Artificial Intelligence Computing“.

Forecast beater

To be fair, it’s not difficult to see why. The AI boom means its trading updates have regularly beaten analyst forecasts during 2023. Indeed, the company was at it again in November when it declared third-quarter revenue of $18.1bn.

This smashed broker predictions of $16.1bn. And it was up an impressive 206% from the same 2022 period. This was driven strong trading at its Data Center division, which develops AI-related products. Sales here rocketed 279% year on year.

Uncertain outlook

AI has the potential to transform a wide range of industries from healthcare through to education. Whilst there can be no guarantees, we think this underpins forecasts of high double-digit growth in the AI market beyond the end of the decade.

Hargreaves Lansdown

As the above quote illustrates, AI has the potential for stunning growth in the coming years.

But the path to blockbuster profits growth may not be straightforward one for Nvidia. Problems so far in the implementation and commercialisation of AI suggest that adoption of this new technology may fall short of what many are forecasting.

The challenging economic backdrop could hinder AI updake, too, as could a growing determination among lawmakers to regulate these disruptive technologies. Last week, the European Union introduced the world’s first regulations, and the UK, US, and China are all expected to follow shortly.

Chipbuilders also face significant uncertainty as relations between the US and China sour. Washington has recently banned the export of certain AI chips to the Asian country. Further restrictions are a possibility that could weigh on the sector’s long-term growth.

The verdict

While Nvidia has been a strong performer of late, these substantial threats mean I don’t plan to add the tech giant’s shares to my portfolio.

I’m also put off from investing by the firm’s meaty valuation. A rich price-to-earnings (P/E) ratio of 39 times could leave it in danger of a share price correction if news flow begins to worsen.

On balance, I’d rather find other shares to buy for 2024.