Will Rolls-Royce (LSE:RR) shares hit £3 before Christmas? I posed this very question to myself a few weeks ago, but without any earnings data due, I didn’t think it would happen so soon.

Now, I’m not so sure. Rolls-Royce shares have rallied further, reaching £2.85, partially driven by the unveiling of its medium-term targets, and several brokerage upgrades. It’s now up 214% over 12 months.

More positivity

On 4 December, JP Morgan upgraded its rating for the aerospace engineer from ‘neutral’ to ‘overweight’ and hiked its target price for the stock from 235p to 400p.

The bank said this was because of “radical moves” made by Rolls-Royce’s chief executive Tufan Erginbilgiç, who joined in January 2023, like raising the price the company charges for its long-term service agreements.

The bank also pointed to a £400m–£500m cost reduction programme announced last month that changed analysts’ minds.

This followed the unveiling of Rolls-Royce’s mid-term targets on 28 November, which included the goal of achieving an operating profit within the range of £2.5bn–£2.8bn by 2027.

Profit targets are to be achieved, according to Rolls, by margin improvements. In civil aerospace, Rolls wants to see operating margins improve from 2.5% in 2022 to a range of 15%–17% by 2027.

In defence, the aim is to improve from 11.8% in 2022 to 14%–16% in 2027, And finally, in power systems, the target is to push operating margins from 8.4% in 2022 to 12%–14% in 2027.

These improved metrics are also being driven by a host of positive influences, including geopolitical tensions and strong demand for travel.

However, the business is still heavily reliant on the civil aviation industry. A respiratory illness is circling around China again, and viruses are raging across the UK. If we were to see another pandemic-like shock, it could be a huge challenges for the business.

Equally, it’s positive that the biggest risk to the business is hopefully unlikely.

Momentum

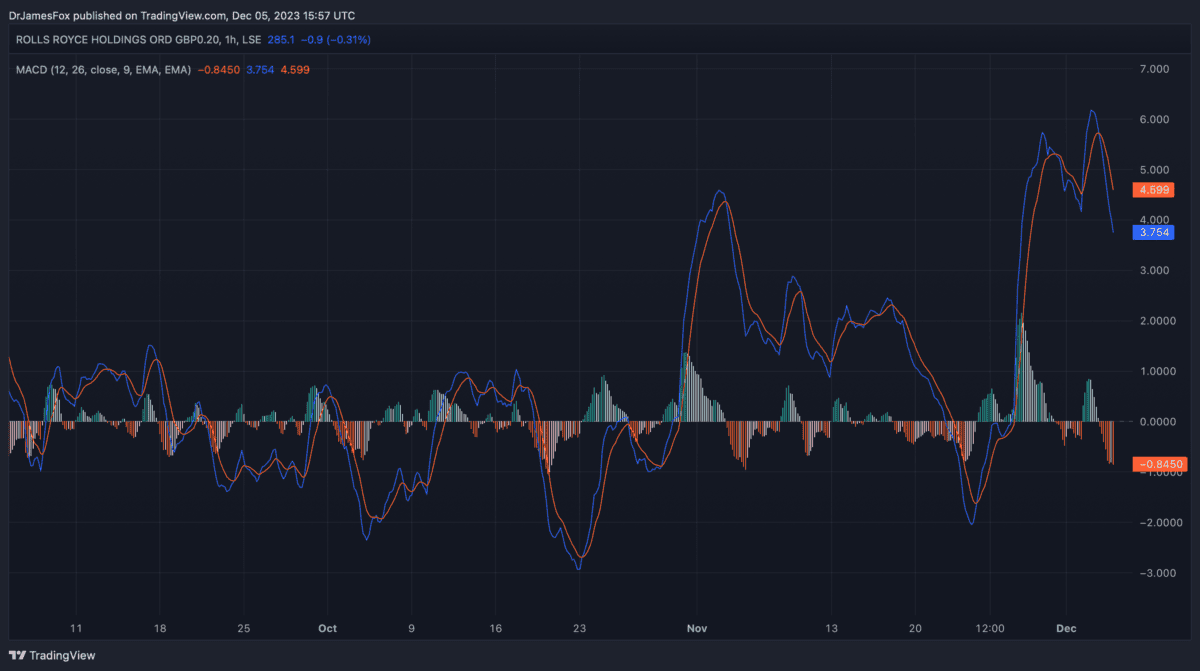

Momentum is an important commodity when investing, and one that’s not easy to come by. Below, we can see momentum in Rolls-Royce shares as highlighted by the moving average convergence divergence (MACD) metric. This compares short-term and long-term moving averages, and provides us with an idea of momentum.

Long-term growth

There are two things that excite me about Rolls-Royce. And they’re both related to growth.

Firstly, Rolls-Royce has a price-to-earnings-to-growth (PEG) ratio of 0.52. This is an earnings metric adjusted for growth, and it suggests that Rolls-Royce’s share price is potentially undervalued by as much as half.

The metric is calculated using the expected growth rate over the coming five years, so there’s room for error, but it is certainly very attractive. In fact, the PEG ratio infers a fair value around £5.70.

Looking beyond that, we can also expect strong demand for air travel over the next two decades. Boeing anticipates that 42,000 aircraft will enter the global fleet by 2040, suggesting the need for at least 84,000 engines.

The only issue is most of the demand is for narrow-body jets, and not the wide-body jets that use Rolls’s engines. The British engineering giant has suggested it could shift its product offering in the coming years.