Fundsmith Equity has hit a bit of a rough patch. Well, at least compared to the market-thrashing returns that investors have long been used to from its star manager Terry Smith.

Here, I’m going to consider whether I should invest in the fund early next year.

Britain’s Warren Buffett

Smith has been hailed as Britain’s — and also Europe’s — Warren Buffett. Going on his stellar long-term record, this is certainly justified.

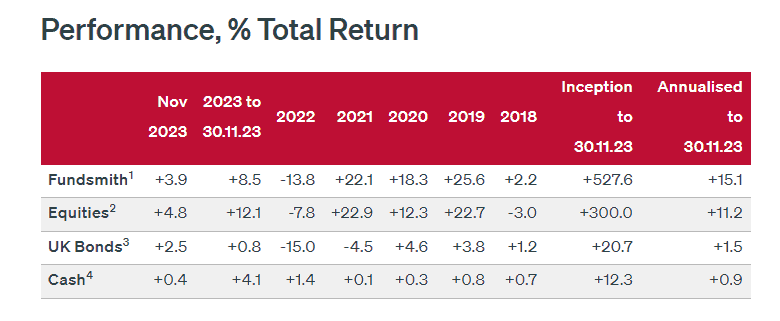

Up to the end of November, Fundsmith Equity has delivered an average return of 15.1% a year since its launch in late 2010.

Like Buffett, Smith is no-nonsense and quotable. His famous investing mantra is “buy good companies, don’t overpay, do nothing“.

A more recent Buffet-esque statement is: “We are not here to wonder what will happen with rates. What matters to us are companies“.

This chimes with my own focus on investing in high-quality companies, ones that are built to survive (and even thrive) regardless of macroeconomic challenges.

What stocks does Fundsmith hold?

The fund’s focus is global, though 67% of the portfolio was held in US equities at the end of November.

This might be a concern if US stocks take a tumble. Another risk is the concentrated portfolio, which means a handful of bad performers can quickly drag on performance.

That said, the stocks at the top of the portfolio look truly excellent to me.

- Microsoft is benefitting from mega-trends like cloud computing and artificial intelligence (it has a large stake in OpenAI, the maker of ChatGPT)

- Novo Nordisk is firing on all cylinders due to Wegovy and Ozempic, its injectable treatments for weight loss and type 2 diabetes, respectively

- Visa and Mastercard (a smaller holding) are at the heart of the unstoppable rise of digital payments

- IDEXX Laboratories, a global leader in veterinary diagnostic equipment, is a play on the “enormous potential of everything related to pets“, according to Smith

A recent addition to the portfolio was Fortinet. This is a fast-growing cybersecurity firm with a net profit margin of 22% and a reasonable valuation. A classic Smith buy.

It is also a company operating in a massive growth market. On 4 December, we had worrying reports that the computer networks of nuclear site Sellafield in Cumbria had been hacked.

Once again, this highlights how important and powerful the cybersecurity trend is. Fortinet is one of the top firms in the space, so this looks like another smart buy to me.

Will I invest?

In 2020, Smith said: “Inevitably, there will be a time when we do less well. But even if this happens, I will not change my strategy“.

That time seems to have come. Up to the end of November, the fund had returned 8.5% versus the MSCI World’s gain of 12.1%. It also underperformed last year and there’s an annual charge of 1%. Not ideal.

To be honest though, this doesn’t worry me. The world index in 2023 has largely been driven by a narrow cohort of expensive tech stocks, notably Nvidia (which the fund doesn’t hold). When market gains widen out, I fully expect Smith to get back to winning ways.

As such, I’ll be looking to invest in the New Year once I have the necessary funds lined up.