I want to get in on the action when I see the Rolls-Royce share price (LSE:RR) has increased over 300% since October 2022.

Yet, as someone passionate and experienced in investing, I reckon that’s a wrong move unless I analyse the situation first.

Therefore, I’ve decided to pull apart precisely what’s happening here. I aim to determine if Rolls-Royce shares are horribly, uninvestably overvalued.

What caused the blast-off?

Under the leadership of new CEO Tufan Erginbilgic, the company is planning to quadruple its profit in five years.

The company is also selling non-core assets, including the electrical-powered aircraft business, to focus on widebody planes and business aviation.

This focus on efficiency and profitability is driving the stock price up, which is working for now.

Why I’m concerned

I think the share price rise for Rolls-Royce is premature. Yes, the company’s one-year revenue growth rate is 32%. But over 10 years, it’s been -4.30%.

This is a concern to me. I think the current share price surge suggests that investors expect this revenue growth will not only be maintained but that it will continue to increase.

I’m curious whether the company can turn around so significantly because of a new CEO focused on efficiency.

Here’s the good news: net income is currently £1.5bn for the last 12 months. But it was £3.4bn in December 2017; that’s the bad news. Even worse, net income dropped to negative £1.3bn in December 2019. What does this signify to me? Unfortunately, instability.

A look at the future

Looking ahead, I want to get a more comprehensive view of Rolls-Royce’s direction.

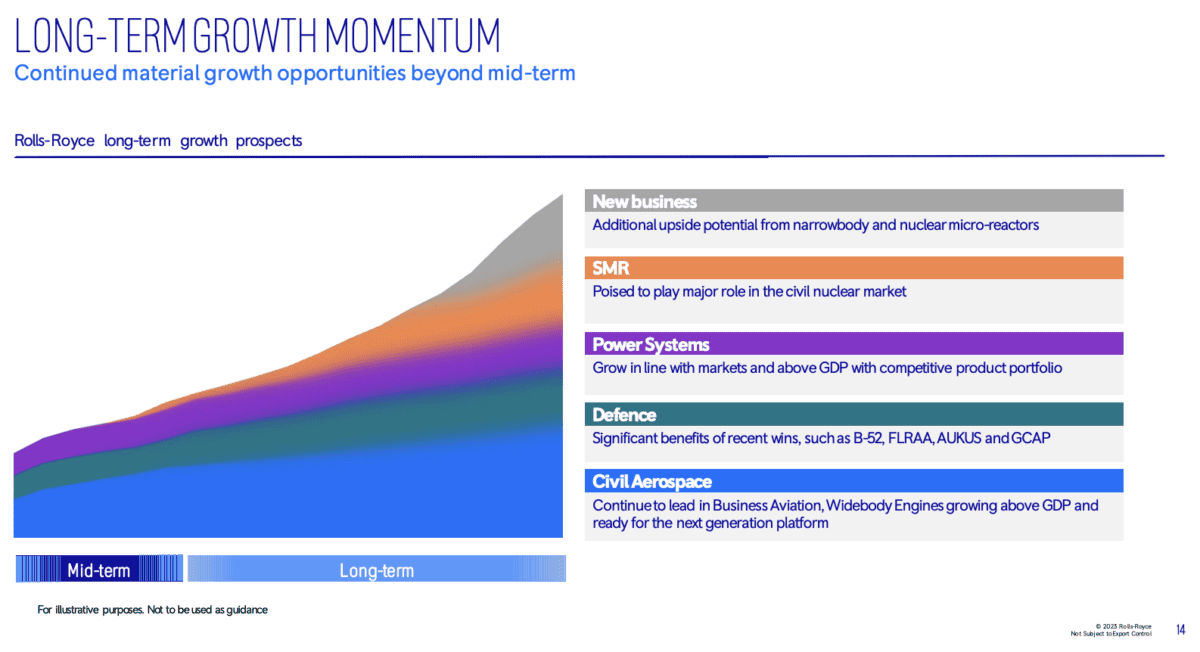

I’ve found a powerful chart from the company’s December 2023 Investor Presentation that outlines the management’s long-term expectations:

The UltraFan is one of the specific operations I’m most excited about. It is described as a leading technology for next-generation aircraft. It features advanced materials and is designed to enhance fuel efficiency and reduce emissions. It is in development and testing as a step towards sustainability and efficacy.

Commercial passenger flights remain the company’s largest business segment. Defence is second, and power systems are third.

Significantly, the company’s aerospace profit margins are expected to increase from 2.5% last year to 15-17%. And while I’m not happy about the current wars in the world, defence spending is on the rise and will likely benefit Rolls-Royce.

Also, new markets, like small reactors and other electricity generators, could develop in the coming years.

The bottom line

I don’t think the current share price is fair right now. Given that net income, revenue, and operational turnaround are at such growing stages, I think the market has overreacted.

Unless the company’s financial predictions are met and then some, I reckon the stock price will come crashing down soon enough.

Perhaps I’m wrong. Forecasting is always a tricky art. Nonetheless, I won’t be buying shares because I’d need more evidence of income stability before I do.