I’m a stock picker by inclination but I also love investment funds that simply track a particular index. And when looking for such funds, people often consider investing in a FTSE 250 tracker.

That’s understandable. I recently watched an interview with fellow Fool Morgan Housel on Diary of a CEO. He mentioned that most asset managers work 80 hours weekly to beat the market and never do.

The American Enterprise Institute analysed this over a 15-year investment horizon. Over 90% of all managers failed to outperform benchmarks like the S&P 500. Ouch!

I think a diversified portfolio that skews towards individual stocks is best, but I also think index funds have a part to play, especially for non-professionals.

My top two index funds

The FTSE 250 is a good choice for exposure to UK companies. However, I think there are better options out there when seeking share price growth over time.

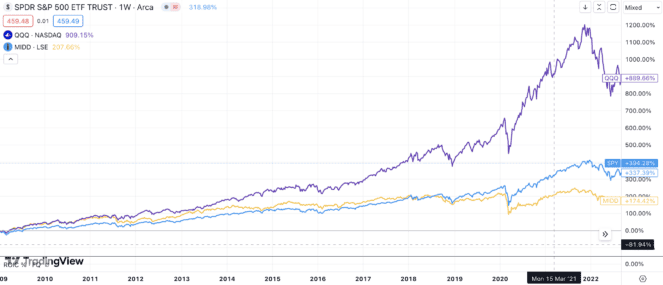

I’ve ranked my top exchange-traded index funds (ETFs) based on high-price returns and exposure to industries and geographies. Then, I’ve included the FTSE 250 for reference.

1. Invesco QQQ Trust Series 1

If I’m looking for the highest returns and a relatively stable journey doing so, I think I have no better option than the Nasdaq 100. One fund, Invesco QQQ Trust Series 1, attempts to mimic this index and I think it does a good job.

The Nasdaq 100 includes 100 of the largest non-financial companies in the world. It’s heavily weighted towards tech but includes retail, biotech, healthcare and more.

The 10-year average annual return of this fund is 17% and for every £1,000 invested, I’d lose only £2 to operational expenses.

Of course, past results are no guarantee of future returns, and the tech sector is usually prone to more volatility.

2. SPDR S&P 500 ETF Trust

SPDR S&P 500 ETF Trust is, as the name suggests, an S&P 500 tracker that’s one of the best-known index funds. It gives exposure to 500 of the best-performing American companies.

Its compound annual return is 10% over the last 30 years and for every £1,000 invested, I’d lose only 90p to operational expenses. That’s a pretty good deal, I feel.

The S&P 500 needs more geographic diversification, being focused on America. However, it provides less volatility than the Nasdaq 100.

3. iShares FTSE 250 UCITS ETF

Meanwhile, iShares FTSE 250 UCITS ETF, issued by BlackRock, aims to track the UK’s FTSE 250.

The FTSE 250 consists of the 101st to 350th largest companies listed on the London Stock Exchange. It’s a quite diversified index and is more directly exposed to the UK economy than the FTSE 100, which has more mega-sized companies with huge international operations.

This ETF isn’t for me. The average annual share price increase is just 4% over the last decade. I’d prefer to buy individual FTSE 250 stocks.

Why I like the US trackers

I personally buy individual stocks as part of a diversified portfolio because I think I can beat the market over the long term. However, I also think it’s important to understand index funds.

And I believe the Nasdaq 100 and S&P 500 funds can get me closer to my financial goals than a FTSE 250 tracker.

Just look at this chart. I think it supports my view!