November was a fantastic month for growth stocks. In fact, it was the biggest monthly rally in global shares in three years as investors cheered the possibility that falling inflation might finally bring about rate cuts.

Here are a couple of stocks that certainly didn’t get left behind.

Ashtead Technology up 21%

Shares of Ashtead Technology (LSE: AT.), the subsea equipment rental group, finished the month 21% higher than they started it. The stock has now reached an all-time high after surging 90% in 2023.

Should you invest £1,000 in Ashtead Technology Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ashtead Technology Plc made the list?

Most of November’s gains, however, came at the end of the month when the share price exploded skywards like a SpaceX rocket.

This followed the £53.5m acquisition of ACE Winches, a leading mechanical rental business based in Aberdeen. ACE has more than 3,000 rental assets and delivers its products to over 50 countries across every continent.

Now, it should be noted that this transaction will be funded through a revolving credit facility. This brings a certain level of risk, especially with higher costs of borrowing.

However, the rental firm expects the acquisition to be earnings enhancing in 2024, with return on invested capital (ROIC) materially ahead of its weighted average cost of capital after just one year. Hence the market’s approval.

Energy trilemma

In H1, the company’s pre-tax profit surged 92% year on year to £13.2m. That was from revenue of £49.8m, representing 57% growth. Its adjusted earnings per share (EPS) improved by 71% to 14.2p.

For the full year, the firm expects to report £105m in revenue, a 43% increase, while brokers have EPS nearly doubling to 29.2p.

Looking ahead, the company should continue benefitting from the energy trilemma. This refers to the difficult balance nations are trying to find between energy security, affordability, and sustainability.

Ashtead Technology is in the sweet spot because it supports both the offshore renewables and oil and gas sectors. So its equipment serves all offshore activity, whether that’s the building or decommissioning of infrastructure.

I only invested in October. But with the shares currently trading at 17 forecast earnings for 2024, I’d be willing to increase my holding with spare cash.

MercadoLibre up 30.75%

The second stock that exploded higher in November was MercadoLibre (NASDAQ: MELI). It rose 30.75%, meaning it’s now up 89% in 2023.

Over a 10-year period, it has gained an incredible 1,407%.

The reason(s) for the explosive share price performance can be found in the names the company has been given. It has been dubbed the Amazon/Shopify/eBay/Craigslist/Block/PayPal of Latin America. It is all of those in one fast-growing company.

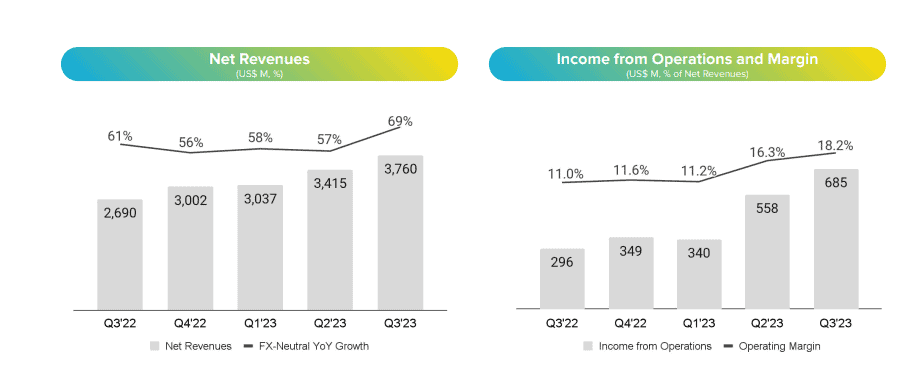

Below are its latest blowout Q3 earnings.

Impressively, its operating profit margin improved from 11% in 2022 to 18.2% this year.

On a negative note, inflation is sky-high across Latin America and the new president of Argentina (where the company has operations) has pledged to shut the nation’s central bank. So there is potential currency risk.

However, the region has long been beset by such problems. And they haven’t prevented the firm’s ascendency.

Looking ahead, Latin America is a massive growth market for MercadoLibre’s fintech, e-commerce and digital advertising businesses.

With the stock trading on a reasonable price-to-sales (P/S) ratio of 6, I’d invest immediately if I hadn’t already done so.