Warren Buffett is among the most successful investors of all time. With his sadly-missed late business partner, Charlie Munger, Buffett turned Berkshire Hathaway into one of the largest listed companies worldwide.

Saving versus investing

Saving, or putting money aside, is great practice. However, it’s what we do with that money that counts. Almost all of us in the UK have a savings account, but a much smaller percentage of us have our money invested in stocks and shares.

Savings accounts are currently offering rates of return far above what we’ve seen over the past decade. While the best savings products are currently returning around 5%, over the last decade, it’s been closer to 2.5%.

Should you invest £1,000 in BHP right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BHP made the list?

That’s fine, but those of us who invest our surplus cash into stocks and shares could achieve much higher rates of return. Buffett, for example, is known for achieving a low-double-digit return.

The strategy

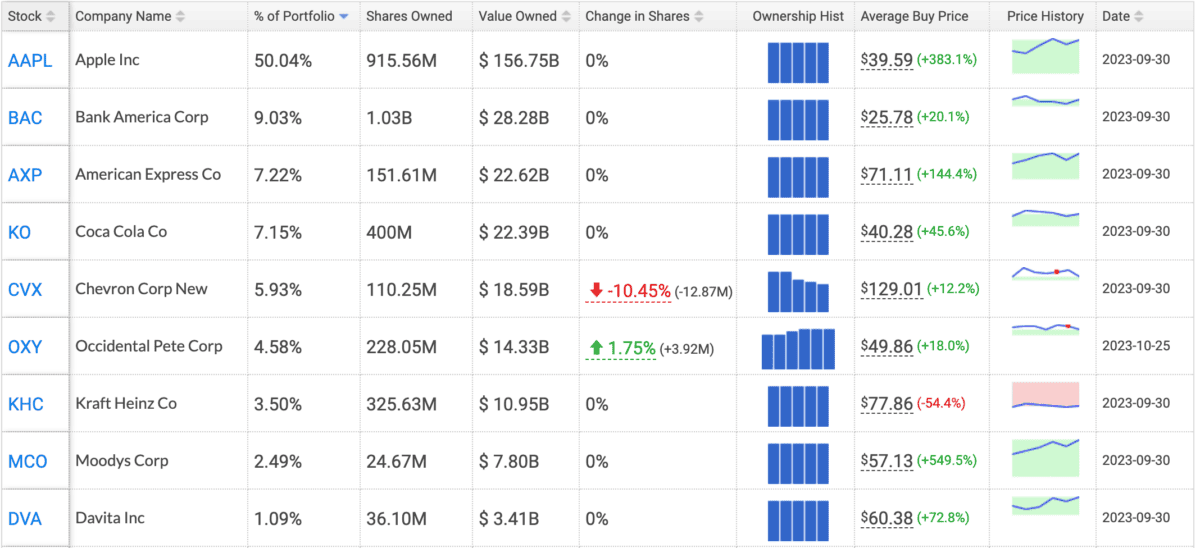

Buffett’s success reflects a disciplined value investing approach.

By identifying undervalued companies with strong fundamentals and enduring competitive advantages, he’s prioritised long-term growth over short-term market fluctuations.

His focus on intrinsic value, a margin of safety, and the compounding of returns contributed to his success.

He’s favoured quality businesses with predictable cash flows and maintained a diversified yet concentrated portfolio.

While past performance is not indicative of future results, Buffett’s methodology provides insights into his enduring success as an investor.

So, by focusing on these elements, I can look to emulate him, and build wealth over the long run.

In practical terms, this means using metrics like the price-to-earnings, price/earnings-to-growth, and discounted cash flow, to find value stocks.

Compounding returns

Most novice investors won’t achieve Buffett-esque returns. Although it’s worth noting that we could do so by investing in his holding company, Berkshire Hathaway.

Compounding returns is central to Buffett’s success and it’s an important lesson for me. Consider this: by achieving a 10% annualised return, the growth of my portfolio outpaces the gradual accrual in a standard savings account.

It’s not just about the percentage itself, it’s about the cumulative impact over time.

This compounding effect transforms incremental gains into a powerful force that propels the portfolio forward at a faster pace.

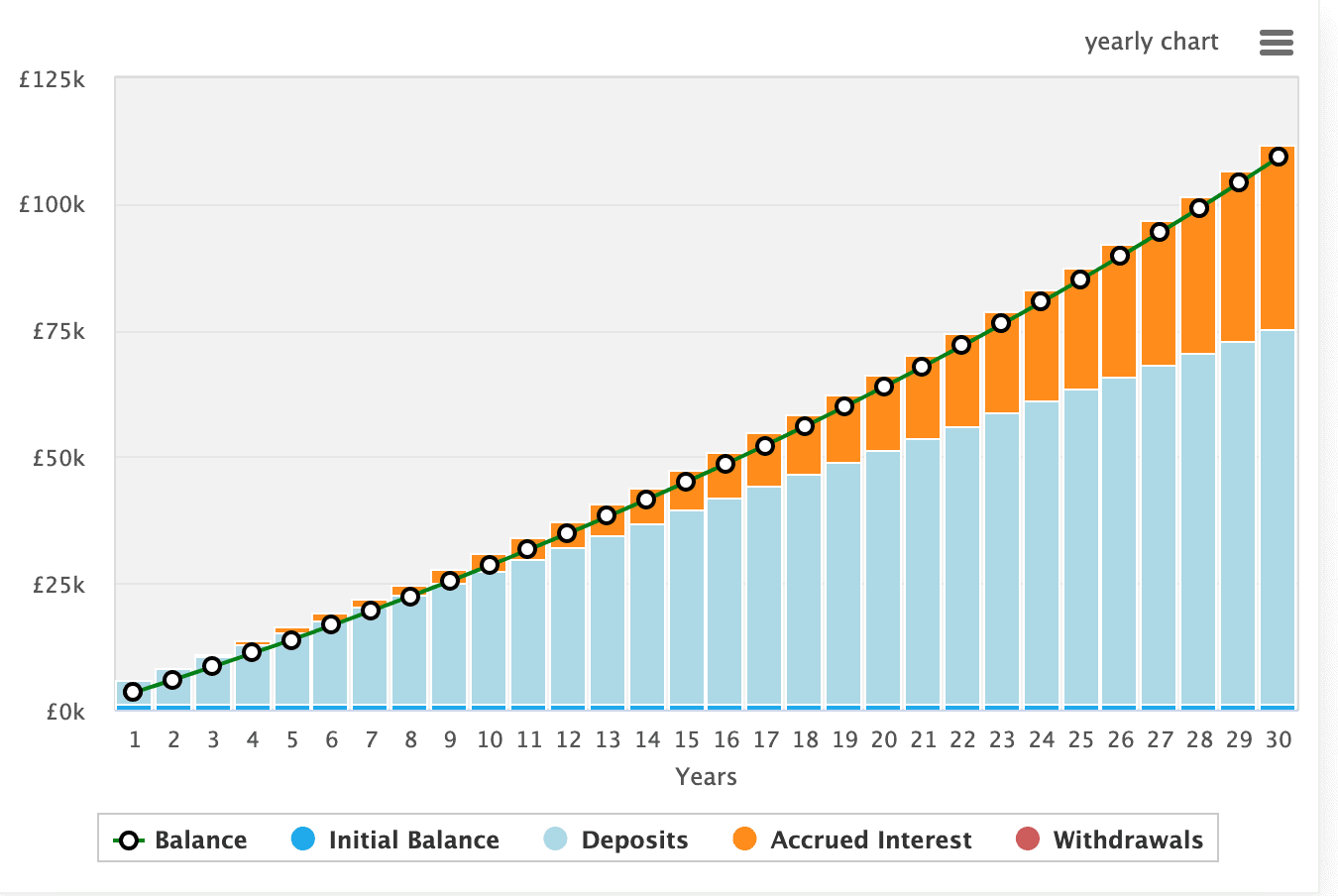

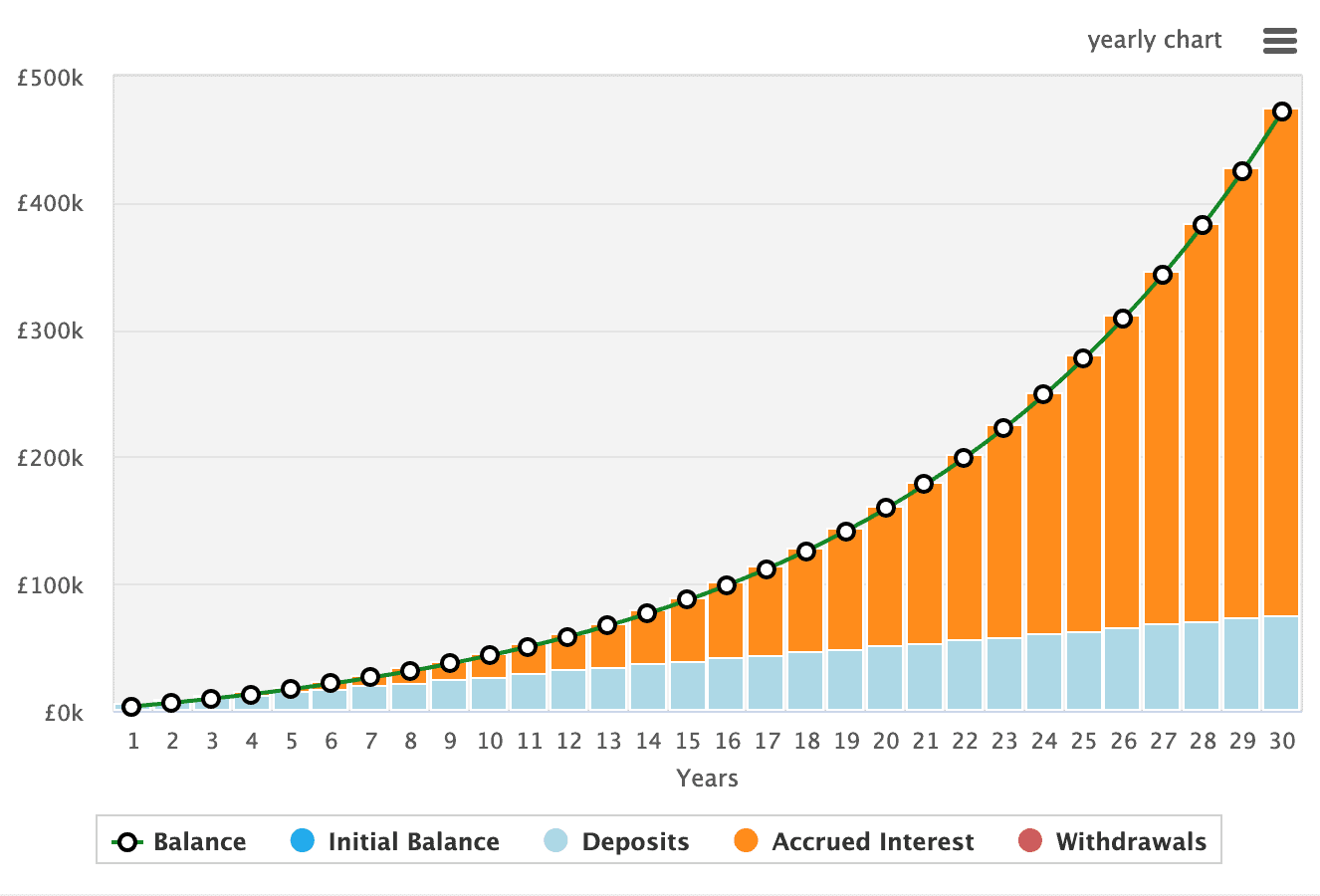

The two images in the slide below show the difference in long-term portfolio growth between a savings account at 2.5% and an investment portfolio growing at 10% annually.

In both examples, I’d be starting with £1,000 and investing £200 a month. When achieving 2.5% annually, I’d have £109k after 35 years. When achieving 10% annually, I’d have £471k after 35 years.

Investing risks

Of course, investing isn’t risk-free. And it’s very easy to lose money if I make the wrong investment decisions. Moreover, if I lose 50%, I’ve got to make 100% to get back to where I was. Thankfully, these days there’s a host of online resources to help us make the right decisions.