Based on a similar idea to the price-to-earnings ratio, Warren Buffett’s indicator divides the market cap of a country’s stock market by its gross domestic product (GDP), and expresses the result as a percentage.

It’s intended to assess whether a particular market is under or overvalued. The American described it as “the best single measure of where valuations stand at any given moment“.

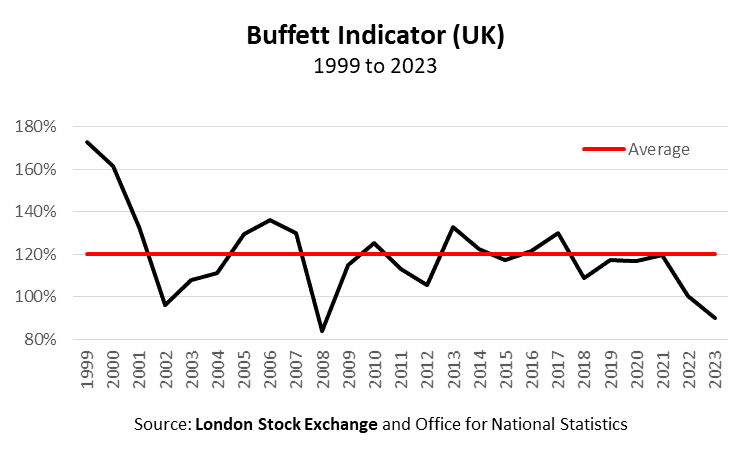

The chart below shows how the Buffett Indicator — as it become known — has fluctuated since 1999, when applied to the UK.

The average for the period is 120%.

It’s currently at 90%, and has only been lower in 2008, when the global financial crisis hit stock market valuations across the world.

If the measure holds true, domestic equities are at their cheapest for 15 years.

For comparison, the total market cap of all US listed companies was $43.3trn at the end of October 2023. And American GDP was $25.5trn in 2022.

The indicator for shares on the other side of the Atlantic is therefore 170%, although with its large number of tech companies — which generally attract better valuations — it’s always likely to be higher.

But if the UK stock market was valued the same as the US, it would be worth £2.1trn (90%) more.

Critics

But the indicator is far from perfect.

Market cap reflects worldwide earnings. But national income doesn’t include sales by subsidiaries of domestic companies in overseas markets.

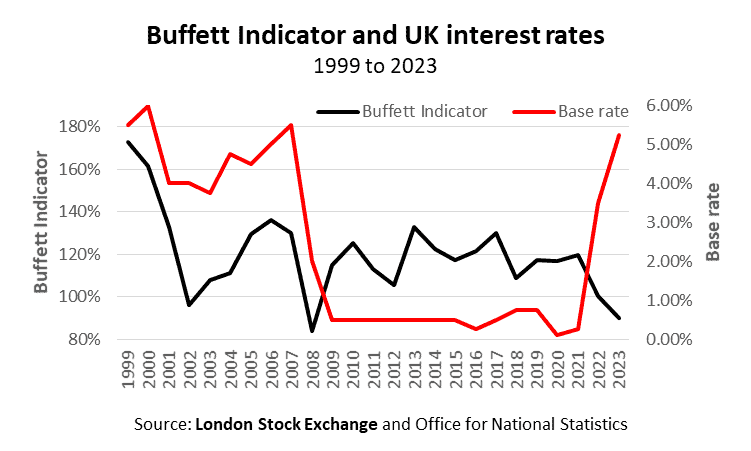

And it doesn’t take into account the impact of interest rates on share prices.

When rates are high, it’s possible to earn a better return on cash deposits and government bonds, with lower risk. Investors therefore tend to swap shares for these. This means there’s an inverse relationship between the stock market and interest rates.

This can be seen below — the Buffett Indicator has fallen over the past two years, which coincides with the Bank of England increasing the base rate 14 times.

Final thoughts

Whatever the merits of this valuation tool, I think UK equities are currently undervalued.

A number of stocks are currently trading close to their 52-week lows, despite reporting strong results over the past few months.

To illustrate this, five from the FTSE 100 are shown in the table below.

| Stock | 52-week low (pence) | 52-week high (p) | Current price (p) | % above 52-week low |

| British American Tobacco | 2,403 | 3,453 | 2,536 | 6 |

| Lloyds Banking Group | 39 | 54 | 43 | 10 |

| National Grid | 918 | 1,229 | 1,025 | 12 |

| Schroders | 357 | 507 | 401 | 12 |

| Legal and General | 203 | 311 | 227 | 12 |

Of course, just because a stock is near its 12-month low, doesn’t automatically mean it would make a great investment.

And I’m not necessarily saying I’d buy any of them — I’d need to do some further research before coming to this conclusion. But at first glance, these are quality companies generating strong earnings. And they are paying healthy dividends too.

I’m sure some of these valuations reflect the pessimism surrounding the prospects for the UK economy. The Office for Budget Responsibility says it’s going to be several years before GDP growth returns to its long-term trend rate.

But if I had some spare cash, I’d be looking at the UK stock market to pick up some bargains. As Warren Buffett advises: “Be fearful when others are greedy and be greedy when others are fearful“.