There are very few ways to earn a truly passive income. Investing is one of them.

It’s about putting money aside, making it work as hard as possible, before eventually drawing down. Much like a pension.

The thing is, while many of us put money aside each month, we often put this money into flexible, easy-to-reach savings accounts that pay very little interest.

Until recently my HSBC active savings account was giving me just 0.25% annual equivalent rate (AER). Even now the 2% AER isn’t overly exciting.

Getting richer

When it comes down to it, it’s about getting rich, or getting richer.

If I put aside £300 a month, 2% AER — which is likely as high as it’s going to get — isn’t going to make me much richer. In fact, it’s still some distance below the current rate of price inflation.

It’s a fairly simple equation. I’ve either got to save more money, or get a better rate of return to build wealth.

Currently, the best interest rate on a savings account is around 5.15%, but as the Bank of England base rate falls, this will decrease. This also requires me to lock my money away for some time.

While investing carries more risk than putting my money in savings accounts, it does offer me the opportunity to make a much higher rate of return.

One portfolio that I follow has grown 55% over the past 18 months, surpassing the S&P 500‘s 22%. However, this is extraordinary. Many novice investors aim for high single-digit returns.

Compounding is key

There’s one thing I’m yet to mention, and that’s the impact of compound returns.

It’s a vitally important ingredient that helps me turn my savings into something much bigger.

It works when I reinvest the returns generated from my investments, allowing me to harness the power of compounding.

It means my money can grow not only on the initial principal but also on the accumulated earnings.

This compounding effect amplifies the overall wealth-building process, exemplifying the profound impact that time and consistency can have on the growth of my financial portfolio.

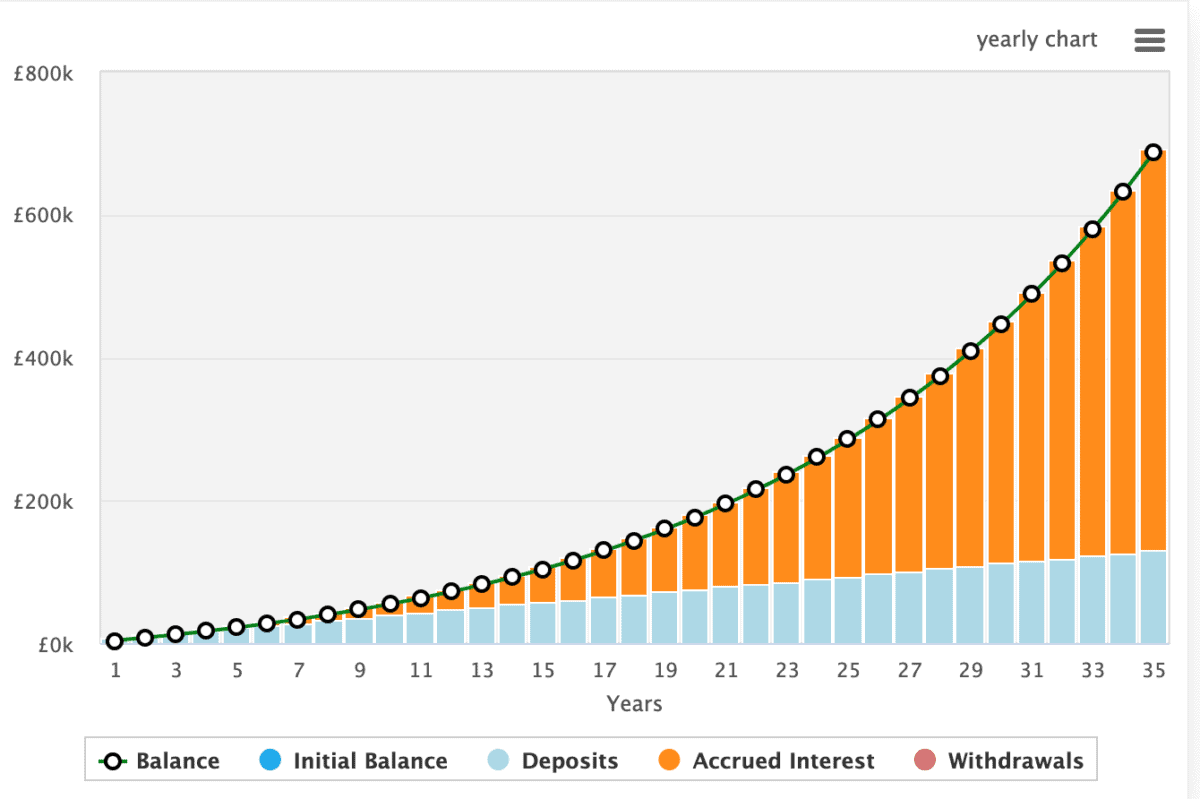

The chart below highlights how the speed of growth increases over time as I reinvest.

This example shows the growth of £300 invested monthly over 35 years with an 8% annualised return.

At the end of the period, I’d have £669k, enough to generate £52,588 in passive income annually.

Not losing money

Warren Buffett’s first rule of investing is “don’t lose money”. That’s a really important one for investors getting started.

It’s sounds simple, but sometimes we need to hear it over and over again. If I lose 50%, I need to gain 100% to get back to where I was.

This is why is pays to make sensible investment decisions. Thankfully, these days, there’s a host of democratising platforms, like The Motley Fool, that can help us make good investment decisions.