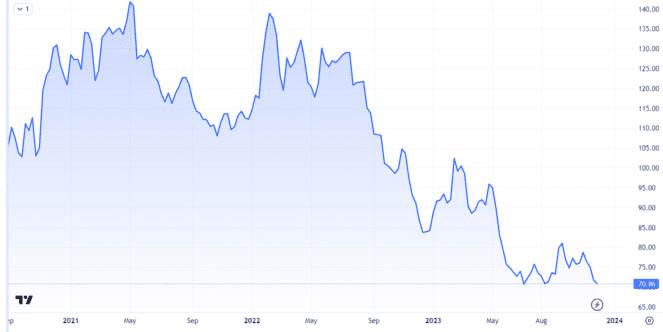

With revenues and profits in the billions of pounds, it may seem odd that Vodafone (LSE: VOD) trades for pennies per share. But that is exactly how it is. The Vodafone share price of around 71p is 58% lower than it was five years ago.

Yet the company has millions of customers in multiple markets, a well-known brand and offers a juicy dividend yield of 11%. That is among the highest of any FTSE 100 company.

Can the Vodafone share price hit a pound again?

The bear case

First let us consider how things reached this situation.

Telecoms can be an expensive business. Bidding for licenses, building networks and maintaining them all cost money even before the expense of attracting customers to use them.

Vodafone has €36bn in net debt. While its revenues are large, they have been declining. In the first half of its current financial year, they fell 4.3% compared to the same period the prior year.

On top of that, the company has been selling off businesses. The revenue decline partly reflected the disposal of Vantage Towers, Vodafone Hungary and Vodafone Ghana last year.

The offloading process has continued this year, with the company agreeing to sell Vodafone Spain. Getting rid of businesses that have helped generate sizeable profits in the past, like the Spanish one, could make it harder to achieve the same levels of profitability again.

The bull case

But getting rid of some such businesses could help the telecoms giant focus on key markets where it has a strategic edge. It has also generated cash that can help support the dividend.

Net debt may be high but it is heading down. Indeed, it fell a fifth by the end of the first half compared to the same period last year.

Meanwhile, the company’s strengths continue to be big in my view. Take its African operation Vodacom as one example. Vodacom alone has over 50m mobile customers. It is a major player in the fast-growing African market for mobile money.

If Vodafone can focus on the right priorities and deliver its strategy, I think it has the basic ingredients for long-term growth.

That could propel the share price upwards. The shares were above a pound each as recently as last year. I think the firm has a clearer strategy now than it did then. That could help support a richer valuation.

While I see the net debt and declining revenues as a threat to the dividend, I am optimistic it may be maintained.

The current chief executive has had a chance to cut the payout already but has not done so. Indeed, the interim payout declared this month was the same as last time around. An 11% yield is certainly attractive to me.

I’m holding

That was one of my reasons to buy the shares this year, along with the firm’s growth prospects.

I think the current share price undervalues the prospects of the business.

So I continue to hold the shares and enjoy the passive income streams I earn from them. In fact, if I had spare cash to invest today, I would be happy to buy more.