It was looking a bit rocky for US shares at the beginning of the year. Both the tech-heavy Nasdaq and benchmark S&P 500 were in a bear market. Even Apple (NASDAQ: AAPL) stock had dropped around 27% in the space of 12 months.

Just like they’ve done countless times before though, the market and Apple shares bounced back.

Yet as Warren Buffett observed: “In the business world, the rearview mirror is always clearer than the windshield.”

Only with hindsight was the rebound nailed on. It certainly wasn’t obvious in January.

Nevertheless, let’s imagine at the start of 2023 I wasn’t convinced that Apple was worth 27% less than a year earlier. How much would I have today from a £10k investment made then?

An amazing year

According to the chart above, the Apple share price opened the year at $130. As I write, the shares are currently changing hands for $189. That’s a gain of 46%, give or take.

It means my hypothetical £10,000 investment would now be worth about £14,600. That would a solid return over three years, let alone 11 months.

A bonus would have been the quarterly dividends, adding another £90 or so to my return.

More growth ahead?

Today, Apple is the world’s most valuable public company with a market cap of $2.95trn. It’s only natural to wonder whether the share price still has any meaningful room to rise.

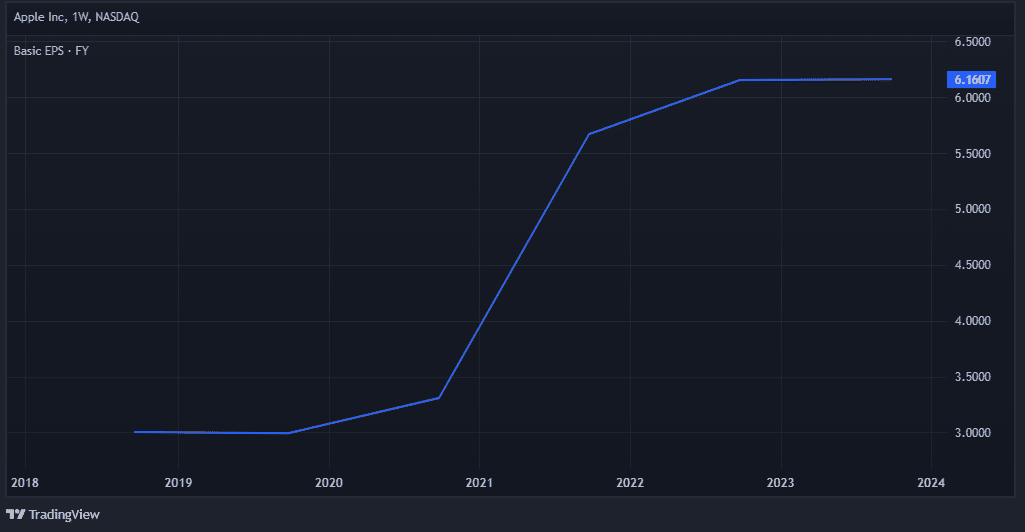

Well, if it does, then share buybacks will likely play a big role. These huge capital return programmes have boosted Apple’s earnings per share (EPS) while top-line growth has understandably plateaued due to the law of large numbers.

In fact, over the past decade, it has bought back over $600bn worth of its own stock. For context, that’s about 38% of shares outstanding!

Looking forward, I think Apple Pay will become a much larger piece of the pie. Its convenience (both online and offline) truly sets it apart. The firm reportedly charges card issuers 0.15% on each Apple Pay purchase.

Also, the Vision Pro mixed-reality headset is out soon. Will this product, which looks like a pair of sci-fi ski goggles, become yet another hit? It wouldn’t surprise me if it did.

Now, one concern is that the shares are trading at almost 31 times earning. This lofty valuation potentially adds risk, especially if iPhone 15 sales underwhelm over the Christmas period.

Foolish takeaway

Under CEO Tim Cook, Apple still embodies the visionary qualities of late co-founder Steve Jobs.

In fact, this is a common feature when we look at the world’s largest companies. They’re mostly run by founders or founder-like management teams that tend to think in decades.

Tesla (under Elon Musk), Nvidia (Jensen Huang), Berkshire Hathaway (Warren Buffett) and Amazon (Jeff Bezos from 1994 to 2021) immediately spring to mind.

Unfortunately, this is something the FTSE 100 noticeably lacks. This is partly due to old rules around dual-class share structures, which prevent companies like £8bn fintech innovator Wise from inclusion in the Footsie.

To be fair, regulators are proposing changes to try and attract more tech firms to list in the UK and bring new blood to the indexes. Meanwhile, it’s a sobering fact that Apple is currently worth more than every FTSE 100 business put together.