The Shell (LSE:SHEL) share price has fallen around 6% from its peak earlier in the autumn. It’s not a huge fall, or even a correction, but it could offer keen investors an opportunity to buy at a lower entry point.

Valuations

Shell is a vertically integrated oil company and it’s useful, for investment purposes, to compare the Anglo-Dutch company against its peers.

So, when I look at the ‘Big Six’ a couple of trends emerge. Firstly, the American companies trade at a premium although they tend to have stronger net income margins. Meanwhile, the European companies trade at lower multiples relative to their earnings.

Eni often appears cheap on a price-to-sales basis. However, its profits margins tend to be lower. It’s an international oil company (IOC) but it’s partially owned by the Italian government, and this means it can occasionally appear more like a national oil company — it has objectives that aren’t purely profit-related (e.g., employment and security of supply). As such, Eni is only non-top-rated oil company for profitability. Eni has a much lower net income per employee — as does Total.

Shell is something of a middling performer when compared to the rest of the Big Six. The below chart highlights Shell’s discount versus its American peers, and premium to the European companies. It’s also apparent that this premium to BP may reflect its better debt position.

| Shell | BP | Chevron | Eni | ExxonMobil | Total | |

| P/E (trailing 12 months) | 7.49 | 6.66 | 10.48 | N.a. | 9.96 | 6.68 |

| P/E forward | 8.87 | 5.62 | 10.39 | 11.69 | 11.3 | 7.06 |

| P/S | 0.66 | 0.46 | 1.34 | 0.51 | 1.21 | 0.74 |

| Net income margin % | 8.64 | 11.36 | 12.56 | 5.14 | 11.74 | 8.58 |

| Debt to equity % | 42.58 | 68.08 | 12.37 | 55.93 | 19.88 | 49.24 |

Growth

Growth is an important consideration when making an investment. We don’t want to buy companies that are going backwards. The below chart shows the projected earnings for the next three years and the resultant forward price-to-earnings (P/E) ratios.

| 2023 | 2024 | 2025 | |

| EPS (£) | 2.94 | 3.41 | 3.42 |

| P/E | 8.87 | 7.61 | 7.59 |

Shell has a PEG ratio — an earnings formula that takes into account growth — of 1.49 based on forward projection for the next five years. This isn’t an overly attractive ratio as one tends to suggest fair value.

Black gold demand

Hydrocarbons remains Shell’s bread and butter despite an industry-wide move to appear greener. The good news here is that long-term demand for black gold appears far more resilient than many expected.

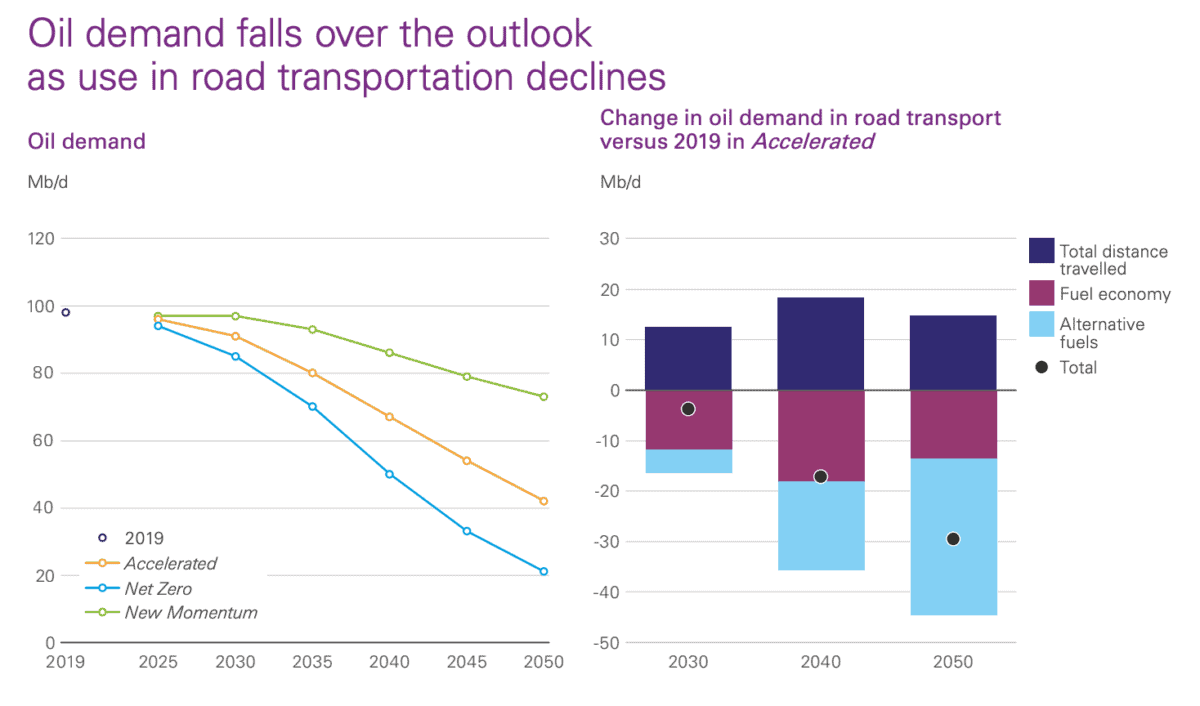

While the above chart shows that oil demand is expected to decline over the next 27 years, it’s worth remembering that oil is an increasingly scarce resource. And it’s this scarcity that analysts expect to push hydrocarbons prices higher over the next decade.

Of course, there’s the next year to think about. With a global recession on the cards, and some disagreements with the OPEC+ cartel, hydrocarbons prices could fall over the next 12 months. It’s perhaps worth noting that lower oil prices would be a US objective in light of Russia’s war in Ukraine and its continuing oil revenues.

I’d certainly consider investing in Shell if I had the capital, but I’m increasingly of the opinion that BP could be a better option.