The Lloyds (LSE:LLOY) share price dipped as low as 39p this year. And, currently, it’s not trading far off that. The blue-chip bank is now changing hands for just 42.4p.

So, why do I think the stock could double in value and trade around 85p a share? Let’s take a look.

Valuation

The price-to-earnings-to-growth ratio, also known as the PEG ratio, is a stock valuation metric that investors use to compare a stock’s price to its expected earnings growth over a specified period of time.

In my opinion, it’s one of the most important metrics to use and it’s normally calculated using the expected growth rate over the coming five years.

A lower PEG ratio is generally considered more favourable, indicating that a stock is undervalued relative to its growth prospects.

Typically, a PEG ratio of one suggests that a company is trading at fair value. Anything under that is normally considered cheap.

However, it’s not easy to find companies with PEG ratios under one.

Lloyds happens to be one such company, with a PEG ratio of 0.5. That infers that the bank is trading at half its fair value. Fair value, therefore, would be around 85p.

Essentially, that’s a price-to-earnings of 4.4 divided by a forecast annualised EPS growth rate around 8.5% of the next five years.

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | |

| EPS (p) | 7.1 | 7.7 | 8.4 | 9.2 | 10 | 10.8 |

I do have one concern with this PEG ratio, however.

The thing is, I didn’t actually create the above PEG ratio myself. It’s a figure that’s posted on a number of specialist websites and would be created from the consensus estimates of a pool of analysts. And analyst estimates can be wrong.

For me, the above EPS projections do look quite optimistic. Nonetheless, I’m willing to trust a pool of analysts. I’m still very bullish on Lloyds myself.

How could this be possible?

Why might analysts be forecasting 8.5% annualised growth? Well, there’s a few good reasons.

- The ‘goldilocks zone’ — Interest rates are falling towards levels considered optimal — 2%-3%. This is where net interest margins remain high while impairment charges are less of a concern than they are now.

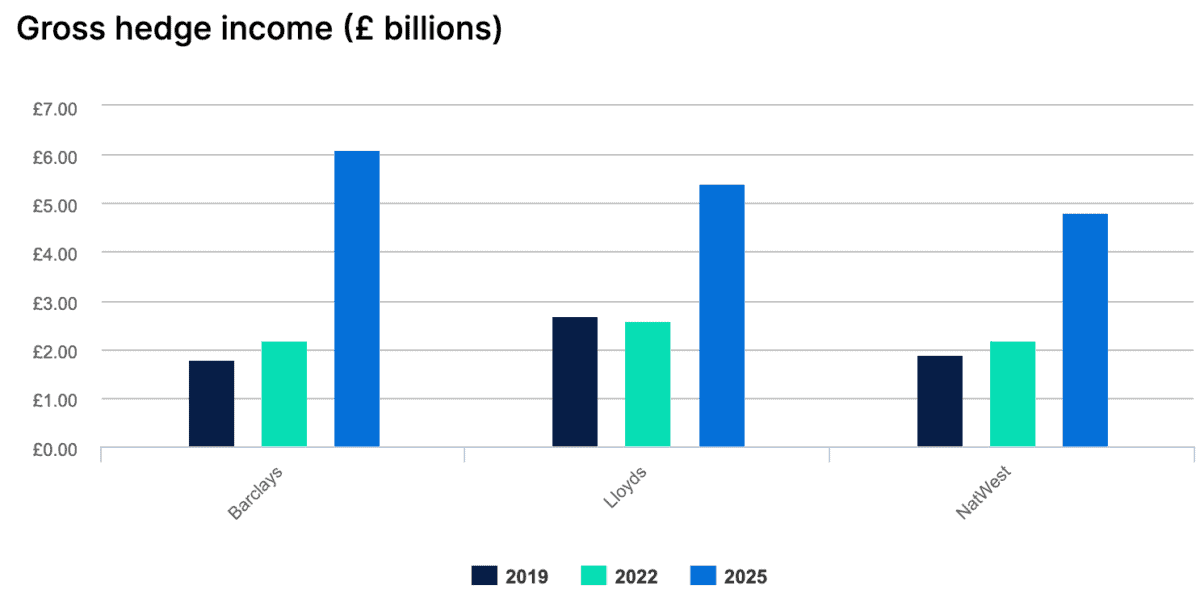

- Hedging — Banks practice hedging in order to reduce the impact of central interest rate changes on their operations. When interest rates have peaked and start to fall, this can benefit banks that have purchased fixed-income assets at higher rates. Lloyds’s gross hedge income is forecast to surpass £5bn in 2025.

- An improving economy — The data doesn’t look too good for next year, but over the medium term, the outlook is expected to improve. Banks are cyclical and perform best in stronger parts of the economic cycle. Of course, that means there’s a risk of serious underperformance when the economy goes into reverse. As Lloyds doesn’t have an investment arm, the impact could be particularly large.

Lloyds might be cheap right now because of the risks associated with an economic downturn in 2024, but, for me, it looks like a great entry point. The lender is among my largest holdings and, if I had the capital available, I’d buy more for my portfolio.