Many of us invest for passive income. It’s about putting money aside today, letting it grow, and eventually having something bigger at the end of the period which we can draw down from.

The thing is, many of us just leave that money we set aside in a flexible savings account which attracts very little interest, even at the best of times.

Investing vs saving

Saving is often seen as a more conservative approach focused on preserving capital and providing liquidity for short-term needs. It can be crucial for building an emergency fund and ensuring financial stability.

Should you invest £1,000 in National Grid right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if National Grid made the list?

However, even today, savings accounts don’t provide excellent rates of return. The best interest rate is around 5.15% at the moment, but as the Bank of England base rate falls, this will decrease. For years, my active savings account only paid me 0.25%.

On the other hand, investing involves taking on some level of risk in pursuit of long-term wealth growth. It’s a strategy geared towards achieving financial goals that extend beyond the near future.

A balanced financial plan often involves a combination of saving and investing, tailored to an individual’s financial objectives, risk tolerance, and time horizon.

However today, I want to talk about how I could use £200 a month to build wealth over the long run, and eventually generate passive income.

It’s all about compounding

Compounding returns is a simple, but hugely impactful, financial concept.

It happens when I reinvest my returns year after year. As returns accumulate on the initial investment and its subsequent earnings, the compounding effect accelerates wealth growth over time.

This creates a self-reinforcing cycle, allowing investors to benefit from the exponential growth of their money as we earn interest on our interest.

By leveraging the principle of compounding, investor can maximise the long-term potential of their investments, turning small contributions into significant financial milestones through the magic of cumulative returns.

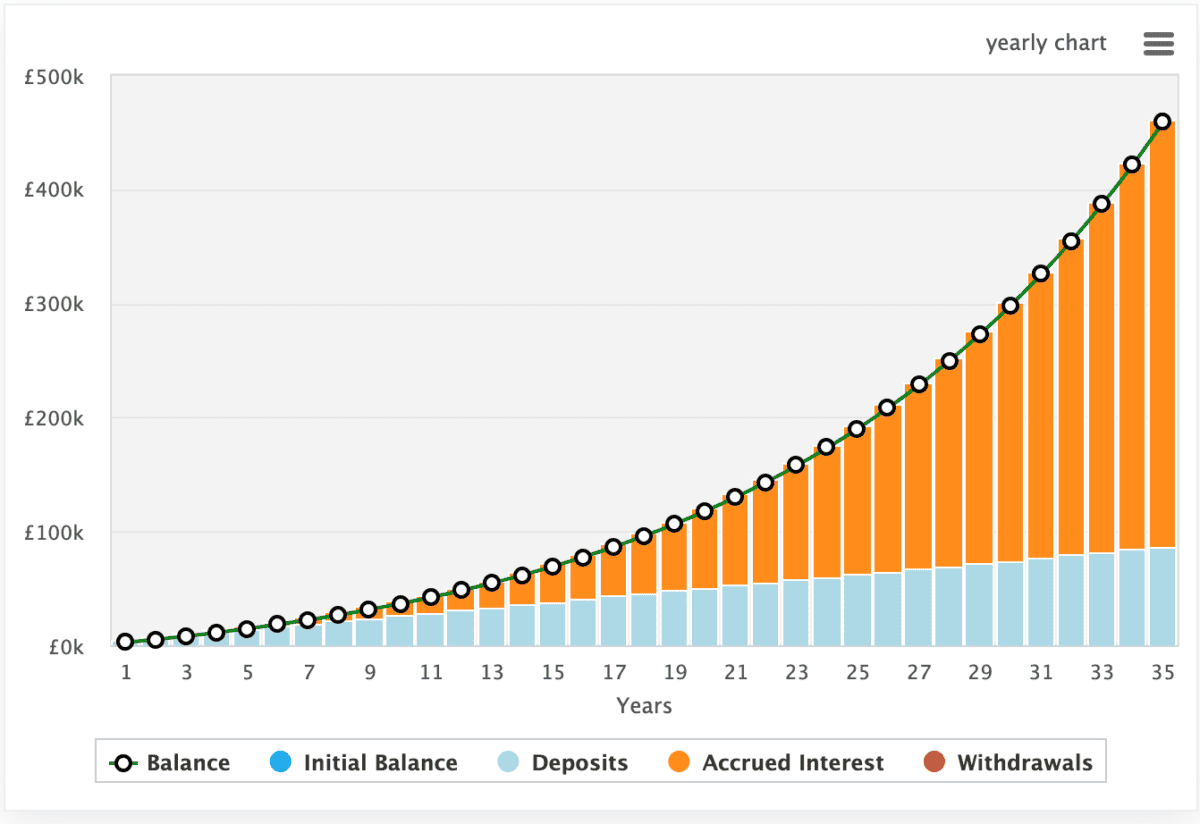

The chart below highlights how the speed of growth increases over time as I reinvest. This example shows the growth of £200 invested monthly over 35 years with an 8% annualised return. At the end, I’d have £460k, enough to generate £35,059 in passive income annually.

Sensible investments

Investing involves risk and no investment is risk-free regardless of how profitable it may appear. And the thing is, if I lose 50% on an investment, it’s got to grow 100% to get back to where it was.

As such, it pays me to do my research and make sensible investment decisions. It’s pretty much impossible to cover every stock on the FTSE 100 and certainly impossible if we expand that to the S&P 500 and the extended FTSE 350.

That’s why it can be useful to make a shortlist, perhaps using recommended picks by analysts. From there, I can work my way through the investment opportunities and decide which is best for me.