The allure of penny stocks is straightforward to comprehend. With a starting market cap of less than £100m, they have the potential to grow much larger and create monster returns.

Of course, potential is one thing and reality is another. Most penny stocks struggle to generate any value whatsoever.

However, the following two stocks have created extraordinary value by turning £20k into at least £1m in 20 years.

Merchandise master

First up we have 4imprint Group (LSE: FOUR). The stock has gone from 83p to 4,375p in 20 years. That’s a 5,171% rise that would have turned £20k into more than £1m!

However, the total return would actually be higher due to numerous dividends.

The FTSE 250 firm sells customised products like drinkware, stationery, and T-shirts in North America, the UK, and Ireland. This niche online market has become big business.

In 2006, the firm reported sales of £119m, generating £7.7m in pre-tax profit. This year, group revenue is expected to be slightly above $1.3bn, with a pre-tax profit of at least $130m.

In early November, though, the shares took a hit after the firm warned of slowing demand. This weakness could continue if cash-strapped businesses deem promotional merchandise non-essential.

Longer term though, I’m optimistic. That’s because despite being one of the largest distributors of such items in the US, 4imprint’s market share is still low. This leaves a large addressable target market.

Plus, the balance sheet is pristine, carrying no debt, and the management team is excellent. Therefore, one of my new year’s resolutions is to become a shareholder.

King of Trainers

Next, we have JD Sports Fashion (LSE: JD), which has gone from a penny stock to a £7.7bn FTSE 100 member.

In November 2003, the share price (adjusted for stock splits) was 1.7p. Today, it is 148p, indicating an incredible 8,605% rise.

It means a £20k investment made 20 years ago would be worth over £1.7m today. Again, that’s not including the dividends, which would have added many more thousands of pounds on top.

The company has boomed as athleisure has become the default mode of dress for younger generations. Not only in the gym, but also when they’re socialising, travelling, and even working. Old footage of formally-dressed people in British streets reminds us that this hasn’t always been the case.

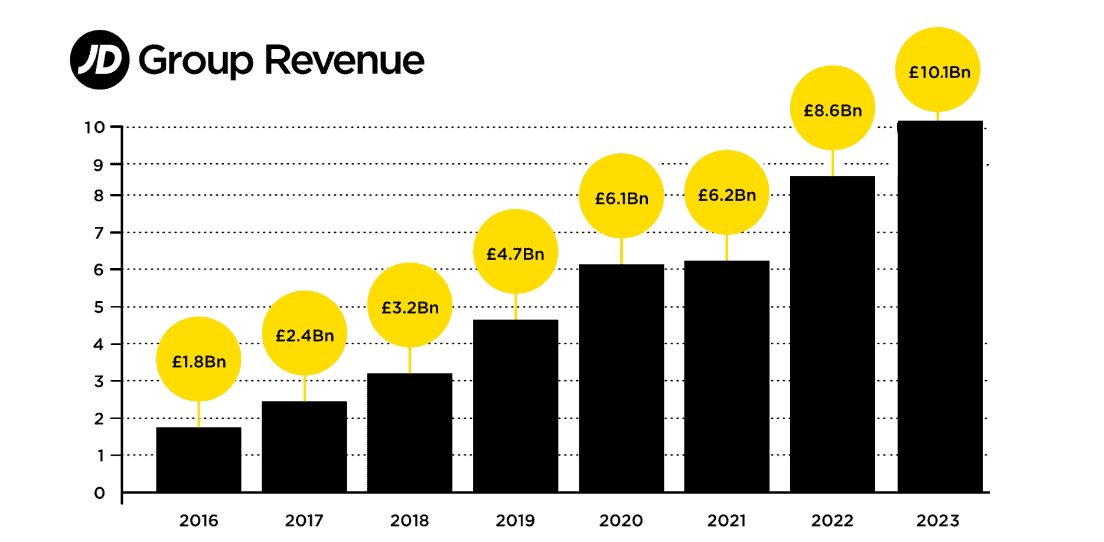

JD’s aim is “to become the leading global sports fashion powerhouse“. And it has made great strides towards this goal, as can be seen in its lightening-fast growth.

The important thing here though is that this growth has been very profitable. In fact, this year (FY 2024) the sportswear firm expects to generate a pre-tax profit of £1bn for the first time.

Key to this growth has been its deep relationship with Nike, whose Air Force 1 range accounts for between 10% and 20% of JD’s annual footwear sales. Clearly, any fracturing of that precious partnership would become a serious issue for the company.

Today, unlike a brand new pair of Air Force trainers, the shares are dirt-cheap. They trade at a price-to-earnings (P/E) multiple of just nine for the 2024 calendar year.

To be honest, I find that incredible value, and I’ll be surprised if I’m not a shareholder before too long.