BP (LSE:BP) shares have fallen 13.1% over the past month, and that’s got me interested. I’ve had my eye on the stock for a while. Not because of the tailwind associated with current conflicts and geopolitical tensions, but for the growing demand for hydrocarbon products in an increasingly resource-scarce environment throughout the long term.

The demand hypothesis

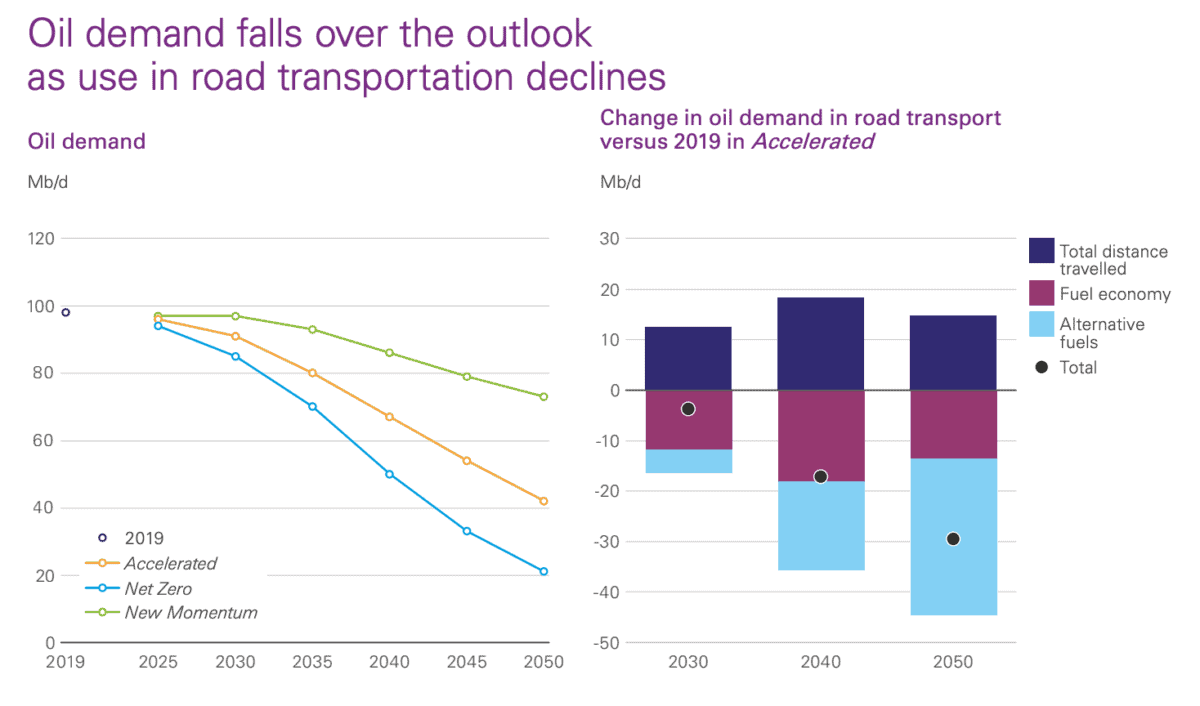

While we’re looking towards greener energies to save the planet, it’s also the case that demand for hydrocarbon products will remain strong for the foreseeable future — this remains the company’s bread and butter.

Looking across the next decade and beyond, oil prices are likely to be higher than they were over the past decade. That’s reflected in BP’s own forecasts.

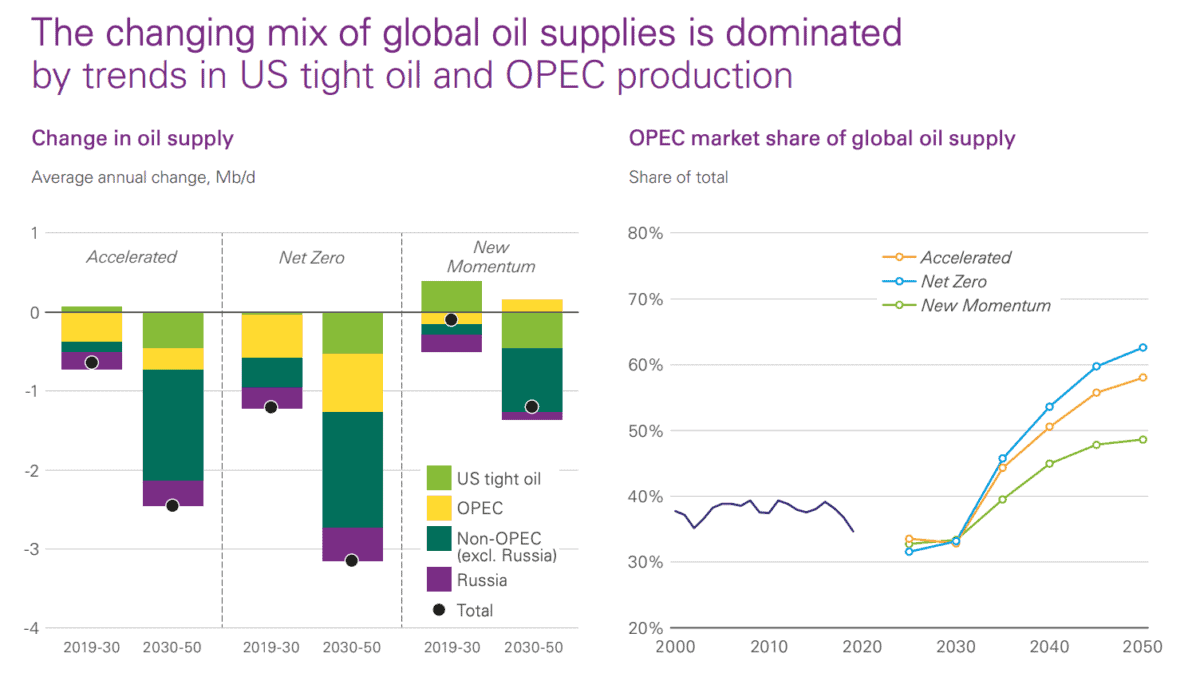

This is because supply is unlikely to outstrip demand as black gold becomes scarcer. In fact, as we can see below, more oil production will originate from OPEC members’ cartel in the coming decades. Meanwhile, demand looks relatively robust. This will be driven by expanding global populations and burgeoning middle classes as the world ever-so-slowly shifts to greener alternatives.

A competitive advantage?

The data provides us with a mixed picture of BP versus the rest of the ‘Big Six’ vertically integrated peers.

To start, BP traditionally boasts a lower unit cost compared to its rivals. Over the period 2010-2019, BP’s 10-year average upstream unit production cost per barrel of oil equivalent was around 18% less than Shell.

When working in the industry and writing my PhD, I was frequently told that BP was at the forefront of technological advancements. This may contribute to its impressive return on total capital (TTM) at 16.7%, which surpasses peers.

However, when we look at metrics including asset turnover ratio and net income margin, BP appears less competitive. Historically, it has had the lowest gross profit margin of the supermajors, standing at 30.7% at the end of Q1.

This lower gross profit may change following the acquisition of aptly-named full-service truck stop and travel hubs TravelCenters of America in Q2. Analysts suggest the move could nearly double its global convenience gross margin with a network of 288 sites along US highways.

However, debt may be a concern for some investors. BP’s net debt to equity of 68% is the highest of its peer group. Much of this debt relates to the legacy Deepwater Horizon disaster.

Best value?

But BP also has the most favourable valuation metrics versus the rest of the Big Six, even when we take into account its higher debt burden.

The London-based company’s price-to-earnings ratio of 4.2 times sits far below its peers including ExxonMobil at 10.2 and Chevron at 10.7.

On a forward basis, BP still looks cheap, trading at 5.7 times earnings, which still puts it at a discount to its nearer peer Total at 7.1 times.

The same trend is true when using the EV-to-EBITDA ratio. BP trades at 3.31 times on a forward basis, which is also cheaper than Total at 3.7 times.

Given these metrics, I’ll look to add BP to my portfolio when possible.