On 16 November, the UK medicines regulator approved a therapy that uses the CRISPR–Cas9 gene-editing tool as a treatment. It sent this growth stock into overdrive.

That’s because the treatment in question was developed by biotech CRISPR Therapeutics (NASDAQ:CRSP) in Zug, Switzerland, in partnership with Vertex Pharmaceuticals in Boston, Massachusetts.

So today, I’m talking about CRISPR Therapeutics. It’s a stock I’ve held for around a year now, and I’m explaining why I think it’ll go higher.

What it does

CRISPR Therapeutics is a clinical-stage biotech company. It uses the CRISPR-Cas9 gene editing system to develop treatments for a series of diseases including hereditary haematology disorders and cancers.

At the heart of its approach is gene-editing technology. This allows scientists to precisely modify and edit genes within living organisms.

This groundbreaking system has the potential to revolutionise the treatment of genetic diseases. It does this by correcting or modifying specific genes responsible for a variety of medical conditions.

One significant focus of CRISPR Therapeutics is on hereditary haematology disorders. This encompasses a range of genetic conditions affecting the blood and its components.

By employing CRISPR-Cas9, the company aims to develop targeted therapies that can correct or modulate genetic mutations responsible for these disorders, offering the potential for more effective and personalised treatments.

In the realms of cancer, the company is exploring the application of gene editing to develop innovative therapies. The precision of CRISPR-Cas9 allows scientists to target and modify specific genes associated with cancer development, potentially disrupting the mechanisms that drive tumour growth.

Latest development

The UK’s approval of exa-cel (exagamglogene autotemcel) for Sickle Cell Disease (SCD), and transfusion dependent beta thalassemia (TDT) is hopefully just the start for CRISPR.

The approval is not only a milestone moment for the Swiss company — exa-cel will be its first product — it was the world’s first gene-editing approval. So in many respects, the firm got there first.

But it also paves the way for approvals elsewhere in the world, most notably in the US were the green light is close. This would also represent a more lucrative market than the UK where SCD is less prevalent.

The maths

The therapy has shown compelling efficacy in clinical trials. All but one of the patients in the trial — where a satisfactory observation period has been reached — have been functionally cured of their illness.

There are 100,000 people diagnosed with the disease in the US, and 20,000 elsewhere in the world. Most these are of African ancestry.

While there’s that many potential patients, analysts anticipate the initial patient pool will be closer to 20,000 people, and will have a price point around $2m.

That’s a huge $40bn in sales, of which CRISPR is due to get 40% and Vertex 60%. The pharma giant gave CRISPR milestone payments in exchange for a greater share of future revenues.

Of course, there are risks. What if the treatment is only effective for a limited period? That would certainly put a dampener on things.

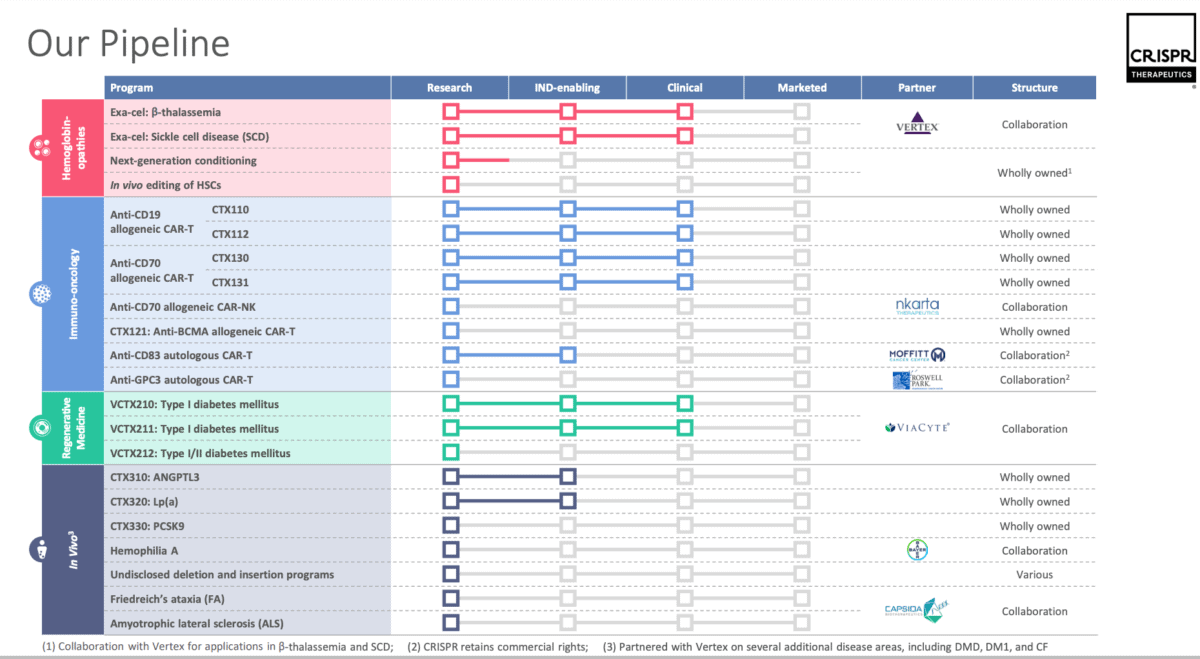

However, for me, it’s worth the risk and I see the SCD treatment as the tip of the iceberg. The pipeline below shows the breadth of the company’s research from its Q3 presentation. On its website, exa-cel is now proudly marked as ‘approved’.