There are many ways to earn a second income. I can investing in stocks, explore buy-to-let properties, find freelancing opportunities, or start a side business. Diversifying income streams can provide financial stability and open up new avenues for wealth generation.

Is buy-to-let worth it?

For years, many Britons have sought to build a passive income by investing in properties and letting them out. This provides a regular income — the rental yield varies across the country but 5% is considered average — and investors tend to benefit from capital appreciation.

However, the current economic climate has impacted the market, especially the large number of buy-to-let investors who use leverage (debt/a mortgage) to fund their property purchase.

In October 2023, the average five-year buy-to-let mortgage rate was 6.32%. This rise in interest rates in recent years has reduced landlords’ rental income — landlord’s percentage of profits of rental income after tax have fallen to 3.9% from 24% in the seven years between 2014 and 2021, according to Hargreaves Lansdown.

Of course, there’s the argument that there’s a dearth of housing in the UK, and people need places to live. It can be a little predatory, but I understand it. Moreover, I appreciate interest rates won’t be this high forever.

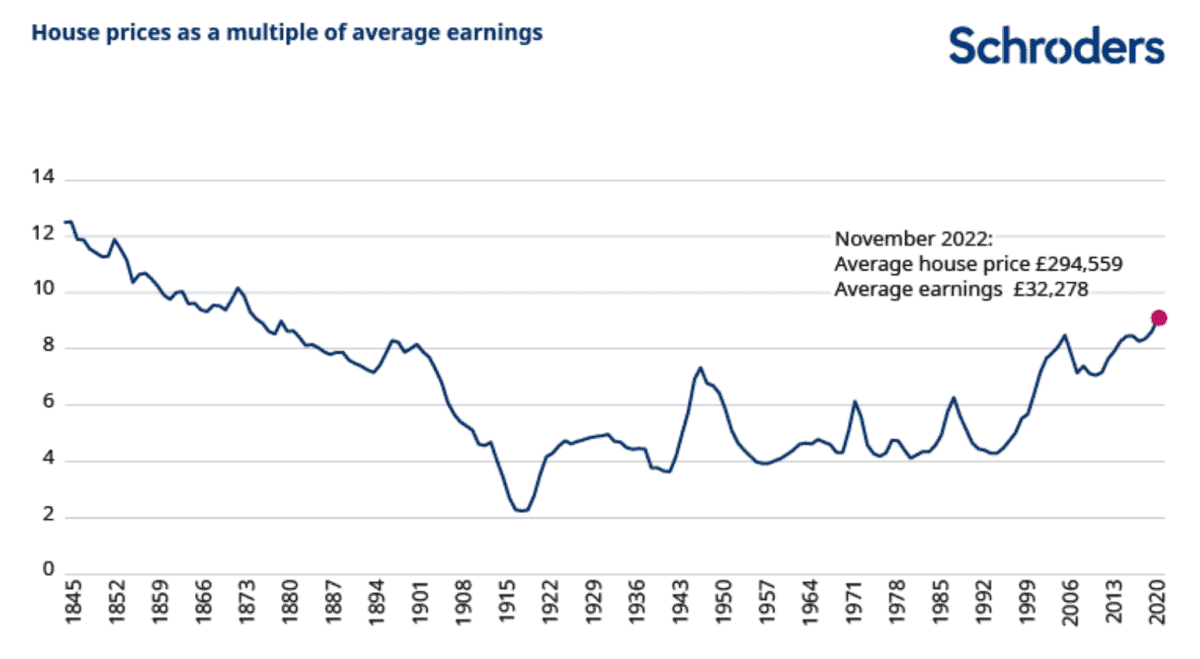

Equally, I’m cautious of the notion that house prices will continue growing at the rates seen post-financial crash. The below chart from Schroders shows that houses haven’t been this expensive for Britons since the Victorian era.

A better extra income?

To start with, if I had £10k, I’d probably struggle to get on the housing market. However, I can easily start investing in a matter of hours.

If I were new to investing, I’d start by opening a Stocks and Shares ISA. Unlike buy-to-let investments, the ISA wrapper allows me to shield my earnings from tax.

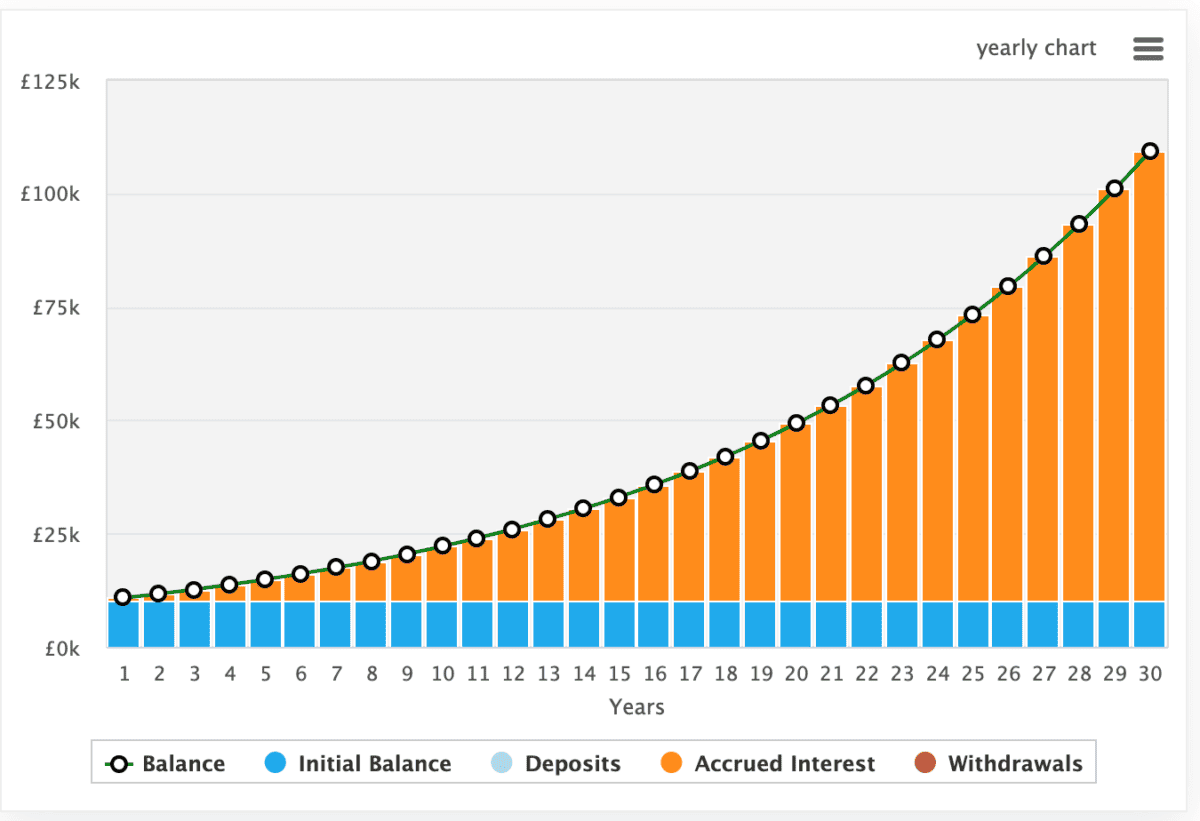

In turn, this allows me to operate more efficiently. I could either build a portfolio of stocks averaging a yield of say 6% and take an annual return of £600, or I can look to compound that.

Assuming my stocks would grow in value as well as offering a dividend, I could look to build wealth over the long run, and eventually earn an even larger second income.

Of course, investing isn’t free from risk, and I’d have to do my research and ensure I’m investing in the right stocks for me. If I invest poorly, I could lose money.

The above example is dependent on me making informed investment choices throughout the life of my portfolio. Some years I’ll outperform my targets, some years I’ll fall short. But the longer I do it, the more I can benefit from compound returns — just look at the improving rate of growth.

Nowadays, novice investors can use a host of online platforms, like The Motley Fool, that have democratised investing, and making it accessible for more and more individuals.