I’m not currently near retirement so I’m not interested in owning dividend shares for passive income that don’t also have strong growth prospects. And as well as seeking growth, it’s even better if I can find a company that’s trading at an appealing valuation too.

Pets at Home (LSE:PETS) currently has a dividend yield of 4.3%. That’s competitive with some of the ‘dividend heroes’ that have 20 years or more of consecutive dividend payments.

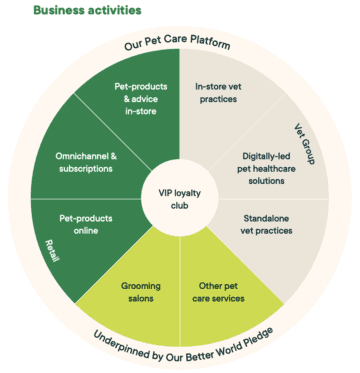

The company describes itself as “the UK’s leading pet care business” offering products, grooming services and first-opinion veterinary care.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

In that leading position, it has high margins, great long-term revenue growth and an appealing valuation, although its debt level is a weak point.

Why I believe in it

As an investor, profits are important, of course. But when deciding which shares to buy, what comes first is finding businesses that I genuinely believe in — and I like this one.

I’m a strong advocate of ethical investing too, and Pets at Home ticks the box in providing care, health and joy to pets and owners alike.

Operational highlights

Pets at Home’s three core operational segments depicted in the infographic below show a diversified presence in the pet-care business.

According to the 2024 annual report, the company’s 457 stores and 339 groomers generated £1.3bn in revenue and £100m in operating profit in 2023. For the same financial year, the company’s 444 vet practices and 115,000 telehealth consultations generated £123m in revenue and £52m in operating profit. The 10-year average annual revenue growth rate is 8.5% right now.

A closer look at the dividends

Pets at Home has paid dividends consistently since 2014, however, the amounts paid have fluctuated. The yields range from 0.9% in 2014 to 6.5% in 2018 and 3.4% in 2023.

That dividend payment history is good, but it’s nothing on some of the UK’s dividend heroes. And there’s no guarantee that the company will continue to pay a dividend or repurchase its shares at the same rate.

It’s worth noting that the company has also increased share buyback yields from 0.3% in 2018 to 3.6% today. Share buyback yields assess the extent of a company’s share repurchases, which reduce outstanding shares and can increase share value over time.

And as I mentioned earlier, debt is an issue to keep and eye on. It has a ratio of 0.3 for cash-to-debt, which ranks worse than 1,108 other companies in the cyclical retail industry. As of this year, the company has £542m of debt as opposed to £178m in cash.

And what of the share pice? The good news for anyone thinking of buying (if not for some existing holders) is that Pets at Home is currently trading 43% below its recent high.

The company’s long-term revenue growth and current share price make me confident I’m investing in Pets at Home cheaply, so I will be buying some shares.

I’m convinced the current price-to-earnings ratio of 15 is justified due to the exceptional growth, profitability and strong dividend yield. I think the company could trade at higher multiples given its operational and financial strengths. For those reasons, it’s my number one dividend play at the moment.