The price of BP (LSE:BP.) shares has fallen recently. They’ve lost 15% of their value since 18 October. And looking at the company’s most recent annual report, I think it’s easy to see why.

During 2022, BP generated most of its earnings from the sale of oil and oil-based products.

Its production and operations division, and its customer and products segment (which includes petrol stations, refining and oil trading), contributed $31bn of its $45.9bn underling replacement cost profit before interest and tax.

A causal relationship?

With such high dependency on ‘black gold’ it appears logical to me that the recent decline in the share price is linked to the fall in the price of Brent crude.

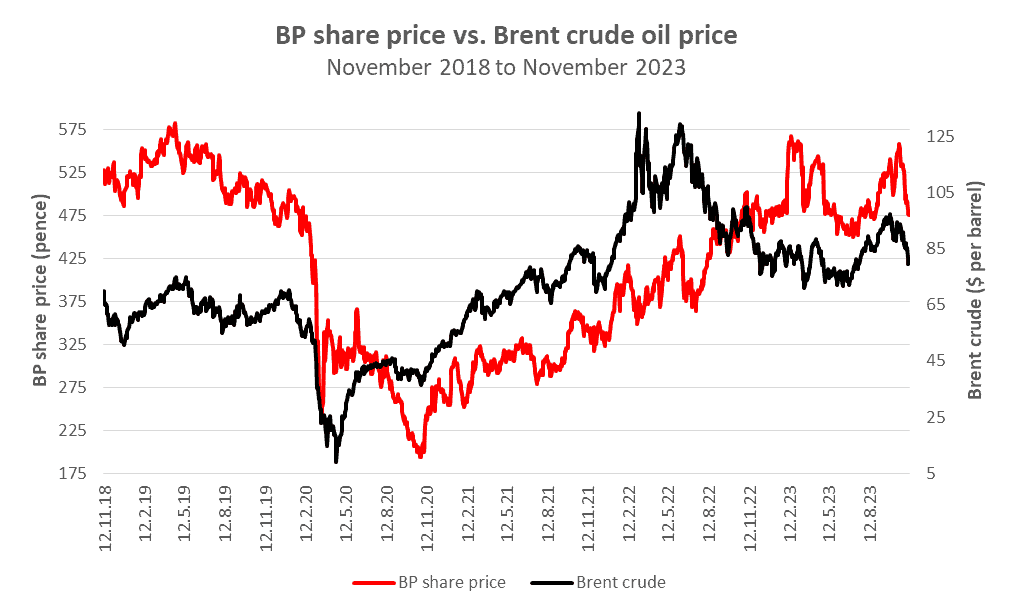

Indeed, over the same period, the price of oil has gone down by a similar amount to BP’s share price. But I think it’s important to consider a longer time period, to confirm that the recent movement isn’t a blip.

The chart below plots the relationship over the past five years. The oil price data has been extracted from the website of the US Energy Information Administration (EIA).

Over this extended period, the relationship appears to be a close one. I therefore think it’s reasonable to conclude that one of the biggest influences (if not the biggest) on BP stock is the price of oil.

Of course, statisticians will caution that correlation doesn’t imply causation.

However, given that the majority of BP’s profits are earned from oil-based activities, I think there’s going to be a strong connection between its stock market valuation and the commodity price.

Shareholder returns

Many investors like BP for its dividends.

I think the company will pay 28.42 cents (23.25p) a share this year. If I’m correct, the stock is currently yielding 4.9%. Although comfortably above the FTSE 100 average of 3.9%, there are others paying more.

And it used to be more generous with its dividends — its payout in 2019 was $1.88. Given this volatility, I don’t consider it to be a dividend stock.

I have no doubt that the board will claim it’s rewarding shareholders with share buybacks — another $1.5bn programme has been announced — but I want cash in my hand.

I’d therefore only buy BP shares if I thought they were going to appreciate in value over the longer term.

A crystal ball

My decision whether to buy the stock therefore largely rests on my assessment of the future price of Brent crude.

And this is where expert opinion differs.

Goldman Sachs is expecting $100 by June 2024. S&P Global is forecasting a 2024 average of $85.

There’s even greater uncertainty looking further ahead. As the world switches away from fossil fuels I’d expect the price of oil to fall. But EIA is predicting $95 by 2050.

I’m not qualified to work out who’s right and I don’t think anybody really knows because geopolitics has such an influence. Some academic studies have found that assuming future prices to be unchanged is equally as reliable as more sophisticated forecasts.

And that’s the problem. I don’t want to base any investment decisions on predictions that are no better than guesses.

Therefore, despite the recent fall in the price, I’m not going to invest in BP shares at the moment.