There are various ways to earn a passive income and, in the UK, many people opt for the buy-to-let property route, which can be very profitable.

However, I prefer to invest in stocks that pay dividends. There are several reasons. Firstly, investing in stocks can be done with limited capital. There’s no need for borrowing. It’s a simple process that can be repeated over and over again.

Secondly, the returns can be much more generous and the income is truly passive — I don’t have to involve myself in the complications of purchasing property.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

So insurance companies are among the listed companies paying the best dividend yields. These are firm with stable cash flows, enabling strong dividends.

Here are the three insurance stocks in my portfolio.

Dividends

The three insurers within my portfolio are Legal & General (LSE:LGEN), Manulife Financial (NYSE:MFC) and Phoenix Group (LSE:PHNX). These companies provide me with exposure to the Asian, British and North American insurance markets.

| Dividend Yield | Dividend Cover | Share Price Growth (1 year) | |

| Legal & General | 8.7% | 1.98 | -6.8% |

| Manulife Financial | 5.7% | 2.15 | 9.8% |

| Phoenix Group | 10.9% | 1.60 | -14.6% |

As we can see, the US-listed stock (Manulife) has performed far better than its UK-listed peers over the past 12 months. That’s fairly typical of the decline in British financial stocks, but Manulife has outperformed much of the US financial sector.

Nonetheless, all these stocks pay above average dividend yields and they have satisfactory coverage ratios. Coverage ratios above two are normally considered healthy. However, investors are often more lenient with insurers because they have strong cash flows.

Overlooked sector

One reason insurance companies tend to have large dividends is because they often don’t engage in share buybacks. Instead, they reward shareholders in the form of dividends.

But it’s also the case that insurance companies may be overlooked at this moment in time. These are diversified businesses which can also benefit from rising interest rates in the long run.

For example, Manulife earns 67% of its income from insurance, 19% from annuities, and 14% from banking. Moreover, rising interest rates means insurers can replace legacy bonds with high-yielding fixed-income assets.

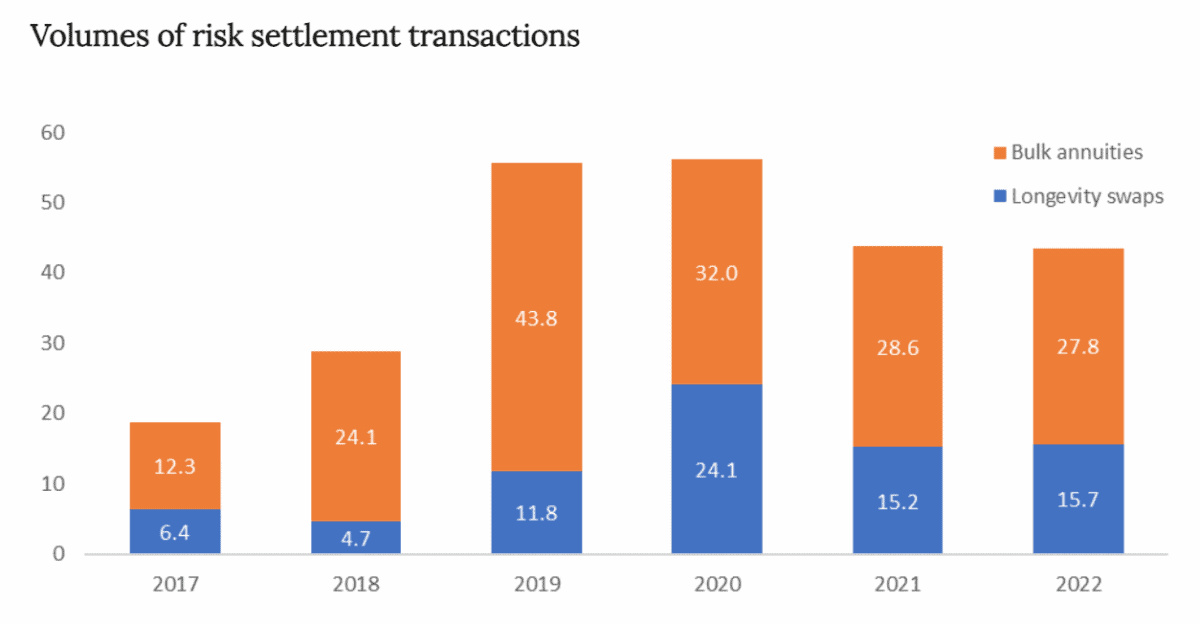

Bulk Purchase Annuities (BPA) is certainly an exciting part of this mix. These are insurance policies purchased by pension schemes or companies to offload their pension obligations and provide retirement income to a group of individuals, typically retirees.

In the UK, the BPA market was worth £50bn in 2022, up from £10bn in 2016. With only 15% of defined benefit pension liabilities transferred to insurers, this market could grow further.

There are plenty of considerations when investing in insurers, and many of the risks are company-specific depending upon their exposures.

However, it’s true to say that these are cyclical stocks, and there fee incomes and asset valuations can be negatively impacted during economic downturns.

Nonetheless, I’m confident these insurers, with strong cash generation, hedging strategies, and positive BPA trends, will deliver for my portfolio.