I’m creating a list of the best FTSE 100 and FTSE 250 stocks to buy for what looks set to be another volatile year. Here are two I’d like to snap up when I next have spare cash to invest.

Grainger

Changes to rental regulations could damage earnings growth at residential landlords like Grainger (LSE:GRI). But right now I think this property stock is an ideal safe-haven one to buy given the weak state of the UK economy.

Should you invest £1,000 in Apple right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Apple made the list?

Even as broader consumer spending power sinks, paying the mortgage or the rent is one of life’s non-negotiables. Therefore companies in the private rental sector enjoy excellent earnings stability at all points of the economic cycle.

In fact I’m pretty excited by the trading outlook for Grainger over the next year. As Britain’s supply of new homes worsens it can expect rental income to continue rocketing.

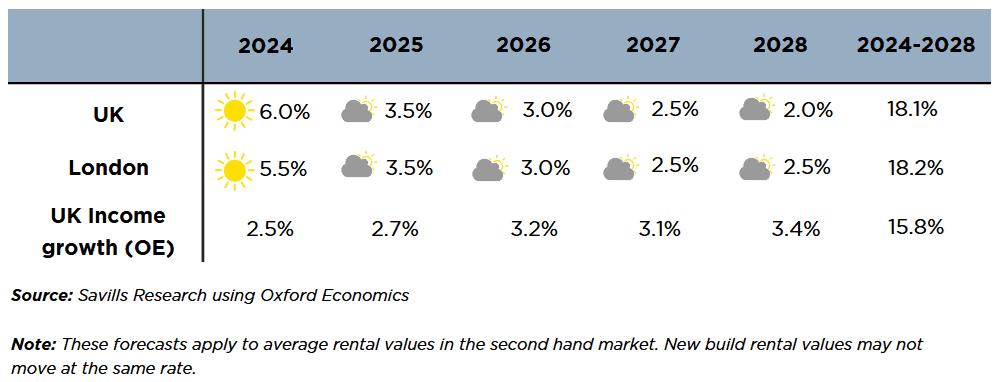

Estate agent Savills expects average second-hand rents to soar 6%. In fact, as the table below shows, the business thinks rents will soar by double-digit percentages all the way through to 2028.

Pleasingly Grainger is expanding its property portfolio rapidly to capitalise fully on this opportunity. The company — which saw like-for-like rents rise 8% during the 12 months to September — has a pipeline of 6,000 build-to-rent homes.

Now, Grainger’s shares don’t come cheap. Today they trade on a price-to-earnings (P/E) ratio of 29.4 times. But I believe the business fully deserves a premium rating like this.

Unite Group

Real estate investment trust (REIT) Unite Group (LSE:UTG) shares the same defensive qualities as the share I describe above. As a provider of student accommodation it can expect rents to continue rolling in whatever the weather.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

In fact, just like in Grainger’s markets, the student ‘digs’ market is also suffering from significant supply shortages that’s pushing rents through the roof. According to student housing charity Unipol, average student rents have soared by 14.6% during the past two academic years.

Tenant costs appear on course to continue rising too. University pupil numbers are tipped to grow over the short-to-medium term. And a weak pipeline of new developments suggests demand will continue to outpace supply.

Unite’s own financials showed how robust demand for its rooms are right now. Rents are up 7.3% for the 2023/2024 academic year. And its occupancy rate stands at a robust 99.7%, up from 97.9% a year earlier.

Buying this FTSE 100 stock could be a good idea for dividend investors specifically. As a REIT it’s obliged to distribute at least 90% of annual rental profits out in the form of dividends.

As a consequence, Unite’s dividend yield for 2023 sits at a healthy 3.8% and eventually moves to 4.2% by 2025. High build cost inflation could remain a problem for the business. But on balance I think it’s a great stock to own for next year.